Allegheny Pennsylvania Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage is a type of loan agreement that allows borrowers in Allegheny, Pennsylvania to access additional funds by securing a second mortgage on their property. This mortgage is subordinate to the first mortgage, meaning the first mortgage lender has the primary claim on the property in case of default. The purpose of this second mortgage is usually to provide homeowners with the means to consolidate debt, fund home improvements, or cover other financial needs. By utilizing the equity built in their property, borrowers can benefit from a lower interest rate compared to other types of loans. It is important to note that while the first mortgage represents the primary loan on the property, the second mortgage carries additional risks for the lender. Hence, the borrower is required to provide a recertification of representations, warranties, and covenants from the first mortgage agreement. This ensures that the borrower reaffirms the truthfulness of the original information provided during the first mortgage application, as well as the fulfillment of any obligations, conditions, or promises associated with the first mortgage. The recertification process typically involves reviewing key elements such as the borrower's financial standing, creditworthiness, employment status, and property value. This helps the lender assess the borrower's ability to repay the second mortgage and identifies any changes or potential risks that may have occurred since the initial mortgage agreement was made. Different variations or types of Allegheny Pennsylvania Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage may include: 1. Fixed Rate Second Mortgage: This involves a fixed interest rate over the mortgage term, providing borrowers with predictable monthly payments and stability. 2. Adjustable Rate Second Mortgage: In this case, the interest rate is adjustable and subject to changes based on prevailing market rates. Borrowers may experience fluctuating monthly payments, which could increase or decrease over time. 3. Home Equity Line of Credit (HELOT): Unlike a traditional second mortgage, a HELOT gives borrowers access to a line of credit based on their home equity, which they can draw upon as needed. This type of mortgage often offers more flexibility in terms of borrowing and repayment. 4. Balloon Payment Second Mortgage: Here, borrowers agree to make regular payments for a specific period, after which the remaining balance becomes due in a lump sum. This structure may be suitable for borrowers who anticipate an increase in finances or the sale of their property before the balloon payment is due. Allegheny Pennsylvania Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage provides homeowners with an additional avenue to leverage their property's equity while allowing lenders to mitigate the associated risks. It is essential for borrowers to thoroughly understand the terms and obligations associated with this type of mortgage and seek professional advice before making any financial decisions.

Allegheny Pennsylvania Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Allegheny Pennsylvania Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

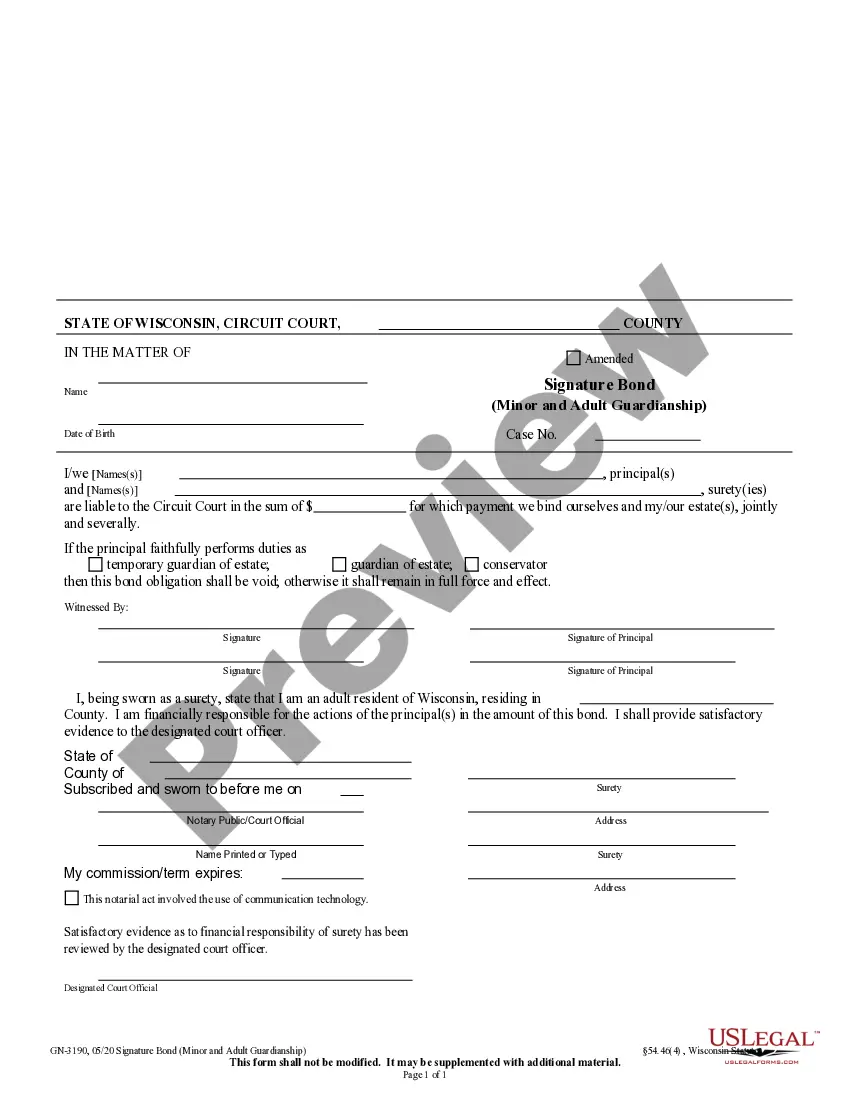

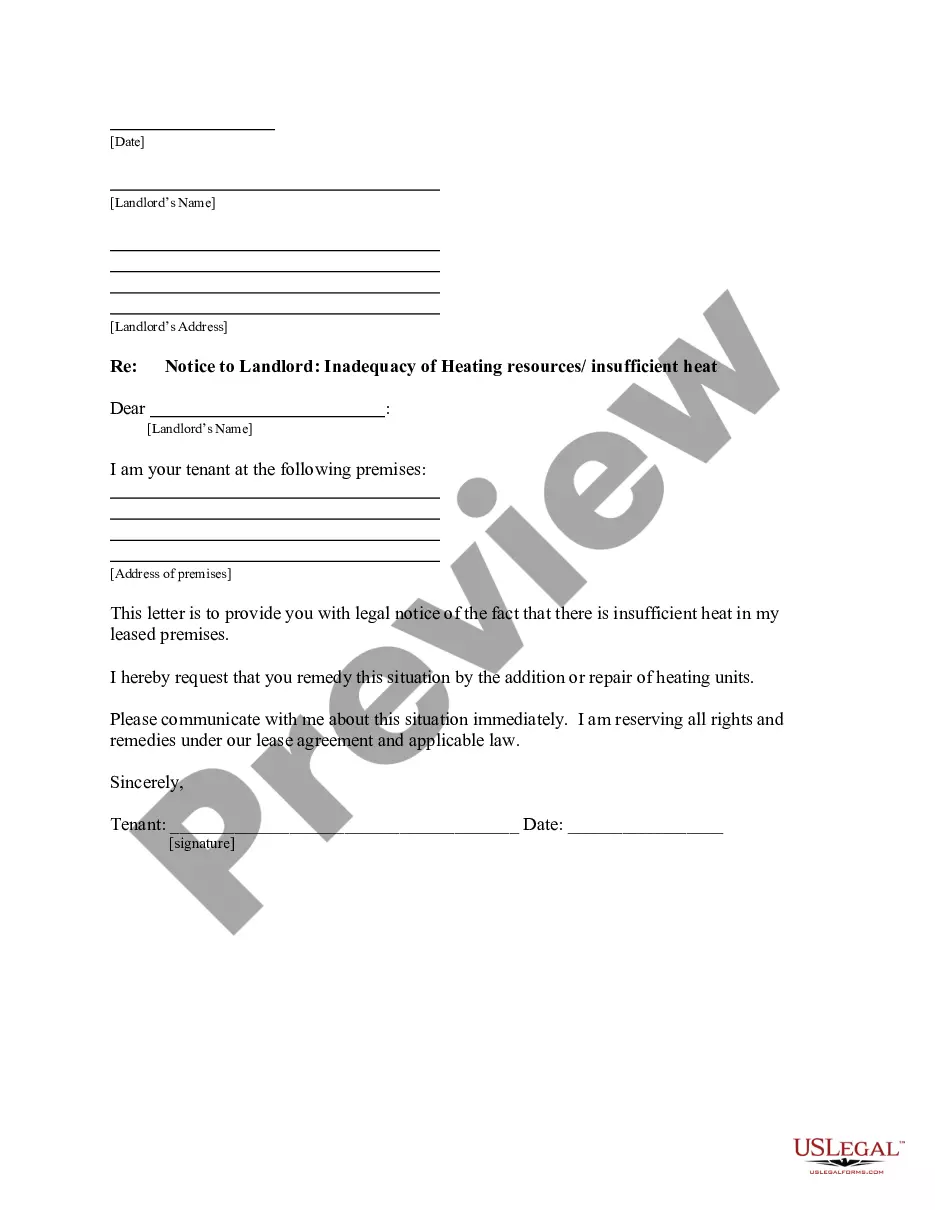

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Allegheny Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information materials and tutorials on the website to make any activities related to paperwork execution straightforward.

Here's how to find and download Allegheny Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the validity of some records.

- Examine the related forms or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and purchase Allegheny Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Allegheny Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you have to deal with an extremely complicated situation, we recommend using the services of a lawyer to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-compliant documents effortlessly!

Form popularity

FAQ

Because the second mortgage also uses the same property for collateral as the first mortgage, the original mortgage has priority on the collateral should the borrower default on his payments. If the loan goes into default, the first mortgage lender gets paid first before the second mortgage lender.

What is an example of a mortgagee clause? Mortgagee clauses protect your lender from damage to your property, even if you caused it. So, for example, if you commit arsonan act that would void your insurance policythe clause protects the mortgagee, ensuring that your lender will still be covered.

Notice of Incomplete Application, NOIA a form sent to the buyer that indicates missing or incomplete loan application information. Buyer must provide all required information for the lender to complete the application process.

Mortgage Foreclosures Rather, a second mortgage's lien is used to demonstrate that property owner's debt to the lender. Second mortgage liens can be foreclosed upon default just like first mortgage liens, though, and that can lead to issues with first mortgage due-on-sale clauses.

A corrective assignment corrects or amends a defect or mistake in the original assignment. A corporate assignment is an assignment of the mortgage from one corporation to another. A mers assignment involves the Mortgage Electronic Registration System (MERS).

Second mortgages allow you to access the untapped equity in your home for cash. HELOCs and home equity loans can help pay for big ticket items like college or major renovations. Interest rates on second mortgages are lower than on private loans or credit cards.

Contents of the Notice of Incompleteness First, the notice must be written. It then must specify the needed information and provide a reasonable period of time for the applicant to provide the missing information.

Second Priority Mortgage means a collective reference to each mortgage, deed of trust, deed to secure debt and any other document or instrument under which any Lien on real property owned by any Grantor is granted to secure any Second Priority Obligations or under which rights or remedies with respect to any such Liens

Notice of Incompleteness (NOI) is a letter from the lender to the loan applicant to request the applicant to provide documentation or information that is needed by the lender to make a credit decision.

If you wait more than 10 business days after you receive a Loan Estimate to tell the lender you intend to proceed, the lender can revise the terms and estimated costs and provide you with a revised Loan Estimate. The lender cannot assume that silence means you intend to proceed.