Orange, California is a vibrant city located in Orange County, California. Known for its rich history and picturesque landscapes, Orange is home to a diverse community and offers a wide range of attractions and amenities. When it comes to the shareholders' buy-sell agreement of stock in a close corporation with the agreement of a spouse in Orange, California, there are different types to consider. These agreements are designed to provide clarity and protect the interests of shareholders and their spouses in the event of certain triggering events, such as death, disability, retirement, or divorce. 1. Cross-Purchase Agreement: In this type of agreement, each shareholder agrees to purchase the shares of the other shareholders in the event of a triggering event. This ensures continuity and control within the close corporation while providing liquidity to the shareholder's spouse. 2. Redemption Agreement: Under a redemption agreement, the close corporation agrees to repurchase the shares of the withdrawing or deceased shareholder. The corporation is funded through various mechanisms, such as life insurance policies or accumulated profits, to ensure a smooth transition without financial strain. 3. Hybrid Agreement: A hybrid agreement incorporates elements of both the cross-purchase and redemption agreements. Shareholders have the option to purchase the shares of the withdrawing shareholder, while the corporation can also choose to redeem the shares. This provides flexibility and can be tailored to the specific needs and preferences of the shareholders and their spouses. In Orange, California, these buy-sell agreements help maintain stability within close corporations while protecting the interests of shareholders and their spouses. They ensure fair treatment and proper compensation in the event of unforeseen circumstances, allowing for a smooth transition and continued success of the corporation. To establish an effective agreement, it is crucial to consult with legal professionals who specialize in corporate law and have experience with buy-sell agreements in Orange, California. With their expertise, shareholders can ensure that their rights and assets are adequately protected and that their spouses' interests are considered in the agreement.

Orange California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse

Description

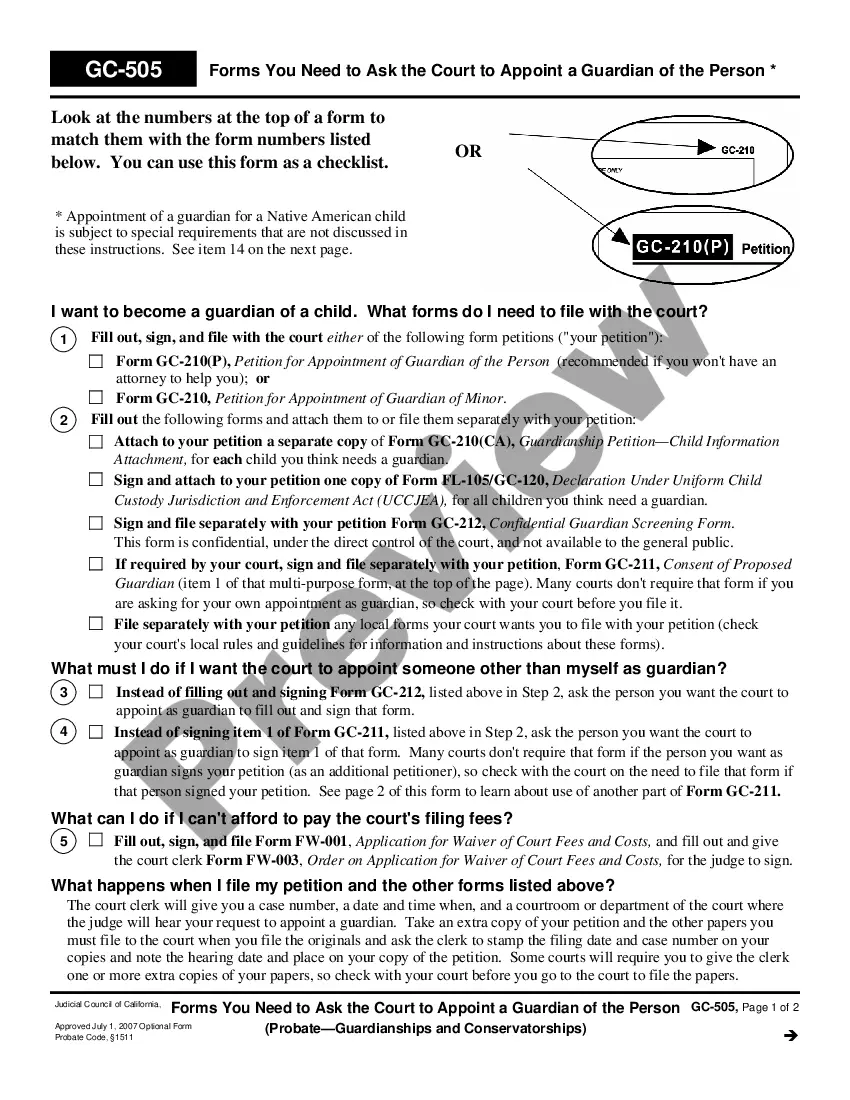

How to fill out Orange California Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Orange Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to obtain the Orange Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse. Adhere to the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Orange Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.

Key Takeaways. A shareholders' agreement is an arrangement among a company's shareholders that describes how the company should be operated and outlines shareholders' rights and obligations. The shareholders' agreement is intended to make sure that shareholders are treated fairly and that their rights are protected.

Sometimes these terms are used interchangeably. However, a Shareholder's Agreement usually contains more terms or conditions which govern the relationship between shareholders, whereas a Buy-Sell Agreement usually deals just with the issue of when a shareholder wants to sell shares or if a shareholder dies.

A stock redemption buy/sell agreement is a contractual arrangement between the shareholders and the corporation in which the corporation is obligated to redeem the shares of a deceased or disabled shareholder.

There are two basic types of buy-sell agreements: entity-purchase and cross-purchase. Under the former, the corporation is a party to the contract with the shareholders and the corporation ultimately purchases the decedent's stock.

Types of buy-sell agreements include cross-purchase agreements, redemption agreements, hybrid buy-sell agreements, company purchase agreements, and asset purchase agreements . Consider your options carefully when engaging in a buy-sell agreement and speak with corporate lawyers to learn about your legal rights.

sell agreement is an agreement among the owners of the business and the entity. 2. The buysell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

Interesting Questions

More info

I got a call from the IRS at 5:36 am asking if I am the person that just posted a blog about an expense that they were going to audit and to get me a copy of the audit report. So I decided to send them all in via the internet. After they started the search, you could see exactly where the funds were sent, the amounts, and when it was paid and so on. If you are a lawyer, you can use a computer program called EFT (electronic file transfer), which saves you from physically looking at the paperwork. So now I had my first glimpse into the world of expenses and taxes. So I was curious to see what would happen if I used an investment company as an employer (a way companies have been doing it for some time). First, let's look at the expenses for a business that employs one person for a year instead of two, using a model asset purchase or transfer agreement, which I purchased as a template.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.