Queens New York Sample Letter for Note and Deed of Trust

Description

How to fill out Queens New York Sample Letter For Note And Deed Of Trust?

Drafting papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Queens Sample Letter for Note and Deed of Trust without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Queens Sample Letter for Note and Deed of Trust on your own, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Queens Sample Letter for Note and Deed of Trust:

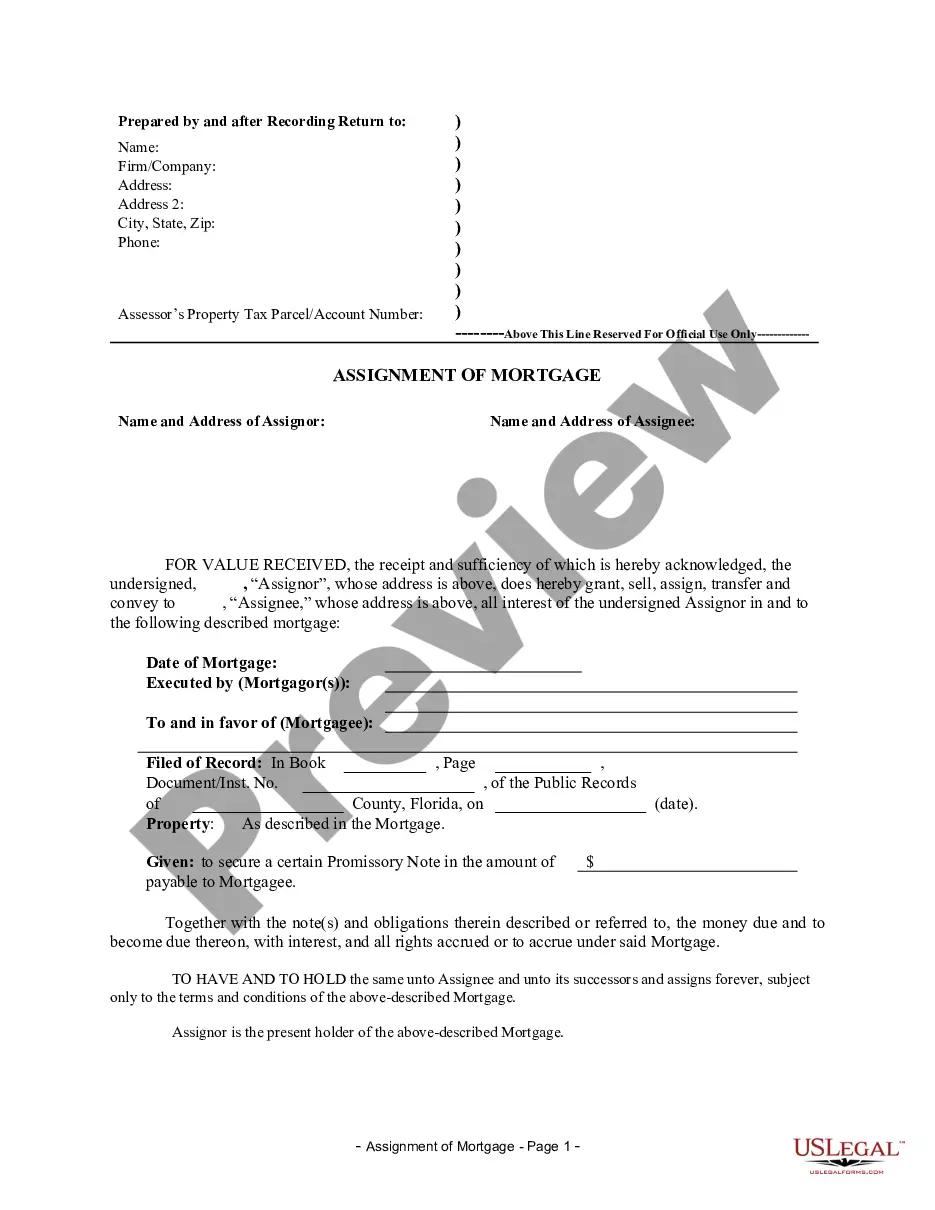

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

How to Prepare a Deed of Trust (Real Estate Seller Financing Tutorial) YouTube Start of suggested clip End of suggested clip There's the promissory note and there's the deed of trust. The deed is the document that essentiallyMoreThere's the promissory note and there's the deed of trust. The deed is the document that essentially transfers ownership from the seller to the buyer.

Assignment of Note and Deed of Trust means an assignment of all of the Participating Lending Institution's right, title, and interest in a Note and Deed of Trust, in substantially the form provided in the applicable Lender's Manual.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a trustee. The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

The promissory note is the promise to repay the loan funds to the lender. The deed of trust secures the house and land to the note and allows a lender to foreclose on a property if there is default. The most common default is failure to make the payments under the promissory note.

A deed of trust often requires a promissory note, but the promissory note is a specific document type. While a deed of trust describes the terms of debt as secured by a property, a promissory note acts as a promise that the borrower will pay the debt. A borrower signs the promissory note in favor of a lender.

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.

The promissory note could bear reasonable interest and be secured by the trust property. As discussed below, a promissory note is generally considered evidence of a loan transaction rather than the current payment of a specific amount.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.