Subject: Important Notice Regarding the Assignment of Debt — San Bernardino, California Dear [Debtor's Name], We hope this letter finds you well. It is our duty to inform you of an important change in the ownership and management of your outstanding debt. This notice serves as a legally binding document that notifies you about the assignment of your debt to a new creditor in accordance with applicable laws. As you may be aware, San Bernardino, California, is a vibrant city located in the Inland Empire region. It is renowned for its rich history, picturesque landscapes, and a diverse community. The purpose of this letter is to outline the various types of San Bernardino, California sample letters for notice to debtor of assignment of debt. 1. Assignment of Debt Notice: This type of letter is used to inform debtors about the transfer of their debt from the original creditor to a new creditor or debt collection agency. It specifies crucial details such as the new creditor's name, contact information, and the amount outstanding. Additionally, it provides information on how the debtor should proceed, including making future payments to the new creditor directly. 2. Verification of Debt Assignment: In some cases, debtors may require clarification of the validity and legitimacy of the new assignment of debt. This letter aims to provide debtors with verification and documentation, highlighting the legal transfer of the debt. It typically includes relevant transaction details, creditor information, and contact details for any further inquiries. 3. Account Balance Verification: An account balance verification letter is sent to debtors to ensure both parties have accurate records of the outstanding debt. It summarizes the original amount owed, any previous payments made, and interest, if applicable. This document serves as a tool for debtors to compare their records with those of the new creditor and identify any discrepancies, if present. 4. Debt Repayment Agreement Amendment: Occasionally, the assignment of debt may prompt changes to the existing repayment agreement. This letter informs the debtor about any modifications or adjustments to the repayment terms, such as payment amounts, due dates, or interest rates. It emphasizes the importance of reviewing and acknowledging these changes to maintain a healthy creditor-debtor relationship. Please note that the aforementioned sample letters should only serve as guides. Exact content may vary depending on the circumstances and requirements of both the debtor and new creditor. Should you have any questions, concerns, or require additional information, we encourage you to contact our office directly using the provided contact details. We appreciate your attention to this matter and look forward to your prompt response. Your commitment to resolving this debt will undoubtedly aid in achieving a mutually agreeable financial arrangement. Thank you for your cooperation. Sincerely, [Your Name] [Your Company/Organization] [Contact Information]

San Bernardino California Sample Letter for Notice to Debtor of Assignment of Debt

Description

How to fill out San Bernardino California Sample Letter For Notice To Debtor Of Assignment Of Debt?

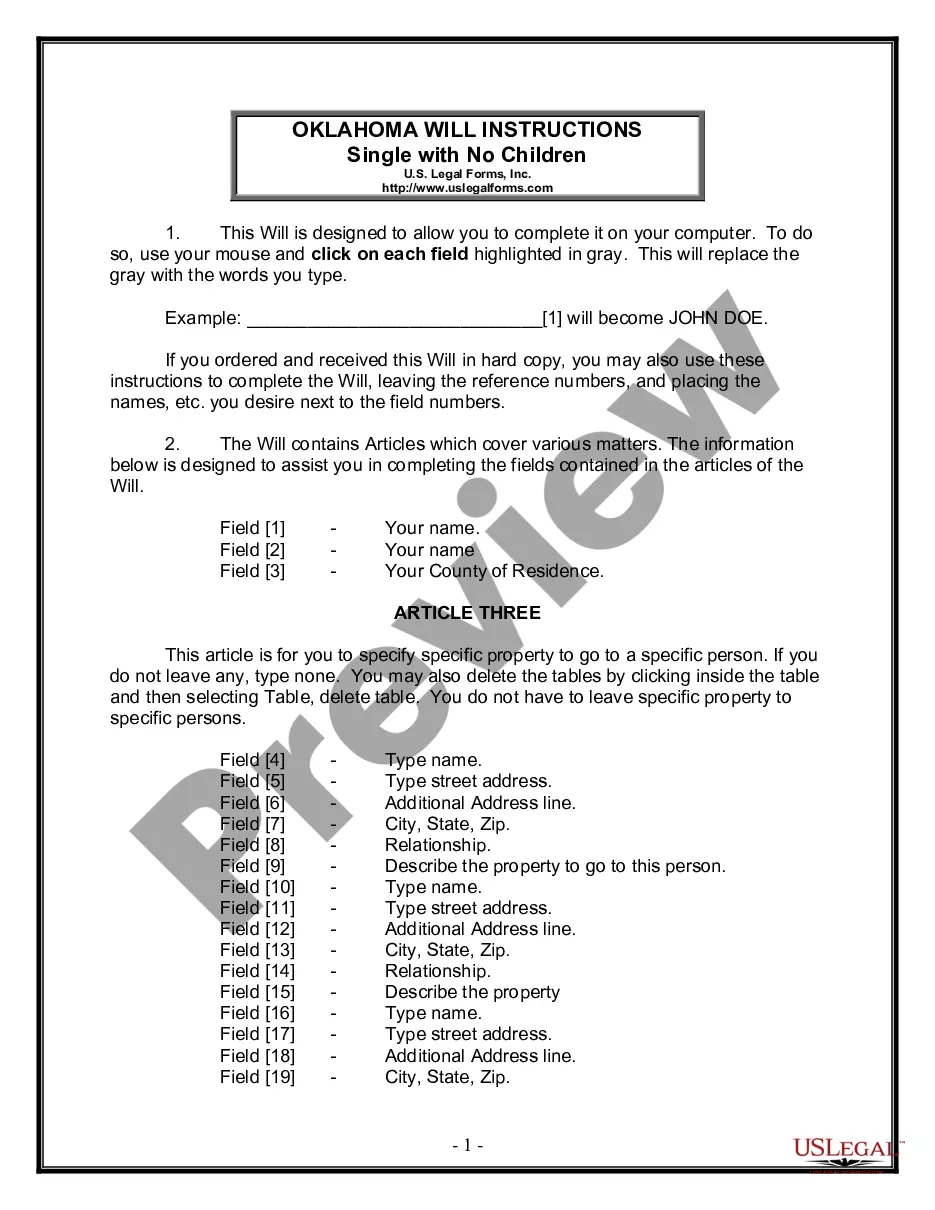

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life situation, locating a San Bernardino Sample Letter for Notice to Debtor of Assignment of Debt meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the San Bernardino Sample Letter for Notice to Debtor of Assignment of Debt, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your San Bernardino Sample Letter for Notice to Debtor of Assignment of Debt:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Bernardino Sample Letter for Notice to Debtor of Assignment of Debt.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!