Subject: Detailed Description of Broward Florida Sample Letter for Exemption of Ad Valor em Taxes Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to provide you with a detailed description of Broward Florida's Sample Letter for Exemption of Ad Valor em Taxes, an essential document used to request exemption from ad valor em taxes in the Broward County area. 1. Introduction: The Broward Florida Sample Letter for Exemption of Ad Valor em Taxes serves as an official request for property owners in Broward County to seek exemption from ad valor em taxes based on certain qualifying criteria. 2. Purpose: The purpose of this letter is to outline the circumstances that make the property eligible for an exemption and to provide supporting documentation to substantiate the claim for exemption. 3. Property Details: In this section, the property owner must provide comprehensive information about the property, including its address, legal description, and property identification number (PIN). It is essential to include accurate details to facilitate the processing of the exemption request. 4. Exemption Type: Broward Florida offers various types of exemptions for ad valor em taxes. Some common types include: a. Homestead Exemption: This exemption applies to primary residences and provides a reduction in property taxes for eligible homeowners. The letter should clearly state the request for Homestead Exemption if applicable. b. Senior Citizens Exemption: This exemption is specifically designed for senior citizens who meet certain age and income requirements. The letter should articulate the property owner's eligibility and desire to apply for this specific exemption. c. Disabled Veterans Exemption: Disabled veterans residing in Broward County may qualify for this exemption. The letter should comprehensively outline the veteran's disability status and the percentage of exemption requested. 5. Supporting Documentation: To substantiate the exemption claim, the property owner must include relevant supporting documentation. Some typical documents may include: a. Copy of Deed or Title: This document verifies ownership and serves as proof of residency. b. Proof of Age: Required for senior citizens exemptions, this can be a copy of a government-issued identification document such as a driver's license or passport. c. Proof of Disability: If seeking a disabled veterans exemption or any other disability-related exemption, the letter should include relevant medical records or documentation confirming the disability status. d. Proof of Income: This may be required for certain exemptions where income eligibility criteria exist. Supporting documents such as tax returns, pay stubs, or a statement of benefits can be included. 6. Conclusion: The conclusion should summarize the purpose of the letter and express gratitude for the opportunity to request an exemption. Encourage the recipient to contact the property owner if any additional information or documentation is required. 7. Closing: Close the letter with a polite ending, followed by the property owner's name, contact details, and signature. In conclusion, the Broward Florida Sample Letter for Exemption of Ad Valor em Taxes is an indispensable tool for property owners in Broward County seeking relief from ad valor em taxes. By providing detailed information, including the property details, desired exemption type, and supporting documentation, property owners can increase the likelihood of a successful exemption request. Should you have any further queries or require additional information, please do not hesitate to reach out to me. Thank you for your attention and support in this matter. Sincerely, [Your Name] [Your Contact Information]

Broward Florida Sample Letter for Exemption of Ad Valorem Taxes

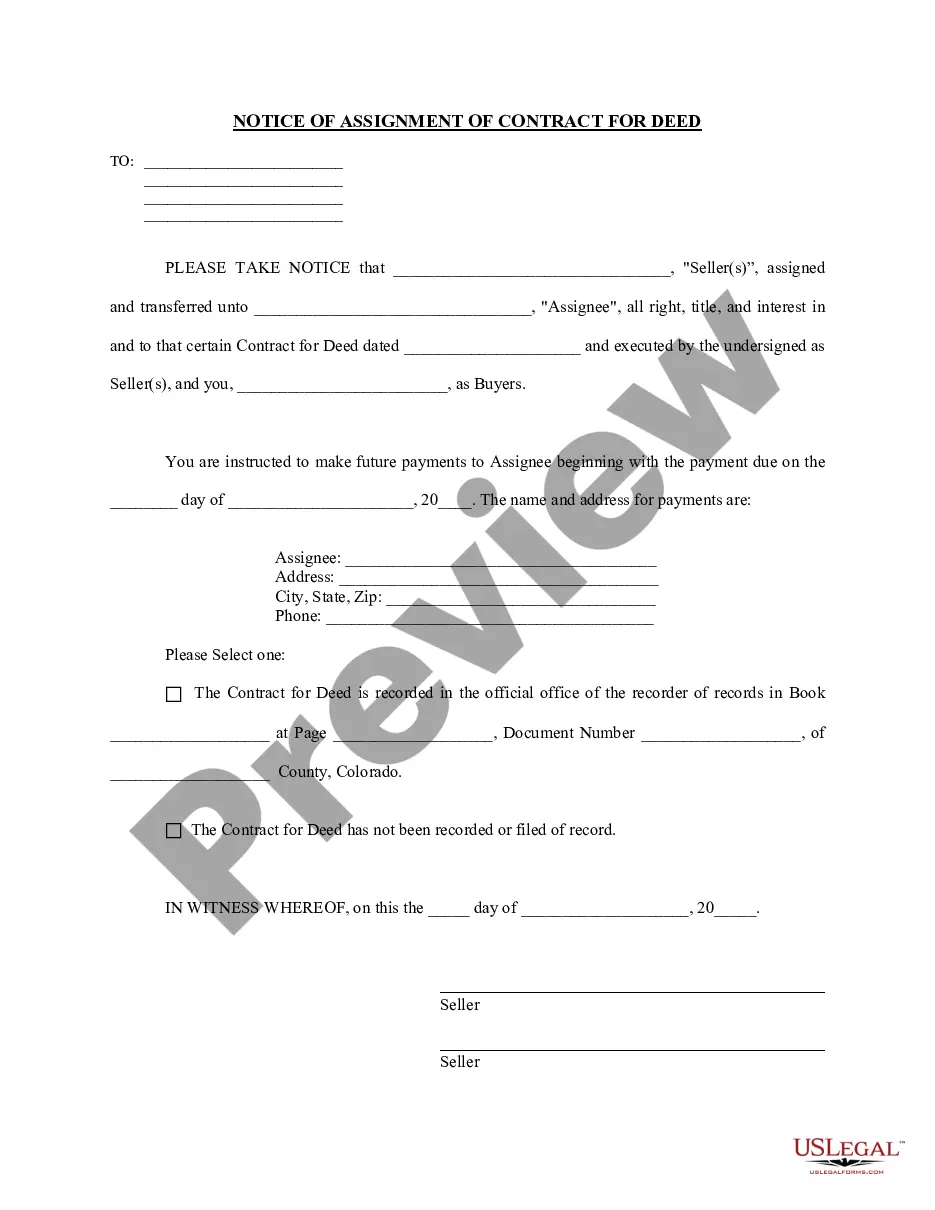

Description

How to fill out Broward Florida Sample Letter For Exemption Of Ad Valorem Taxes?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Broward Sample Letter for Exemption of Ad Valorem Taxes is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Broward Sample Letter for Exemption of Ad Valorem Taxes. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Broward Sample Letter for Exemption of Ad Valorem Taxes in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!