A San Jose California Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage is a type of loan arrangement where a borrower obtains a second mortgage on a property located in San Jose, California. This particular mortgage product includes a provision that requires the mortgagor to recertify their representations, warranties, and covenants made in the first mortgage. Keywords: San Jose California, second mortgage, mortgagor's recertification, representations, warranties, covenants, loan arrangement, property. In San Jose, California, there are various types of Second Mortgages with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage, including: 1. Fixed Rate Second Mortgage: This type of second mortgage features a fixed interest rate throughout the loan term. It provides borrowers with the certainty of consistent monthly payments. 2. Adjustable Rate Second Mortgage: This second mortgage offers a variable interest rate, which adjusts periodically based on a specific index, such as the Treasury Index or the London Interbank Offered Rate (LIBOR). This type of mortgage can be suitable for borrowers who anticipate fluctuating interest rates. 3. Home Equity Line of Credit (HELOT): A HELOT is a flexible second mortgage option that allows borrowers to access funds as needed, up to a predetermined credit limit. Borrowers can withdraw money multiple times during the "draw period" and may choose to pay interest only during this time. 4. Combination (or Piggyback) Second Mortgage: This type of second mortgage is commonly used to avoid paying private mortgage insurance (PMI) by combining two loans. The first mortgage covers a majority of the property's purchase price, and the second mortgage (often known as a piggyback loan) covers the remainder. This way, the borrower can avoid PMI and potentially obtain better interest rates. The recertification of representations, warranties, and covenants in the first mortgage is a crucial aspect of a San Jose California Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage. It ensures that the borrower reaffirms the accuracy and truthfulness of their initial statements, commitments, and obligations made in the first mortgage agreement. This recertification helps protect the lender's interests and ensures that all parties involved are in compliance with the mortgage terms. Overall, a San Jose California Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage offers borrowers in San Jose, California additional financing options secured against their property, while also ensuring the continued validity of the representations and commitments made in the original mortgage agreement.

San Jose California Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

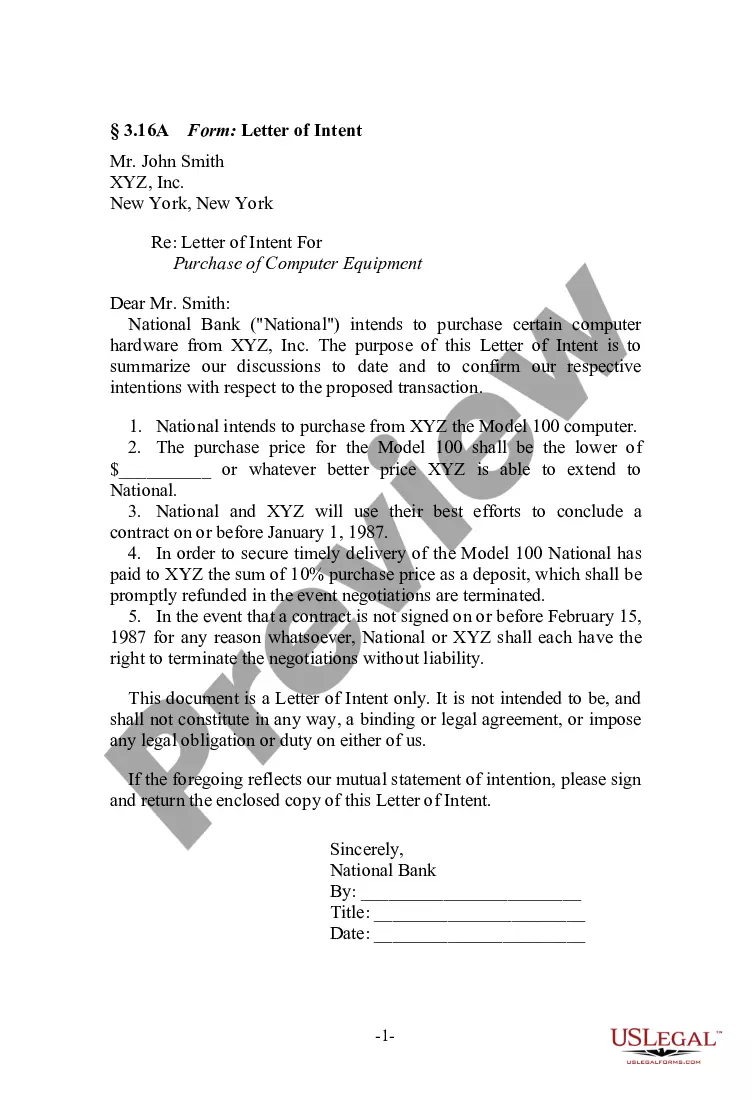

How to fill out San Jose California Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the San Jose Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the latest version of the San Jose Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Jose Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your San Jose Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!