Harris Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse is a legally binding document that outlines the terms and conditions under which shareholders of a close corporation can buy or sell their stock. This agreement is crucial for maintaining the smooth operation and continuity of the corporation, especially when a shareholder wishes to transfer their ownership or in the case of unforeseen events like death or divorce. Key elements of this agreement include the identification of the parties involved, the purpose of the agreement, and the procedures for buying and selling stock. Additionally, the agreement should address the involvement of the shareholder's spouse, as their agreement is typically required when it comes to the transfer of stock. A few types of Harris Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse include: 1. Traditional Cross-Purchase Agreement: In this agreement, the remaining shareholders have the option to purchase the departing shareholder's stock directly. This type of agreement is often seen in smaller close corporations with a limited number of shareholders. 2. Entity Redemption Agreement: In this agreement, the corporation itself has the obligation to buy back the departing shareholder's stock. This type of agreement is typically chosen when the corporation has sufficient funds to repurchase the stock or if it benefits from tax advantages. 3. Hybrid Agreement: As the name suggests, this agreement combines elements of both cross-purchase and entity redemption agreements. It allows the remaining shareholders and the corporation to cooperate and decide who will buy the departing shareholder's stock. This type of agreement can offer flexibility and cater to the specific needs of the close corporation. The inclusion of the shareholder's spouse in this agreement is crucial, as their consent is often required to ensure a smooth transfer of stock. This is especially important in community property states like Texas, where spousal consent is generally necessary for the transfer of any marital property. In conclusion, the Harris Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse is a vital document that protects the interests of shareholders and ensures the efficient transfer of stock in a close corporation. It is advised to consult with legal professionals experienced in corporate law to draft an agreement tailored to the specific needs of the corporation and its shareholders.

Harris Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse

Description

How to fill out Harris Texas Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse?

Creating paperwork, like Harris Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse, to take care of your legal affairs is a difficult and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for different cases and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Harris Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before downloading Harris Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse:

- Ensure that your document is compliant with your state/county since the rules for creating legal documents may differ from one state another.

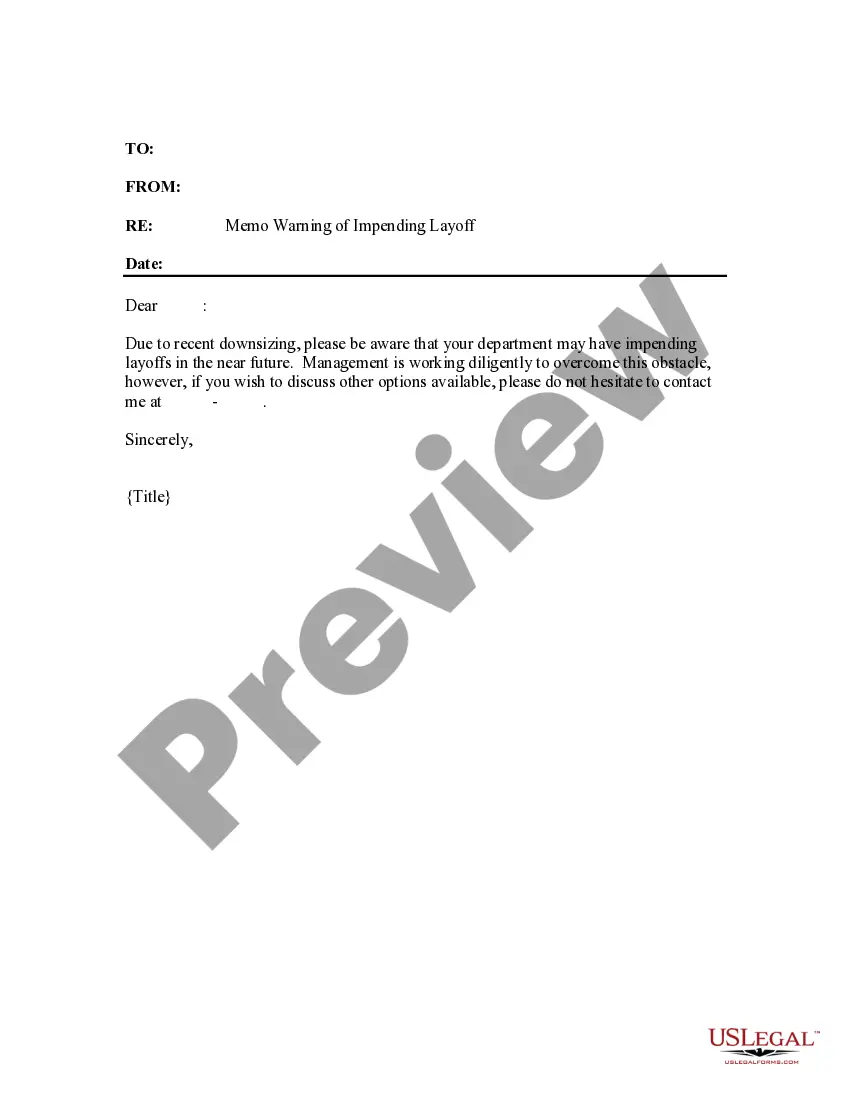

- Learn more about the form by previewing it or reading a brief description. If the Harris Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our website and download the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!