Contra Costa California is a county located in northern California, known for its diverse communities, vibrant culture, and scenic surroundings. Within the realm of mortgage financing, a Contra Costa California Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage refers to a specific type of loan arrangement available to property owners in the county. This mortgage option allows homeowners in Contra Costa California to leverage the equity they have built up in their property by taking out a second loan on their home. This type of loan is commonly used for various purposes, such as home improvements, debt consolidation, or funding educational expenses. By utilizing the equity in their property, homeowners can access a significant amount of capital to meet their financial needs. One notable feature of this particular mortgage option is the Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage. This means that the borrower, also known as the mortgagor, is required to reaffirm the accuracy and validity of the statements they made during the original mortgage application process. This recertification ensures that the lender has up-to-date information and can accurately assess the borrower's financial situation and risk profile before granting the second mortgage. Different types of Contra Costa California Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage may include: 1. Fixed-Rate Second Mortgage: This type of second mortgage offers a fixed interest rate throughout the loan term, providing borrowers with stability and predictable monthly payments. It is commonly chosen by borrowers who prefer a consistent repayment plan. 2. Adjustable-Rate Second Mortgage: In contrast to the fixed-rate option, an adjustable-rate second mortgage offers an interest rate that can fluctuate based on market conditions. Borrowers may benefit from lower initial interest rates, but they should be prepared for potential rate adjustments in the future. 3. Home Equity Line of Credit (HELOT): A HELOT is another type of second mortgage that provides homeowners with a line of credit, allowing them to access funds as needed. This option gives borrowers flexibility in borrowing and repaying, similar to a credit card, within a predetermined time frame referred to as the "draw period." When considering a Contra Costa California Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage, it is crucial for borrowers to thoroughly understand the terms and conditions, consult with a reputable lender, and assess their financial capabilities before proceeding with this financing option.

Contra Costa California Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Contra Costa California Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Contra Costa Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the latest version of the Contra Costa Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Contra Costa Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage:

- Look through the page and verify there is a sample for your region.

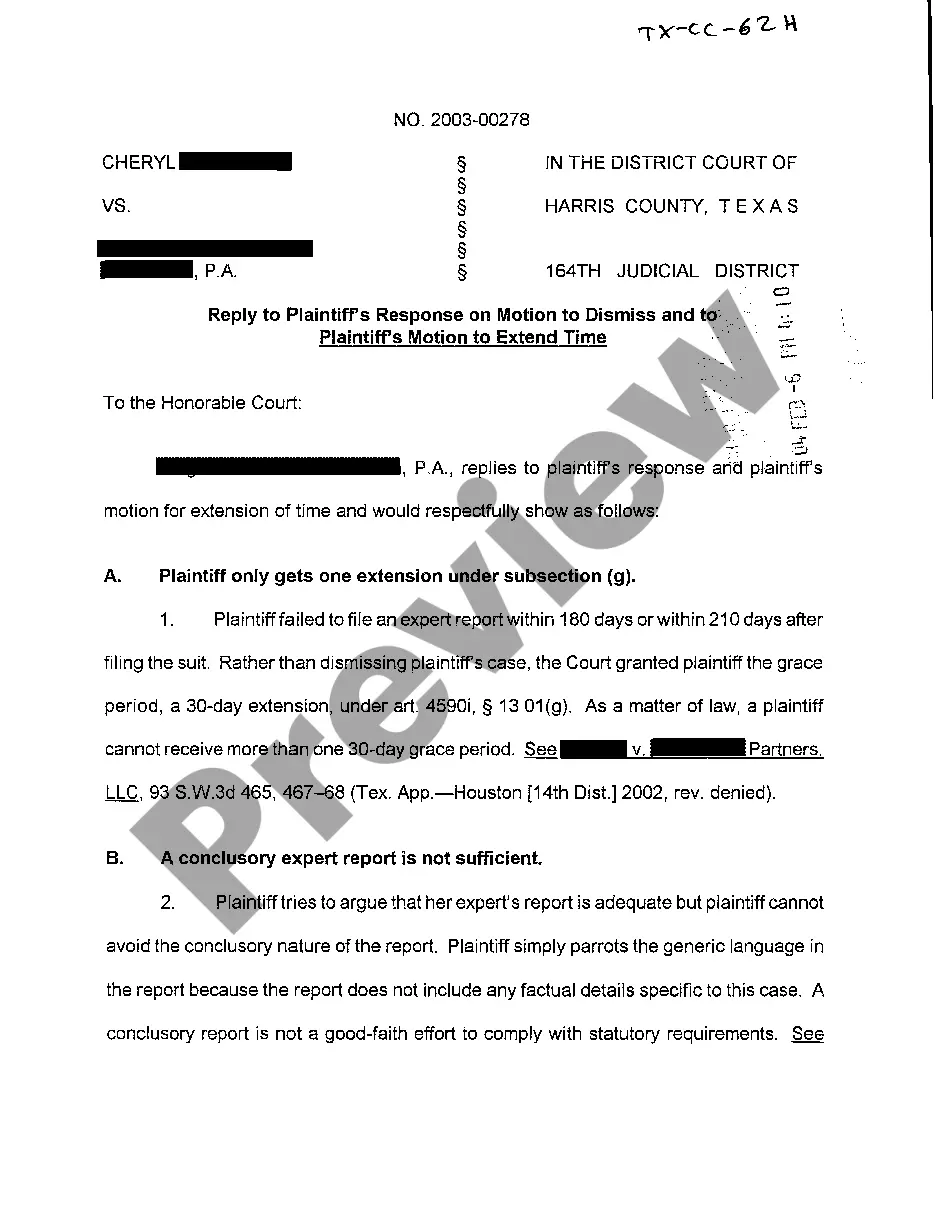

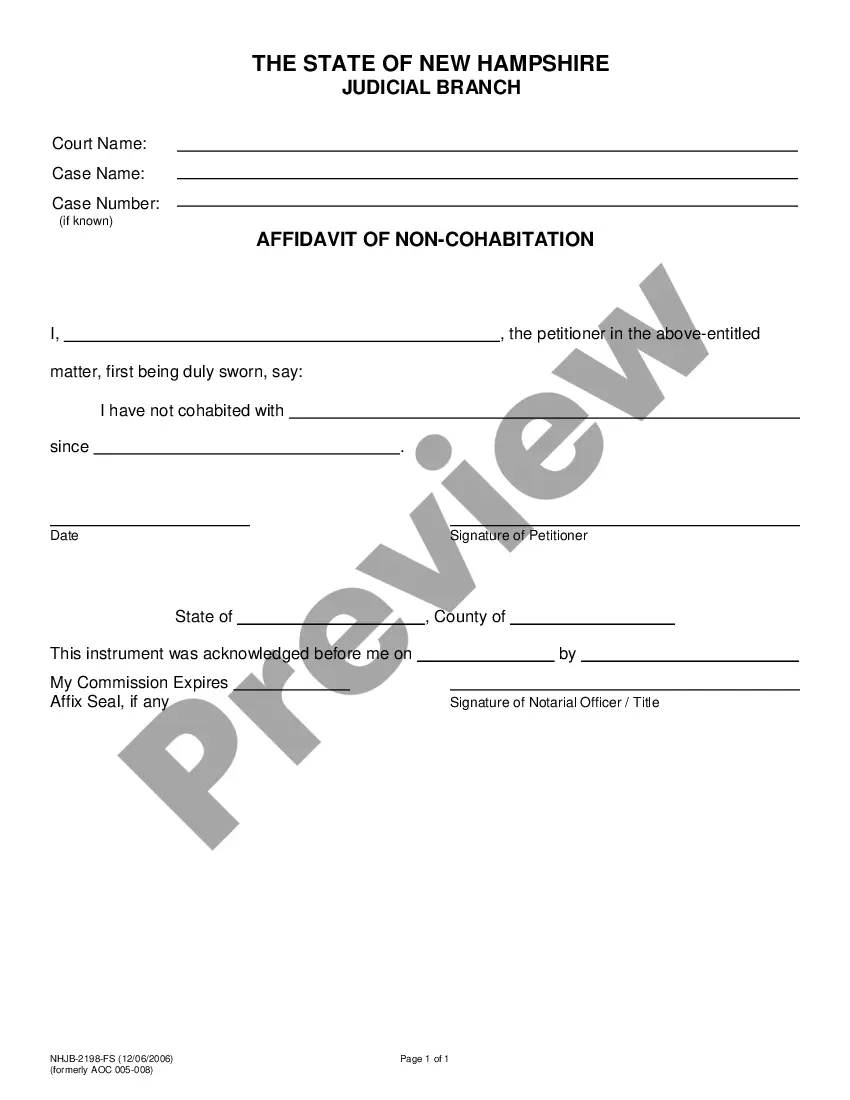

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Contra Costa Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!