Lima Arizona Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage is a financial arrangement that allows homeowners in Lima, Arizona to borrow against the equity they have built up in their property, using their first mortgage as collateral. This type of mortgage is commonly used for debt consolidation, home improvements, or to fund other major expenses. The Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage is an essential component of this second mortgage. It requires the borrower to reaffirm the accuracy and completeness of the statements made in the original first mortgage. By doing so, the borrower ensures that all representations, warranties, and covenants made in the initial mortgage agreement remain valid and in effect. Different types of Lima Arizona Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage may include: 1. Fixed-Rate Second Mortgage: This type of second mortgage offers a fixed interest rate and fixed monthly payments, providing borrowers with stability and predictability over the loan term. 2. Adjustable-Rate Second Mortgage: An adjustable-rate second mortgage features an interest rate that can fluctuate over time. The initial rate may be lower than a fixed-rate option, but it can increase or decrease based on market conditions. 3. Home Equity Line of Credit (HELOT): A HELOT functions like a credit line, allowing borrowers to access funds as needed during a specific period. Borrowers can borrow and repay the funds multiple times, making it a versatile option. 4. Balloon Second Mortgage: A balloon second mortgage offers lower monthly payments initially, but a large lump sum payment (balloon payment) is due at the end of the loan term. Borrowers should be prepared to fully repay the loan or refinance before the balloon payment is due. 5. Reverse Mortgage: This specialized second mortgage is available to older homeowners and allows them to convert their home equity into cash flow without having to sell the property or make monthly mortgage payments. These mortgages are typically repaid when the homeowner moves out or passes away. When considering a Lima Arizona Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage, it is essential to consult with a knowledgeable financial advisor and carefully assess your financial goals and needs. Additionally, comparing different loan options, understanding the terms, interest rates, and repayment schedules, as well as reviewing the recertification requirements, are crucial steps in making an informed decision.

Pima Arizona Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Pima Arizona Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

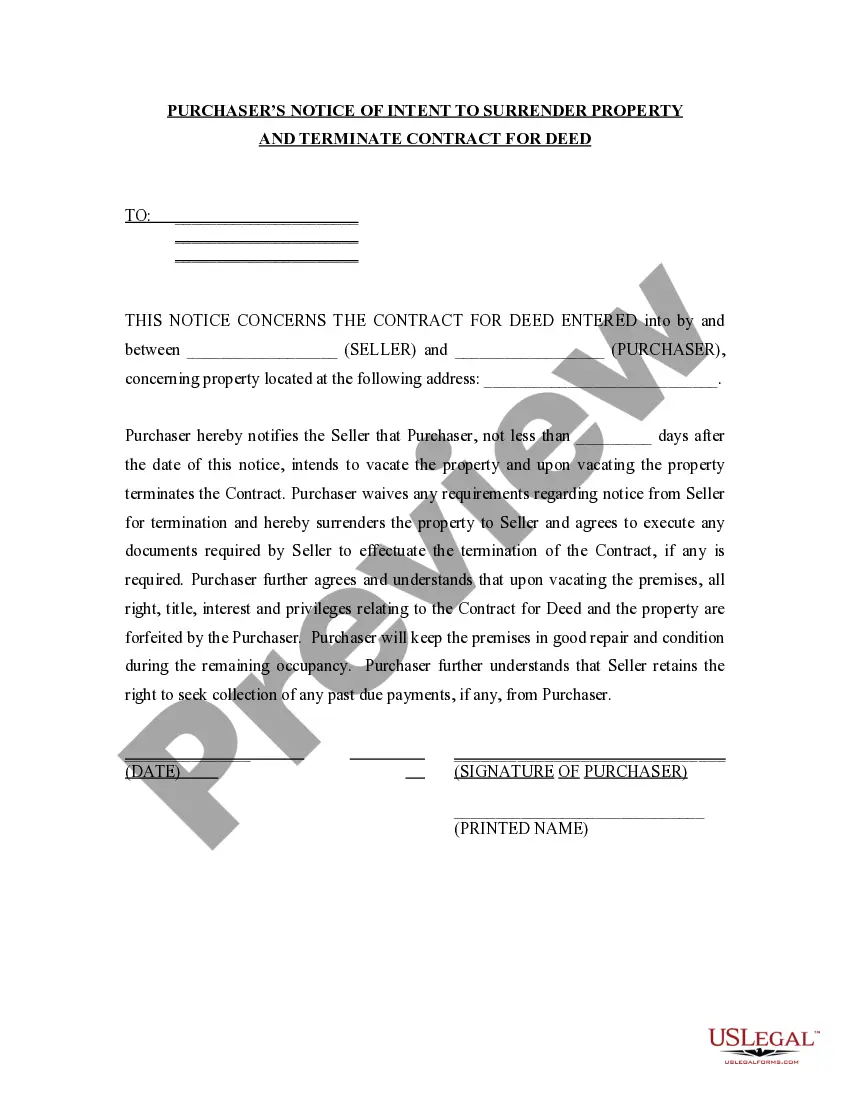

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Pima Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any activities related to paperwork completion simple.

Here's how you can find and download Pima Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Examine the related document templates or start the search over to locate the right file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and buy Pima Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Pima Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to deal with an exceptionally difficult case, we recommend getting an attorney to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

Representations and warranties are assertions or assurances given by the parties to the agreement. While most purchase agreements contain representations and warranties from seller and buyer, the seller representations and warranties typically are the most extensive and more important.

A representation is an assertion of past or existing fact given by one party to induce another party to enter into an agreement. A warranty is a promise that the assertion of existing fact or future facts are or will be true, along with an implied promise of indemnity if the assertion is false.

If an earlier mortgagee becomes aware that a subsequent mortgagee has entered into possession or is effecting power of sale, the earlier mortgagee can enter into possession itself rendering the second mortgagee powerless.

From 11 October 2021 Second Mortgages will no longer require First Mortgagee consent for registration in NSW.

Married couple buying a house under only one name FAQ Yes, one spouse can purchase a home without the other's name on the new mortgage application or title. In communal property states, the home would still belong to both partners during divorcee proceedings.

Essentially, the first mortgagor goes first while the second mortgagor has to wait until the first mortgage is paid out. In addition, a first mortgagor has to consent to the second mortgage before the second mortgage can be registered.

A representation is an assertion as to a fact, true on the date the representation is made, that is given to induce another party to enter into a contract or take some other action. A warranty is a promise of indemnity if the assertion is false.

Mortgage Holder Consent means, with respect to each Approved Project and the related Property, that certain mortgage lender disclosure form and consent setting forth an amount not less than the financing amount of the Approved Project, requesting confirmation from the related mortgage lender (providing mortgage finance

The best reason to get a second mortgage is to use the money to increase the value of your home. Using the money from a second mortgage to improve your home's value can maintain the equity you have in your home.

The second mortgage is a lump sum payment made out to the borrower at the beginning of the loan. Like first mortgages, second mortgages must be repaid over a specified term at a fixed or variable interest rate, depending on the loan agreement signed with the lender.