Subject: Fulton, Georgia — Sample Letter for Exemption of Ad Valorem Taxes Dear [Recipient's Name], I hope this letter finds you well. I am writing to discuss an important matter regarding the exemption of ad valor em taxes in Fulton, Georgia. With its various subdivisions, such as Homestead Exemption and Conservation Use Exemption, it is crucial for residents to understand the process and requirements pertaining to these tax exemptions. Fulton County, located in the vibrant state of Georgia, is home to a diverse population, diverse business landscape, and a flourishing community. Ad Valor em taxes, commonly known as property taxes, play a significant role in local government revenue generation while supporting public services, infrastructure development, and other key initiatives. However, the county realizes that certain individuals, due to specific circumstances, might qualify for exemptions from these taxes. 1. Homestead Exemption: The Homestead Exemption is designed to provide property tax relief for eligible homeowners. This exemption offers substantial savings by reducing the assessed value of a primary residence for tax purposes. It is available to both elderly citizens aged 65 or older and disabled individuals. We provide a sample letter below to assist eligible applicants in requesting Homestead Exemption: [Sample Letter for Homestead Exemption] [Include a detailed letter highlighting the applicant's eligibility, contact information, and any supporting documentation required by the county.] 2. Conservation Use Exemption: The Conservation Use Exemption aims to encourage the preservation of environmentally sensitive lands and promotes sustainable farming practices in rural areas of the county. This exemption grants a significant reduction in property taxes for qualifying agricultural, timber, or environmentally sensitive properties. We provide a sample letter below to guide applicants requesting Conservation Use Exemption: [Sample Letter for Conservation Use Exemption] [Prepare a comprehensive letter outlining the property's agricultural or environmental significance, supporting documentation, and contact details of the owner or representative.] Understanding the importance of tax exemptions and their eligibility criteria not only ensures fair taxation but also helps maintain a thriving Fulton County community. It is essential to familiarize yourself with the specific requirements and deadlines set by the Fulton County Tax Assessor's office. We encourage you to seek guidance from the Fulton County Tax Assessor's office for complete and up-to-date information on each exemption category, application processes, required documentation, and submission deadlines. The county's website or office can provide sample letters tailored to specific exemptions and further address any questions or concerns you may have. Please note that the sample letters provided are for informational purposes only and should be customized to meet your specific needs and circumstances. Thank you for your attention to this important matter. Should you have any queries or require further assistance, please do not hesitate to reach out to the Fulton County Tax Assessor's office. Warm regards, [Your Name] [Your Contact Information]

Fulton Georgia Sample Letter for Exemption of Ad Valorem Taxes

Description

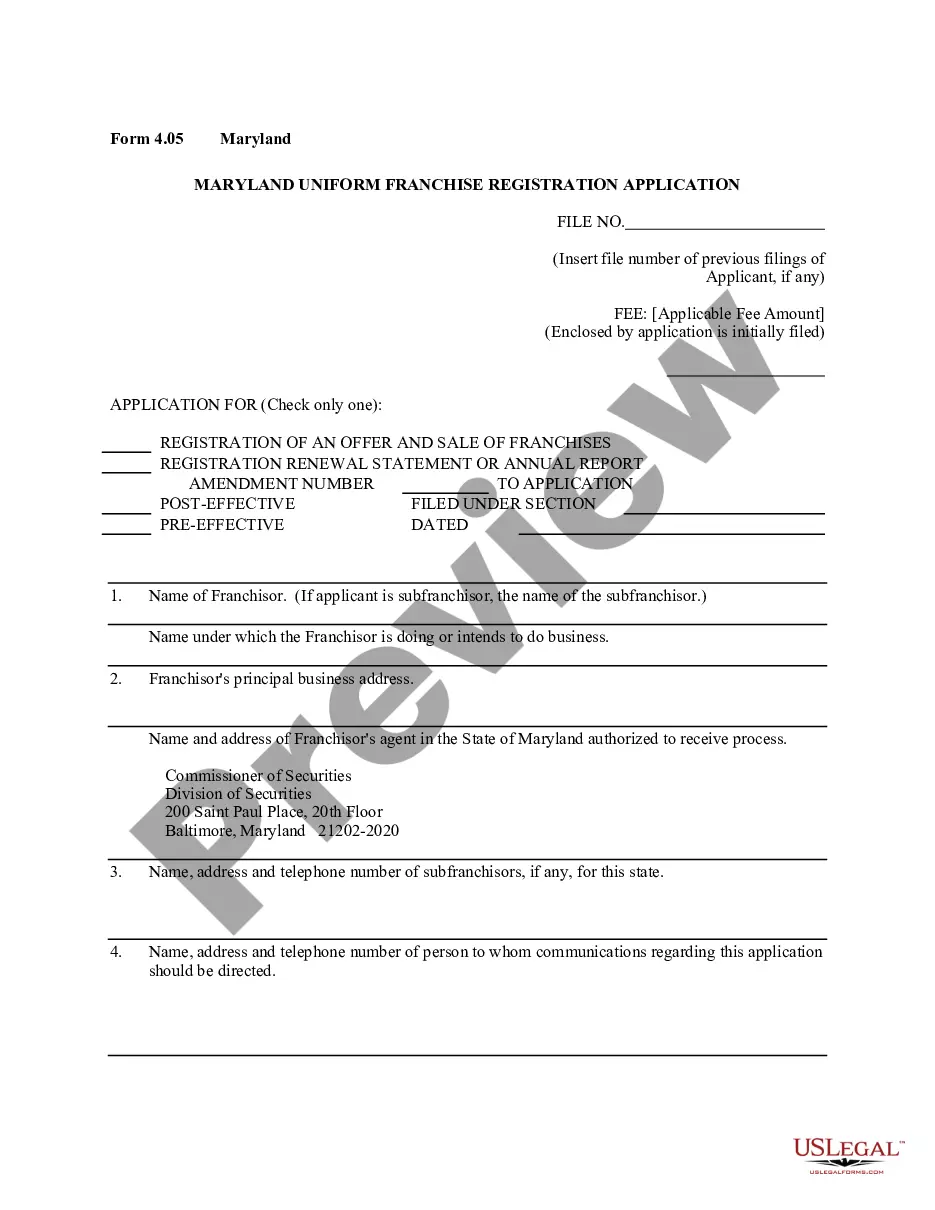

How to fill out Fulton Georgia Sample Letter For Exemption Of Ad Valorem Taxes?

Do you need to quickly create a legally-binding Fulton Sample Letter for Exemption of Ad Valorem Taxes or maybe any other form to handle your own or corporate affairs? You can go with two options: contact a professional to write a valid paper for you or create it entirely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get professionally written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant form templates, including Fulton Sample Letter for Exemption of Ad Valorem Taxes and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, carefully verify if the Fulton Sample Letter for Exemption of Ad Valorem Taxes is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were looking for by using the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Fulton Sample Letter for Exemption of Ad Valorem Taxes template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Moreover, the templates we offer are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!