Nassau New York Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage is a financial agreement that involves securing a second mortgage on a property located in Nassau County, New York. This type of mortgage is accompanied by a recertification process, where the mortgagor reaffirms the accuracy and truthfulness of various representations, warranties, and covenants made in the first mortgage agreement. With a Nassau New York Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage, the primary goal is to provide additional funding while taking into account the borrower's previous commitments in the first mortgage. This allows homeowners to tap into the equity they have built in their property without disturbing the terms and conditions of the existing primary mortgage. This type of mortgage agreement often carries specific variations depending on the lender and borrower's preferences. Some common types of Nassau New York Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage may include: 1. Fixed-Rate Second Mortgage: In this scenario, the interest rate remains constant throughout the term of the loan, providing predictable monthly payments to the borrower. 2. Adjustable-Rate Second Mortgage: With an adjustable-rate second mortgage, the interest rate fluctuates over time based on market conditions, potentially affecting the monthly payment amount. This type of mortgage may come with specific terms and adjustment periods. 3. Home Equity Line of Credit (HELOT): Helots allow borrowers to access a revolving line of credit secured by their property's equity. This option offers flexibility, as homeowners can borrow and repay multiple times within a designated draw period. 4. Lump-Sum Second Mortgage: A lump-sum second mortgage disburses the loan amount in one single payment. Borrowers typically choose this option when they need a specific amount of funds for a particular purpose. When obtaining a Nassau New York Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage, it is crucial for both the lender and borrower to understand the terms, conditions, and recertification process to ensure compliance with the agreement. This mortgage arrangement can provide financial options for homeowners while maintaining the integrity of the initial mortgage contract.

Nassau New York Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Nassau New York Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Nassau Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the Nassau Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Nassau Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage:

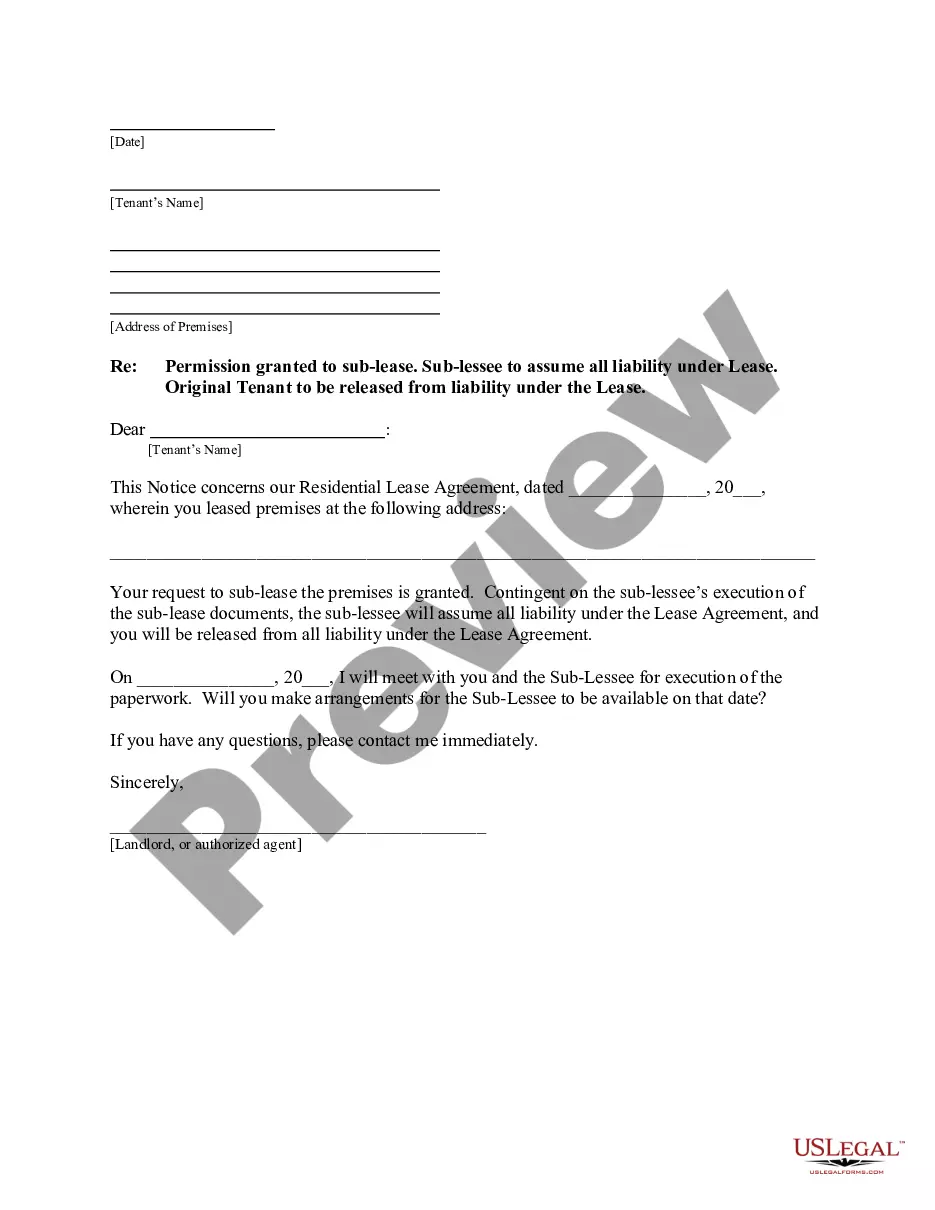

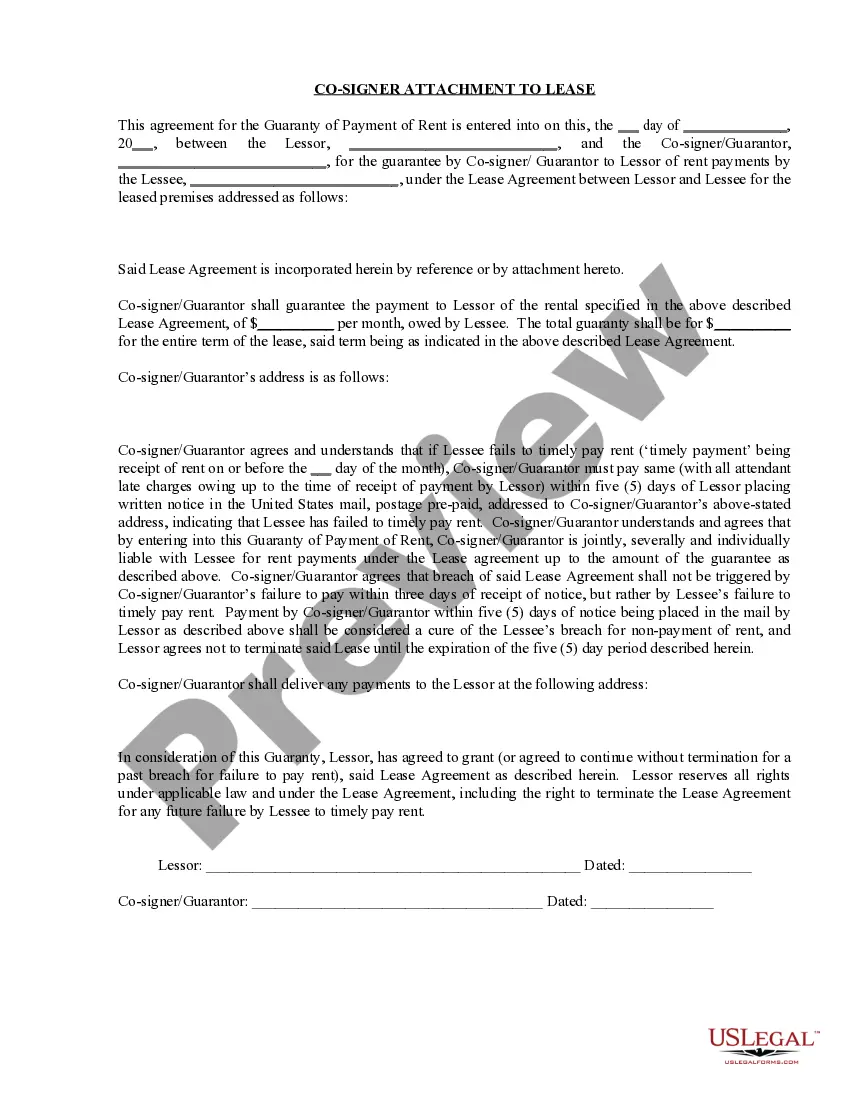

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Nassau Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!