Sacramento California Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage is a legal document that outlines the terms and conditions of a second mortgage agreement in the Sacramento, California area. This type of mortgage involves a borrower pledging their property as collateral to secure a loan, with the lender holding the second position behind the primary mortgage lender. The purpose of including a mortgagor's recertification of representations, warranties, and covenants in the first mortgage is to ensure that the borrower provides updated information and confirms the accuracy of their initial statements. This is important to protect the interests of the lender and maintain the integrity of the mortgage agreement. Some common types of Sacramento California Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage include: 1. Fixed-rate second mortgage: This type of second mortgage carries a fixed interest rate throughout the loan term, providing stability and predictability in monthly payments. 2. Adjustable-rate second mortgage: In an adjustable-rate second mortgage, the interest rate is subject to change periodically based on a specified index. This can result in fluctuating monthly payments. 3. Home equity line of credit (HELOT): A HELOT allows homeowners to borrow against the equity in their property, providing flexibility in accessing funds as needed. The interest rate may be adjustable or fixed, depending on the agreement. 4. Interest-only second mortgage: This type of second mortgage allows borrowers to make interest-only payments for a predetermined period before principal payments kick in. This can potentially lower monthly payments but may result in a balloon payment at the end of the interest-only period. 5. Balloon payment second mortgage: A balloon payment second mortgage involves making regular payments for a fixed term, usually with lower monthly payments, but with a large lump-sum payment due at the end of the term. When entering into a Sacramento California Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, it is essential for both the borrower and lender to carefully review and understand the terms and obligations outlined in the agreement. Seeking legal advice or consulting with a mortgage professional can help ensure a smooth and transparent process.

Sacramento California Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Sacramento California Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Sacramento Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks associated with document execution simple.

Here's how you can purchase and download Sacramento Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

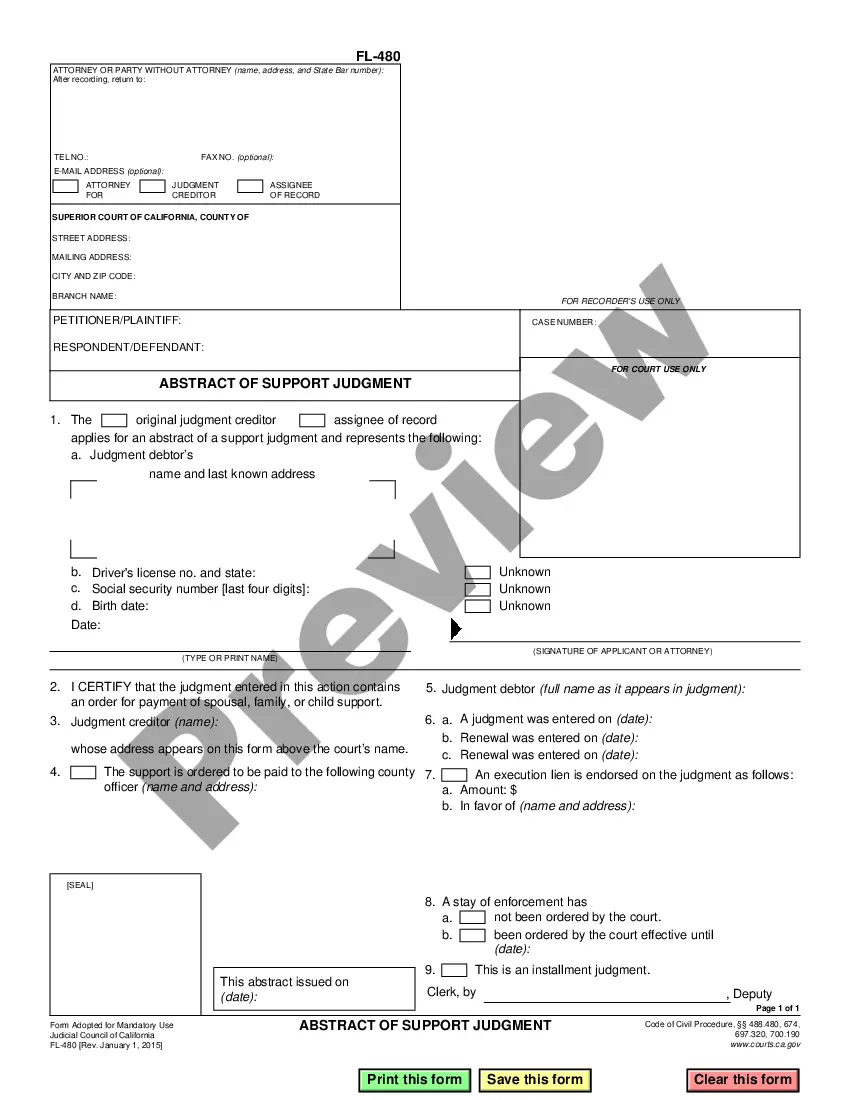

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar forms or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Sacramento Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Sacramento Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you need to deal with an exceptionally difficult situation, we recommend getting an attorney to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork with ease!