Title: Cuyahoga Ohio Sample Letter for Deed of Trust and Promissory Note: Exploring Key Types and Information Introduction: When entering into a real estate transaction, it is crucial to have proper documentation in place to protect the interests of all parties involved. This article aims to provide a detailed description of what a Cuyahoga Ohio Sample Letter for Deed of Trust and Promissory Note entails, highlighting its importance and various types. 1. Cuyahoga Ohio Sample Letter for Deed of Trust and Promissory Note: A. Purpose: The Sample Letter for Deed of Trust and Promissory Note serves as a legally binding agreement between a borrower and a lender pertaining to the financing of a real estate property. It outlines the terms, conditions, and obligations of both parties, offering security to lenders and defining the repayment schedule for borrowers. B. Importance: This document plays a vital role in protecting the lender's interest, as it allows them to claim ownership of the property if the borrower defaults on the loan. It also provides a clear understanding of the terms and expectations for the borrower, ensuring transparency and peace of mind for all parties involved. C. Key Components: i. Identification: The document clearly identifies the borrower, lender, and the property in question, including relevant details such as address, legal description, and parcel identification number. ii. Loan Terms: It outlines the loan amount, interest rate, duration, monthly payments, and any prepayment penalties, offering clarity on the financial aspect. iii. Security Agreement: The Deed of Trust establishes the property as collateral for the loan until the borrower fulfills their obligations according to the promissory note. iv. Lender's Rights: The document outlines the lender's right to accelerate the loan, in case of default, and their ability to initiate foreclosure proceedings to enforce the security interest if necessary. 2. Types of Cuyahoga Ohio Sample Letter for Deed of Trust and Promissory Note: A. Standard Template: This is the most common and widely used type of Cuyahoga Ohio Sample Letter for Deed of Trust and Promissory Note, suitable for conventional financing, where the borrower commits to fully repay the loan within the agreed-upon terms. B. Adjustable Rate Mortgage (ARM): This type of Sample Letter for Deed of Trust and Promissory Note permits the interest rates to vary during the loan term, based on external factors such as the market index, making it a viable option for borrowers seeking flexibility. C. Balloon Payment Note: This variation includes smaller monthly payments for a predetermined period, followed by a larger payment at the end of the term. It can be helpful for borrowers with short-term financing needs but requires careful planning to ensure the final lump sum payment can be met. Conclusion: In the realm of real estate financing, a Cuyahoga Ohio Sample Letter for Deed of Trust and Promissory Note is a crucial document that safeguards the interests of both borrowers and lenders. It outlines the terms and conditions of the loan, establishing the borrower's responsibilities while protecting the lender's investment. Understanding the various types available enables individuals to choose an appropriate document tailored to their specific needs.

Cuyahoga Ohio Sample Letter for Deed of Trust and Promissory Note

Description

How to fill out Cuyahoga Ohio Sample Letter For Deed Of Trust And Promissory Note?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business purpose utilized in your county, including the Cuyahoga Sample Letter for Deed of Trust and Promissory Note.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Cuyahoga Sample Letter for Deed of Trust and Promissory Note will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to get the Cuyahoga Sample Letter for Deed of Trust and Promissory Note:

- Ensure you have opened the right page with your localised form.

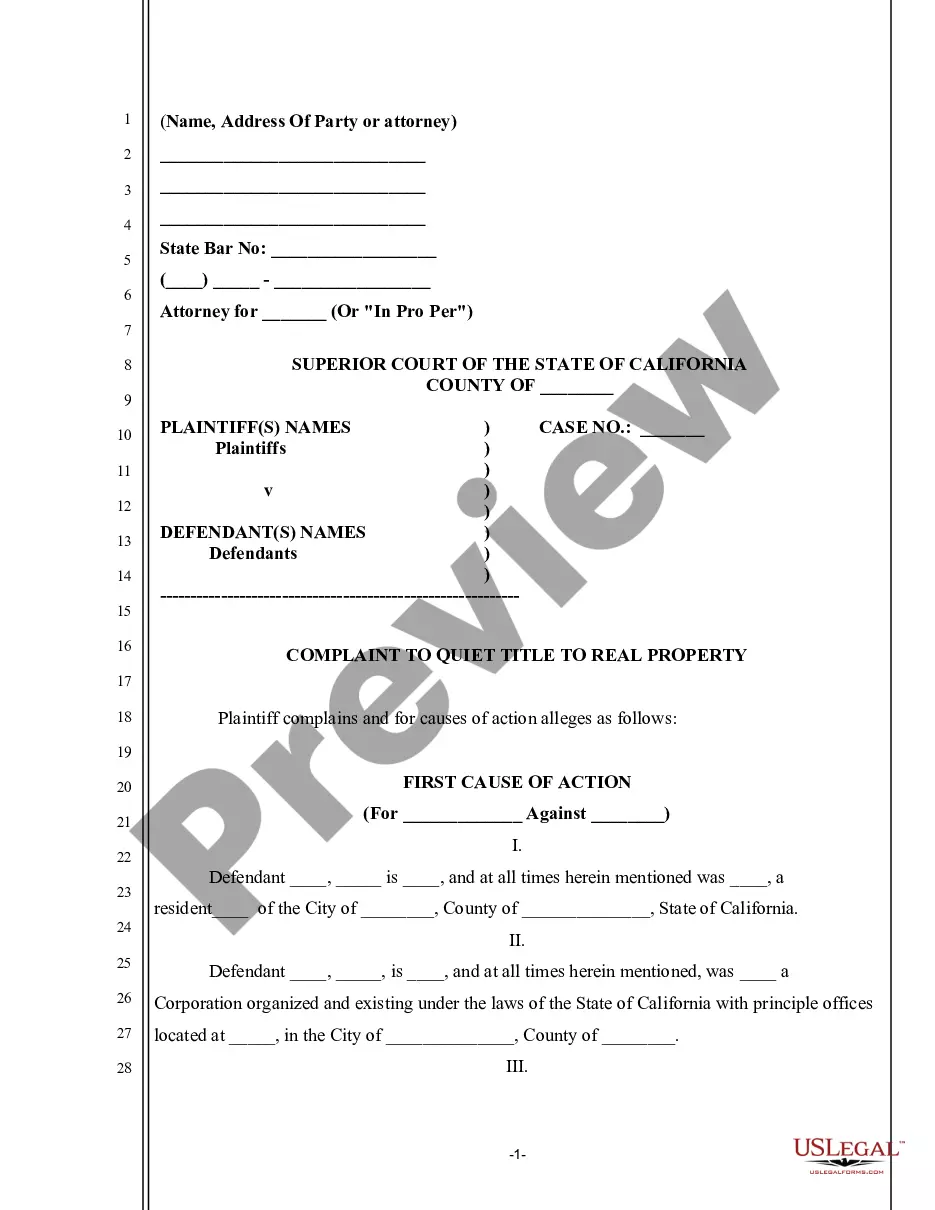

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Cuyahoga Sample Letter for Deed of Trust and Promissory Note on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!