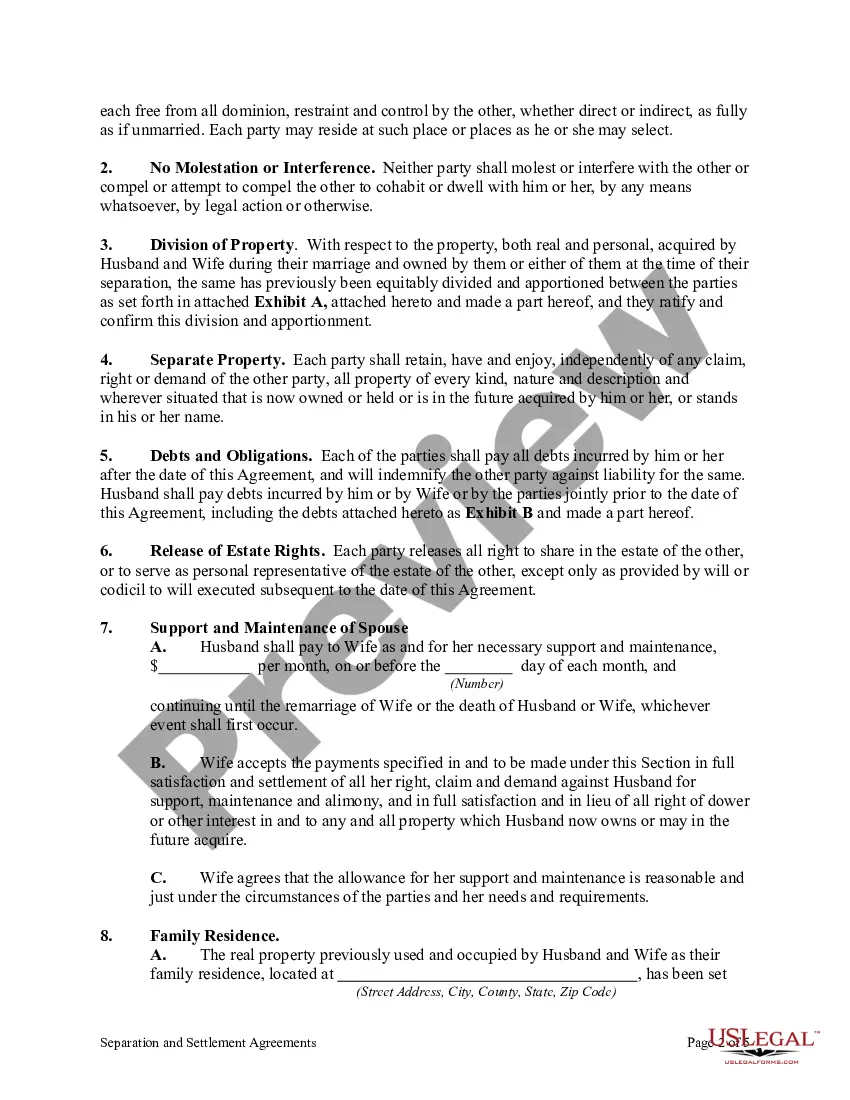

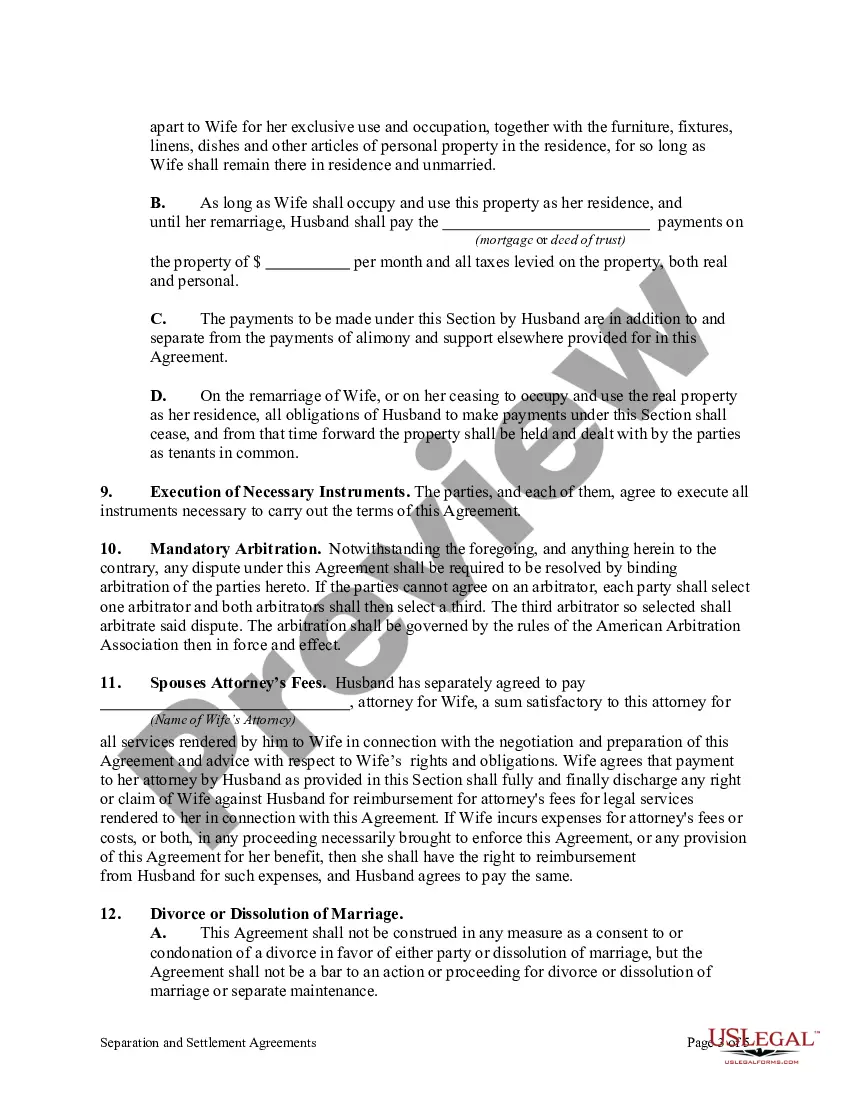

Franklin Ohio Separation and Settlement Agreement with Provisions for Support of Spouse is a legally binding document that outlines the terms and conditions of the separation and eventual divorce between spouses in Franklin Ohio. This agreement is specifically tailored to address the financial support needs of the dependent spouse during and after the separation period. Here are some key provisions that are commonly included in Franklin Ohio Separation and Settlement Agreements with Provisions for Support of Spouse: 1. Alimony or Spousal Support: The agreement will specify the amount and duration of spousal support payments from the paying spouse to the dependent spouse. It may also address any potential changes in spousal support over time, such as modifications based on fluctuations in income or changes in circumstances. 2. Child Support: If the spouses have children, the agreement will outline the responsibilities of each parent in providing financial support for their children. It will include provisions for child support payments, including how they will be calculated, when they are due, and any potential modifications based on changes in income or custody arrangements. 3. Division of Assets and Debts: The agreement will detail the division of marital assets and debts between the spouses. This may include the division of real estate, bank accounts, retirement accounts, investments, and any debts accrued during the marriage. The agreement should specify how each asset and debt will be allocated and any potential tax implications. 4. Health Insurance and Medical Expenses: If one spouse provides health insurance coverage for the family, the agreement will determine how this coverage will be maintained during and after the separation. It may also address how medical expenses for the dependent spouse and children will be handled, such as through insurance or shared expenses. 5. Tax Considerations: The agreement should consider tax implications for both spouses, such as who will claim dependency exemptions or the filing status for tax returns. It may also outline any potential tax liabilities resulting from the division of assets or payments of spousal support. 6. Legal Fees: The agreement may specify how legal fees and related costs will be handled, such as whether each spouse will be responsible for their own fees or if one spouse will provide financial assistance to the other for legal representation. Types of Franklin Ohio Separation and Settlement Agreements with Provisions for Support of Spouse can differ based on specific circumstances, such as the length of the marriage, the financial situation of each spouse, and the presence of children. Some specific types include: 1. Uncontested Separation Agreement: When both spouses can agree on the terms of the separation and support provisions without court intervention. 2. Contested Separation Agreement: When there are disputes and disagreements between the spouses regarding the support provisions, requiring court intervention to reach a resolution. 3. Temporary Separation Agreement: When the spouses decide to live separately for a period of time, and the agreement addresses temporary support provisions until a final settlement is reached. In conclusion, a Franklin Ohio Separation and Settlement Agreement with Provisions for Support of Spouse is a comprehensive legal document that outlines the financial responsibilities and division of assets between divorcing spouses. It is crucial for both parties to seek the guidance of a qualified attorney to understand and negotiate the terms of the agreement to ensure a fair and equitable distribution of financial resources.

Franklin Ohio Separation and Settlement Agreement with Provisions for Support of Spouse

Description

How to fill out Franklin Ohio Separation And Settlement Agreement With Provisions For Support Of Spouse?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Franklin Separation and Settlement Agreement with Provisions for Support of Spouse, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any activities related to document execution straightforward.

Here's how you can find and download Franklin Separation and Settlement Agreement with Provisions for Support of Spouse.

- Take a look at the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the legality of some records.

- Examine the similar forms or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Franklin Separation and Settlement Agreement with Provisions for Support of Spouse.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Franklin Separation and Settlement Agreement with Provisions for Support of Spouse, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you need to cope with an exceptionally challenging case, we recommend using the services of a lawyer to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant documents with ease!