Harris Texas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage is a legal document used in the state of Texas for securing a second mortgage on a property. This type of mortgage allows homeowners to access additional funding by leveraging their equity in the property. The purpose of the Harris Texas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage is to establish a lien on the property, just like a primary mortgage, but with different terms and conditions. It is important for the mortgagor to understand and agree to certain representations, warranties, and covenants related to the first mortgage. Keywords: Harris Texas Second Mortgage, Mortgagor's Recertification, Representations, Warranties, Covenants, First Mortgage, legal document, equity, lien, terms, conditions. Types of Harris Texas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage: 1. Fixed-Rate Second Mortgage: This type of second mortgage offers a fixed interest rate over the loan term. It provides stability with predictable monthly payments, allowing homeowners to budget effectively. 2. Adjustable-Rate Second Mortgage: With an adjustable-rate second mortgage, the interest rate may fluctuate periodically based on market conditions. This option can be beneficial for homeowners who expect interest rates to decrease in the future. 3. Home Equity Line of Credit (HELOT): A HELOT functions as a revolving line of credit, allowing homeowners to withdraw funds up to a predetermined limit. It offers flexibility in borrowing and repaying, much like a credit card. 4. Closed-End Second Mortgage: This type of second mortgage provides a lump sum payout to the homeowner, similar to a traditional mortgage. The repayment terms are fixed, and the interest rate remains constant throughout the loan term. 5. Construction-to-Permanent Second Mortgage: This option is suitable for individuals planning to build a new home or make significant renovations. It allows the borrower to obtain financing for both the construction phase and the permanent mortgage. It is essential for homeowners considering a Harris Texas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage to carefully review and understand the terms and conditions of each type. Consulting with a mortgage professional or legal advisor is highly recommended ensuring informed decision-making.

Harris Texas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

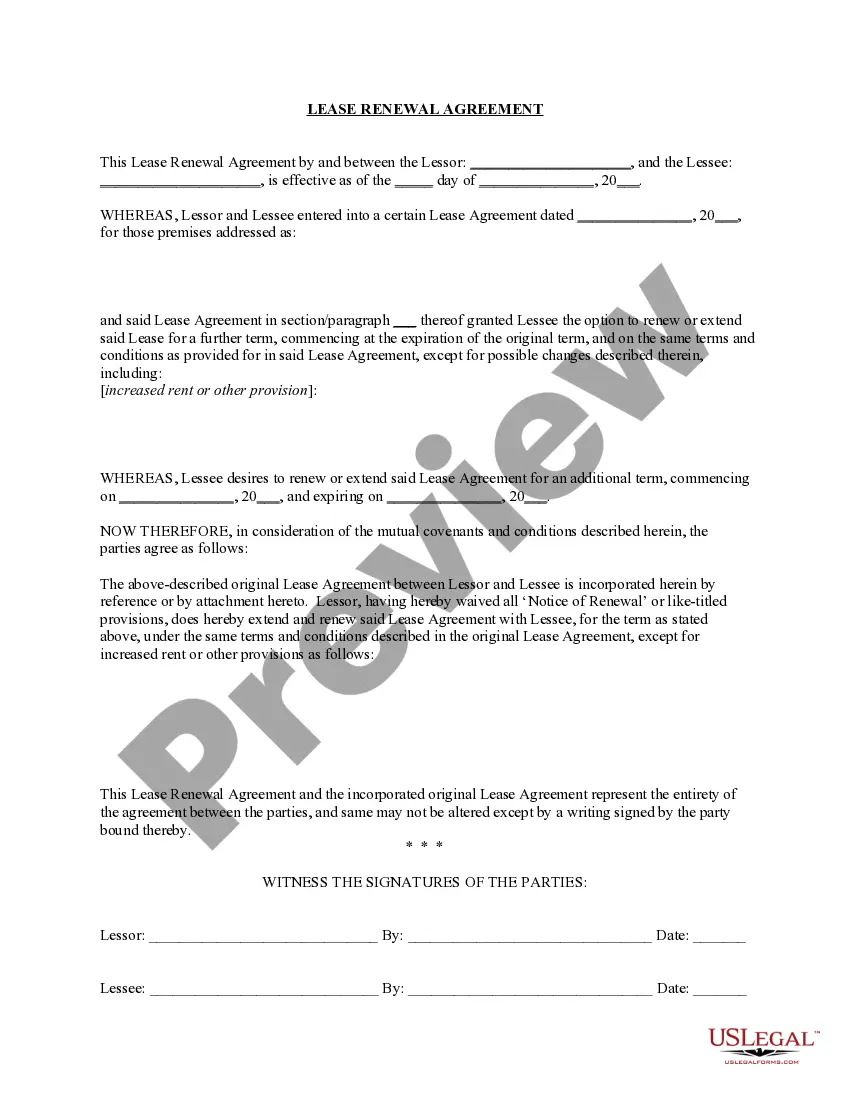

How to fill out Harris Texas Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Harris Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to get the Harris Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage. Follow the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!