Chicago Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse is a legal document that outlines the terms and conditions for the purchase and sale of stock in a close corporation, with the consent and agreement of the shareholder's spouse. This agreement is significant for shareholders who want to establish a clear framework for the transfer of their stock ownership and ensure a smooth transition in the event of certain triggering events, such as death, divorce, retirement, or disability. This type of agreement provides a structured approach to the sale of stock within a close corporation, which is a small, privately held company with a limited number of shareholders. By having a buy-sell agreement in place, shareholders can avoid potential disputes and conflicts when stock transfers are required, protecting the interests of all parties involved. The Chicago Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse typically includes the following key elements: 1. Purchase Rights and Obligations: This section outlines the rights and obligations of the shareholders and their spouses regarding the purchase and sale of stock. It defines the triggering events that result in a stock transfer, such as death, divorce, retirement, or disability. 2. Purchase Price Determination: This clause explains how the purchase price will be determined, either through a pre-agreed formula, appraisal, or a negotiation process. It aims to establish a fair market value for the stock to ensure a fair transaction. 3. Funding Mechanisms: This part of the agreement outlines the mechanism to finance the stock purchase. It may involve various options, such as life insurance policies, installment payments, or external financing. 4. Restrictions on Transfer: This section places certain restrictions on the transfer of stock outside the agreement. It ensures that the stock remains within the close corporation and does not fall into the hands of unwanted shareholders. 5. Consent and Agreement of Spouse: This clause establishes the requirement for the shareholder's spouse's consent and agreement to sell or transfer their stock in the event of a triggering event. It provides legal protection for both parties and ensures the spouse's rights are considered. Different types of Chicago Illinois Shareholders Buy Sell Agreements of Stock in a Close Corporation with Agreement of Spouse may include: 1. Cross-Purchase Agreement: This agreement allows the remaining shareholders to individually purchase the departing shareholder's stock. Each shareholder has the right to buy the stock in proportion to their existing ownership stake, maintaining the balance of ownership. 2. Redemption Agreement: In this type of agreement, the close corporation buys back the departing shareholder's stock. The corporation uses its funds or takes out a loan to finance the stock purchase, effectively retiring the shares. 3. Hybrid Agreement: A hybrid agreement combines elements of both cross-purchase and redemption agreements. It allows the remaining shareholders and the corporation to have the option to purchase the departing shareholder's stock, providing more flexibility and alternatives based on the specific circumstances. Overall, Chicago Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse provides a legal framework that protects the interests of shareholders, their spouses, and the close corporation itself when it comes to the transfer of stock ownership in various triggering events.

Chicago Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse

Description

How to fill out Chicago Illinois Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse?

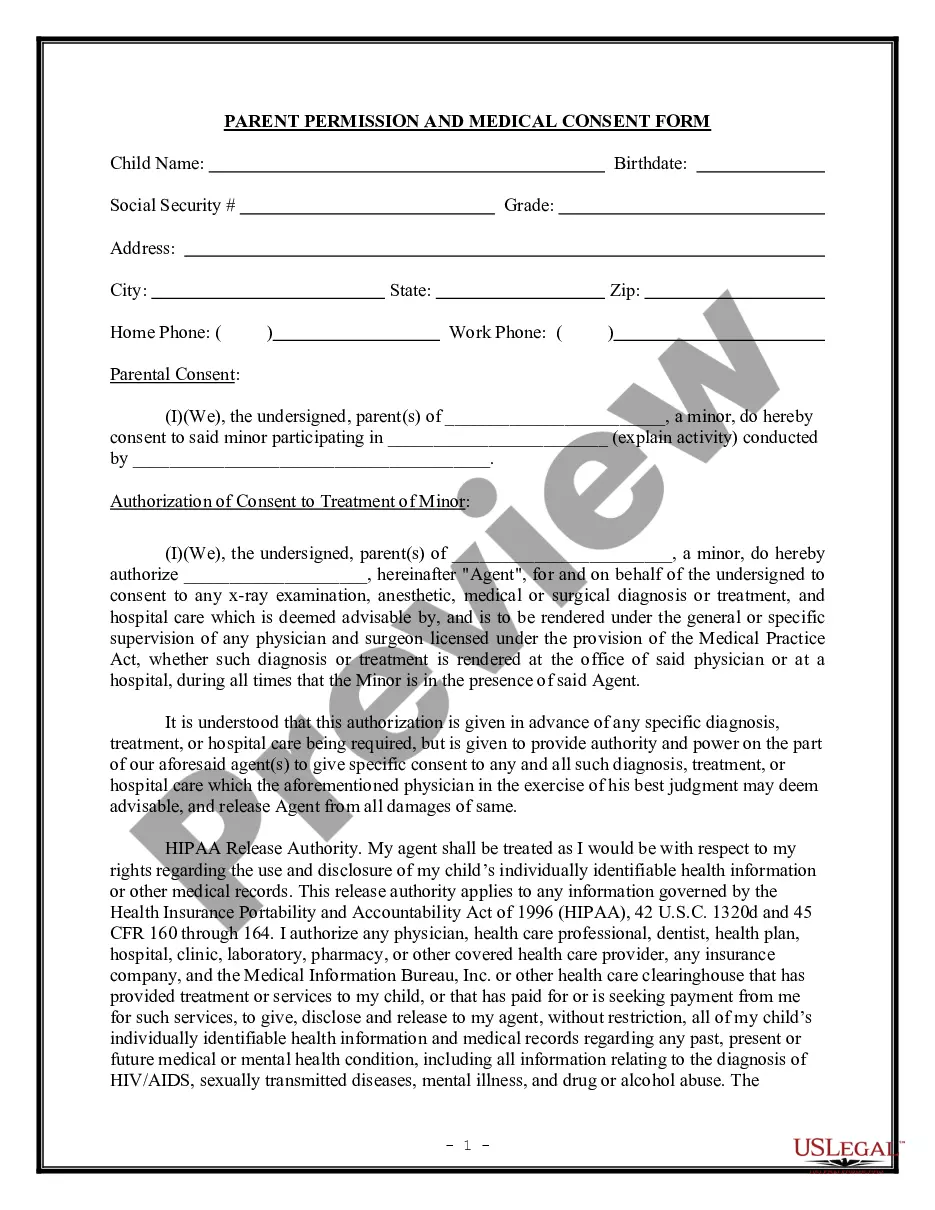

Are you looking to quickly draft a legally-binding Chicago Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse or maybe any other form to handle your personal or business matters? You can go with two options: contact a professional to draft a valid paper for you or create it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific form templates, including Chicago Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and form packages. We provide documents for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, double-check if the Chicago Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Chicago Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the documents we provide are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!