Contra Costa California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse is a legally binding contract that outlines the terms and conditions regarding the buying and selling of stock among shareholders in a close corporation based in Contra Costa County, California. This agreement also involves the agreement of spouses, ensuring their consent and understanding of the stock transactions within the corporation. Keywords: Contra Costa California, shareholders, buy sell agreement, stock, close corporation, agreement of spouse, terms and conditions, contract, consent, stock transactions. There are several types of Contra Costa California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse, including: 1. Redemption Agreement: This type of agreement allows the corporation to purchase the shares of a departing shareholder, either upon their voluntary exit or due to certain predefined events, such as death, disability, retirement, or divorce. The agreement ensures fair valuation of the shares and provides the departing shareholder or their spouse with a means of liquidity. 2. Cross-Purchase Agreement: In this type of agreement, the remaining shareholders of the close corporation agree to purchase the shares of a departing shareholder. Each remaining shareholder has the option to buy a proportionate share of the departing shareholder's stock, ensuring an equitable distribution of ownership among the remaining shareholders. The agreement also includes provisions for the spouse's agreement on the transaction. 3. Hybrid Agreement: A hybrid agreement combines elements of both the redemption and cross-purchase agreements. It allows the corporation itself, as well as the remaining shareholders, to have the option to purchase the shares of a departing shareholder. The specific terms and conditions are outlined within the agreement, and the spouse's agreement is also incorporated. 4. Put-Call Agreement: This type of agreement provides an option for both the shareholder and the corporation to initiate the sale of shares. The shareholder with the "put" option can request the corporation to buy their shares at a predetermined price and time. Conversely, the corporation with the "call" option can request the shareholder to sell their shares at a specified price and time. The agreement involves the agreement of the shareholder's spouse as well. In conclusion, the Contra Costa California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse is a comprehensive legal document that ensures a fair and transparent process for buying and selling stock among shareholders in a close corporation. It provides different options and approaches, including redemption, cross-purchase, hybrid, and put-call agreements, while also addressing the spouse's agreement to facilitate smooth stock transactions within the corporation.

Contra Costa California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse

Description

How to fill out Contra Costa California Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse?

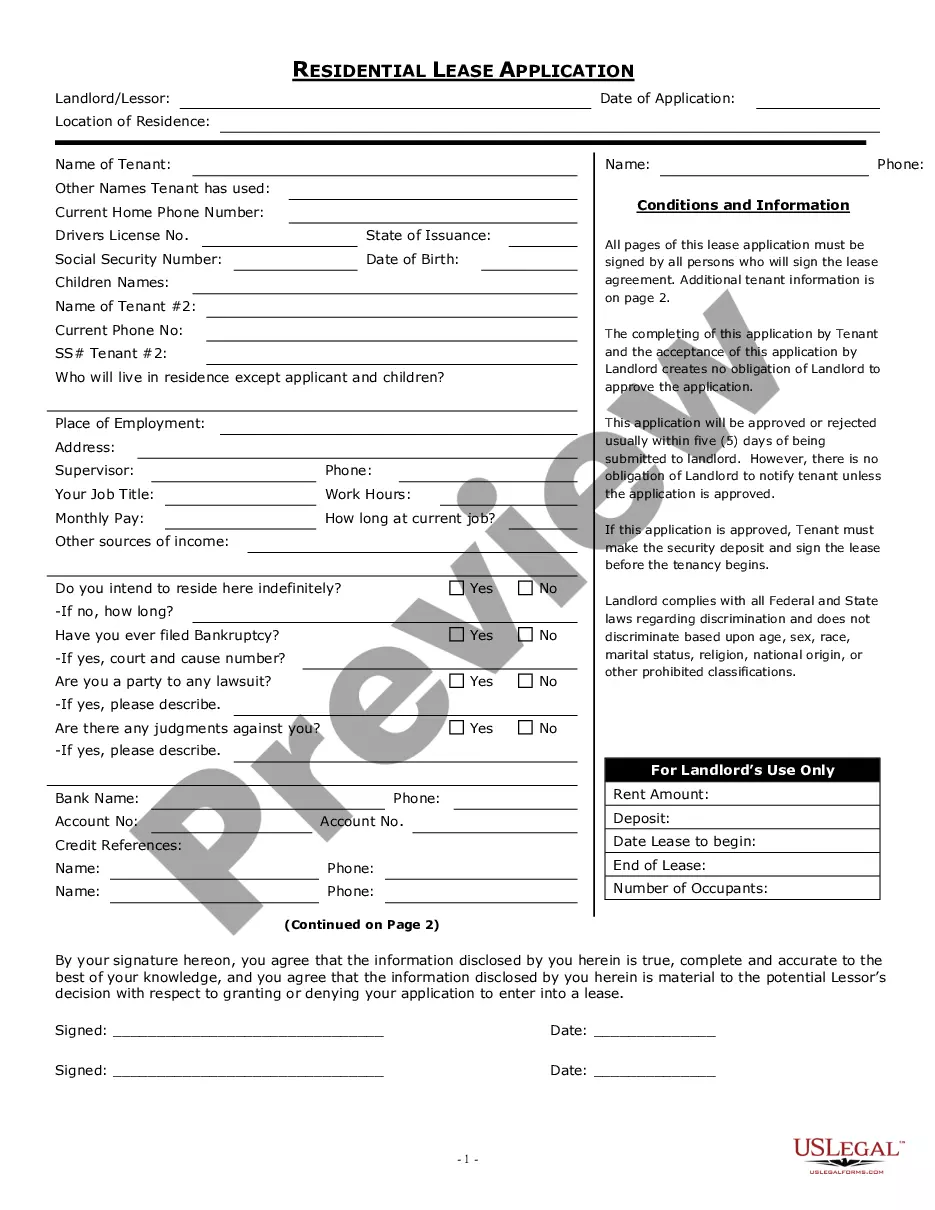

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life sphere, finding a Contra Costa Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Contra Costa Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Contra Costa Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Contra Costa Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

There are two basic types of buy-sell agreements: entity-purchase and cross-purchase. Under the former, the corporation is a party to the contract with the shareholders and the corporation ultimately purchases the decedent's stock.

In a cross purchase buy-sell agreement, each business owner buys a life insurance policy on the other owner(s). With multiple owners, this can get very complex and complicated. Instead, try a trusteed cross purchase buy-sell, in which a third-party (acting as trustee) takes care of the buy-sell arrangement.

A stock redemption buy/sell agreement is a contractual arrangement between the shareholders and the corporation in which the corporation is obligated to redeem the shares of a deceased or disabled shareholder.

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

Sometimes these terms are used interchangeably. However, a Shareholder's Agreement usually contains more terms or conditions which govern the relationship between shareholders, whereas a Buy-Sell Agreement usually deals just with the issue of when a shareholder wants to sell shares or if a shareholder dies.

A shareholder buyout refers to a company's owners buying back a departing shareholder's interest (their shareholding) in the company.

Despite the name, buy-sell agreements have little to do with buying and selling companies. Instead, they are binding contracts between co-owners that control when owners can sell their interest, who can buy an owner's interest, and what price will be paid.

Entity Buy-Sell Agreement an agreement between a partnership or a corporation, as an entity, and the owners (partners or stockholders) that, upon the death of an owner, the company (partnership) will purchase the deceased owner's share of the business.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.