Title: Harris Texas Sample Letter for Note and Deed of Trust: A Comprehensive Guide Introduction: When engaging in real estate transactions in Harris County, Texas, it is essential to understand the intricacies of the legal documents involved, such as the Note and Deed of Trust. This article aims to provide a detailed description of what the Harris Texas Sample Letter for Note and Deed of Trust entails, explaining its significance and outlining the types available. 1. Understanding the Harris Texas Note and Deed of Trust: The Note and Deed of Trust are commonly used legal documents in real estate financing. They serve as a mutually binding agreement between a borrower and a lender outlining the terms and conditions of a loan. The Note codifies the borrower's promise to repay the loan, while the Deed of Trust provides the lender with a security interest in the property as collateral. 2. Importance of a Sample Letter for Note and Deed of Trust: Utilizing a sample letter for Note and Deed of Trust helps ensure that all essential elements and clauses required by Texas law are included. These documents are legally binding, and any omission or error could potentially have significant repercussions. 3. Components of a Harris Texas Sample Letter for Note and Deed of Trust: a) Introduction: The document begins with a clear and concise statement identifying all parties involved, including the lender (or beneficiary), borrower (or trust or), and the property being financed. b) Loan Terms: This section outlines the crucial loan details, including the principal amount, interest rate, repayment schedule, late fees, and any potential penalties. c) Loan Default and Foreclosure: The letter specifies the actions to be taken in the event of borrower default or non-payment, describing the lender's rights and remedies, including foreclosure proceedings. d) Escrow and Insurance: If applicable, the document may address the requirement for an escrow account for property taxes and insurance, ensuring timely payments to protect the lender’s interests. e) Dispute Resolution: The sample letter may include a provision for alternative dispute resolution methods, such as mediation or arbitration, to settle any conflicts arising between the parties. f) Signatures and Notarization: To finalize the agreement, the letter must be signed and notarized by the involved parties and witnesses, ensuring its authenticity and legal validity. 4. Types of Harris Texas Sample Letters for Note and Deed of Trust: a) Residential Note and Deed of Trust: This type is used for financing residential properties, such as homes or condominiums. b) Commercial Note and Deed of Trust: Suitable for commercial properties like office buildings, shopping centers, or warehouses, catering to specific legal and financial complexities. c) Construction Note and Deed of Trust: Designed for loans used in construction projects, ensuring proper disbursement of funds and adherence to construction milestones. Conclusion: Taking the time to understand the intricacies of the Harris Texas Sample Letter for Note and Deed of Trust is crucial for anyone involved in real estate transactions in Harris County. By utilizing relevant keywords, this article provides a comprehensive overview, outlining its significance and various types available, ensuring a smooth and legally sound process.

Harris Texas Sample Letter for Note and Deed of Trust

Description

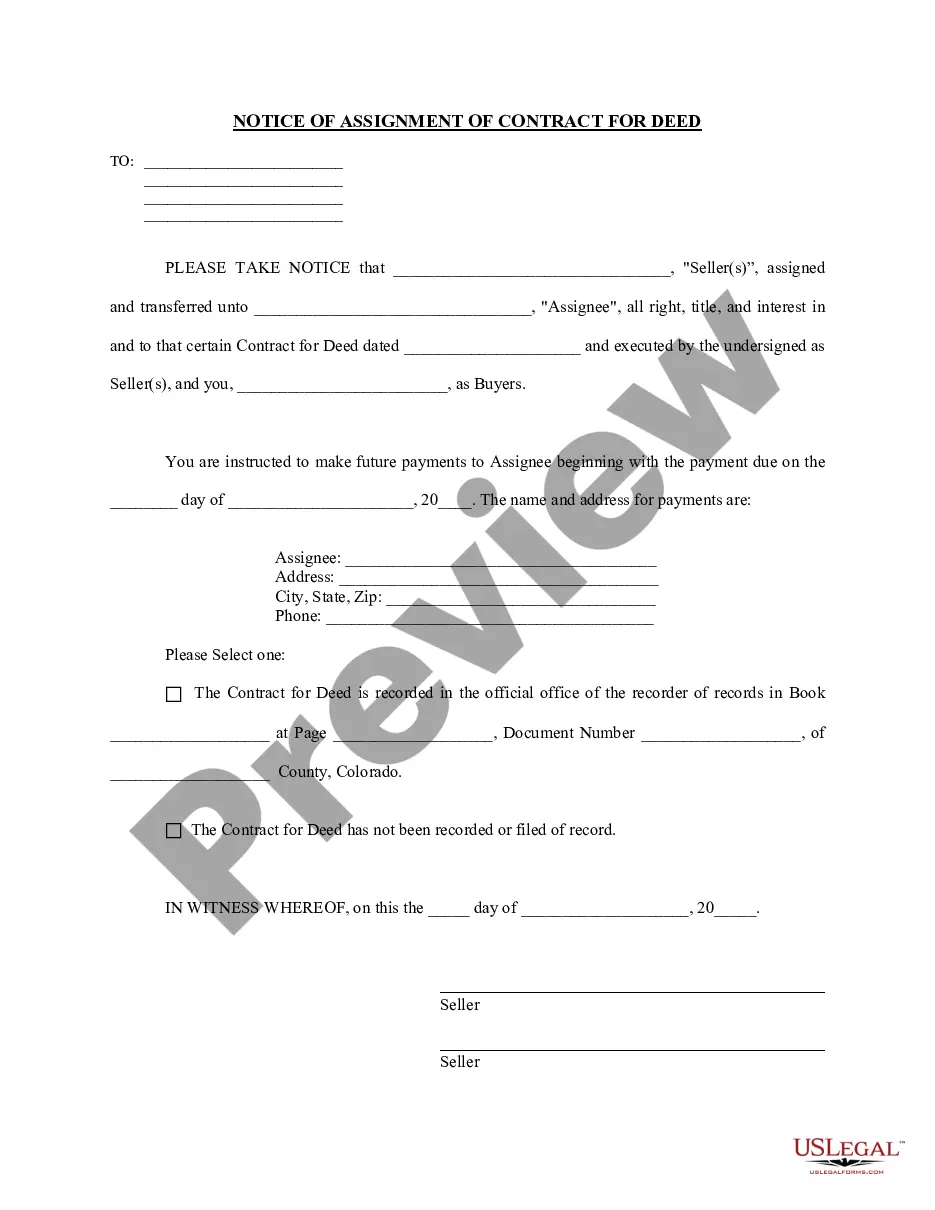

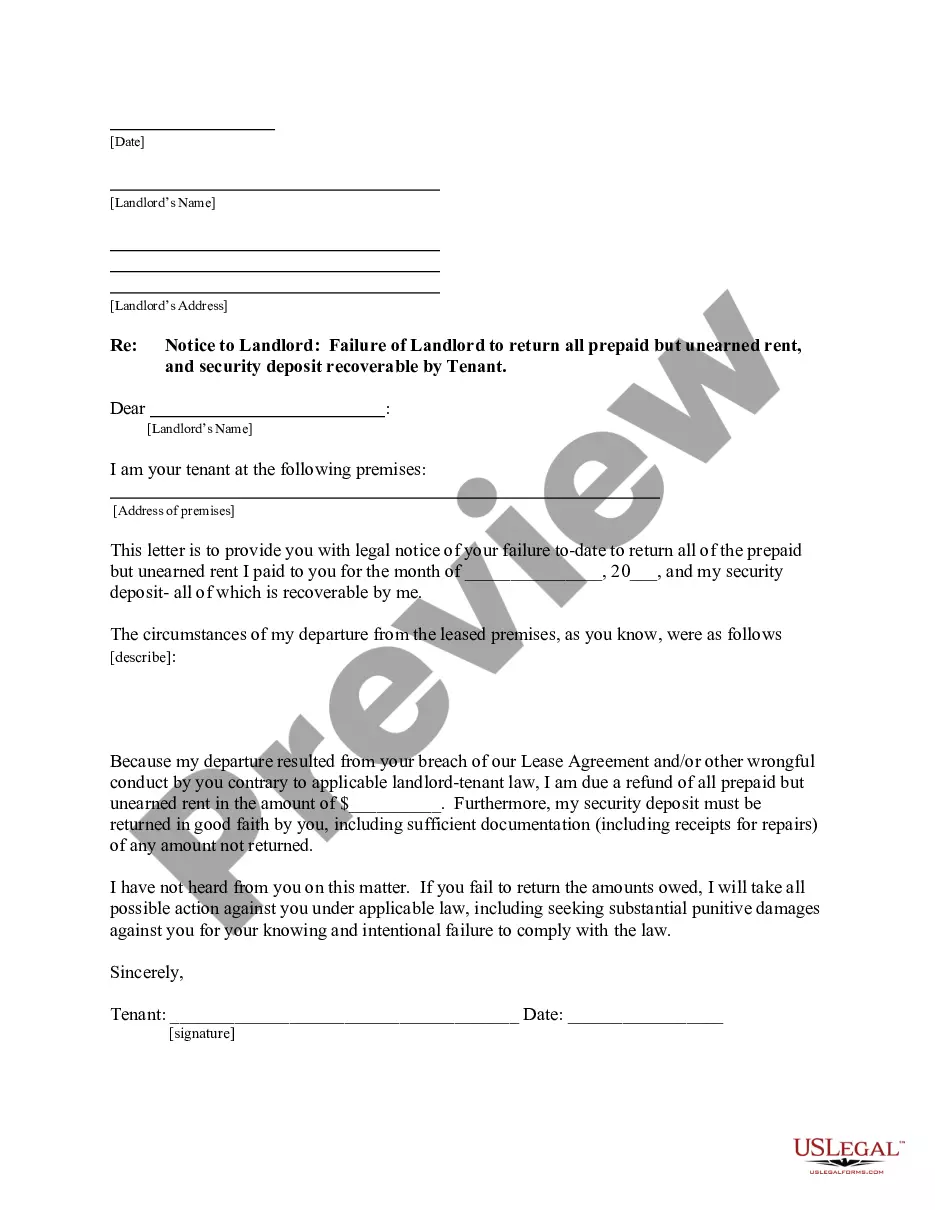

How to fill out Harris Texas Sample Letter For Note And Deed Of Trust?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, finding a Harris Sample Letter for Note and Deed of Trust meeting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Harris Sample Letter for Note and Deed of Trust, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Professionals verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Harris Sample Letter for Note and Deed of Trust:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Harris Sample Letter for Note and Deed of Trust.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Where can I file my Release of Lien? Releases of Liens can be filed in person or by mail in the Real Property Department. The nine annex offices can accept them for filing, however it may take 5 -7 business days to be filed based upon delivery of the work to the downtown office.

If you wish, a copy may be obtained in person at the Harris County Clerk's Office located downtown in the Harris County Civil Courthouse, 201 Caroline, 3rd Floor, Monday through Friday from a.m. to p.m. If your property is not located in Harris County and you would like to obtain a copy of the recorded deed

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

The Heirship Affidavit need only be signed Page 2 and sworn by the disinterested parties. All signatures must be in the presence of a Notary Public. Clerk of the county of decedent's residence, along with an Order for the Judge to sign approving it as conforming with the requirements of TPC §137.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

Purchase paper copies of documents without the unofficial watermark in person at any Annex Location. by fax: (713) 437-4868. by email to: ccinfo@cco.hctx.net. by mail to: Teneshia Hudspeth, Harris County Clerk. Attn: Information Department. P.O. Box 1525. Houston, TX. 77251. For Questions Call (713) 274-6390.

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.

To e-file through the State of Texas' electronic portal EFileTexas.gov, you must first select an electronic filing service provider (EFSP). To view a list of electronic filing providers (EFSP) that have been approved by the State visit .

Harris County Clerk Probate Department Harris County Civil Courthouse. 201 Caroline, Suite 800. Houston, TX 77002. (713) 274-8585.