San Diego, California is a vibrant city located on the Pacific coast of the United States. Known for its perfect year-round weather, stunning beaches, and diverse cultural scene, San Diego attracts millions of visitors each year. When it comes to the legal aspects of business ownership in San Diego, shareholders in a close corporation often enter into a buy-sell agreement to outline the terms of buying and selling stock within the corporation. This agreement helps establish a framework for shareholder transitions, ensuring a smooth process and protecting the interests of both parties involved. In particular, when a shareholders' buy-sell agreement involves spouses, it is referred to as a "Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse." This type of agreement recognizes that in a close corporation, spouses may have an inherent interest in the shares owned by their partner. There are different types of San Diego California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse, also known as "variants" or "options." Here are some common types: 1. Cross-Purchase Agreement: In this agreement, shareholders agree to buy the shares of a departing shareholder. In the variant involving spouses, both the shareholder and their spouse agree to purchase the shares jointly. 2. Stock Redemption Agreement: In this variant, the corporation itself is responsible for buying back the shares from the departing shareholder. The agreement involving spouses would require both the corporation and the shareholder's spouse to participate in the purchase. 3. Hybrid Agreements: Some buy-sell agreements combine elements from both cross-purchase and stock redemption agreements. This hybrid approach allows flexibility in arranging the purchase, and both the corporation and the shareholder's spouse may be involved. Regardless of the specific type of buy-sell agreement involving spouses, these legal documents typically outline essential details such as the method of valuation for the stock, trigger events that may initiate the buy-sell process (such as death, disability, retirement, or divorce), and the payment terms for acquiring the shares. By having a San Diego California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse in place, shareholders ensure a clear understanding of their rights, responsibilities, and safeguards for the smooth operation of their closely held business. It is recommended to consult with legal professionals who specialize in business law to draft an agreement tailored to the specific needs and circumstances of the close corporation and its shareholders.

San Diego California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse

Description

How to fill out San Diego California Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse?

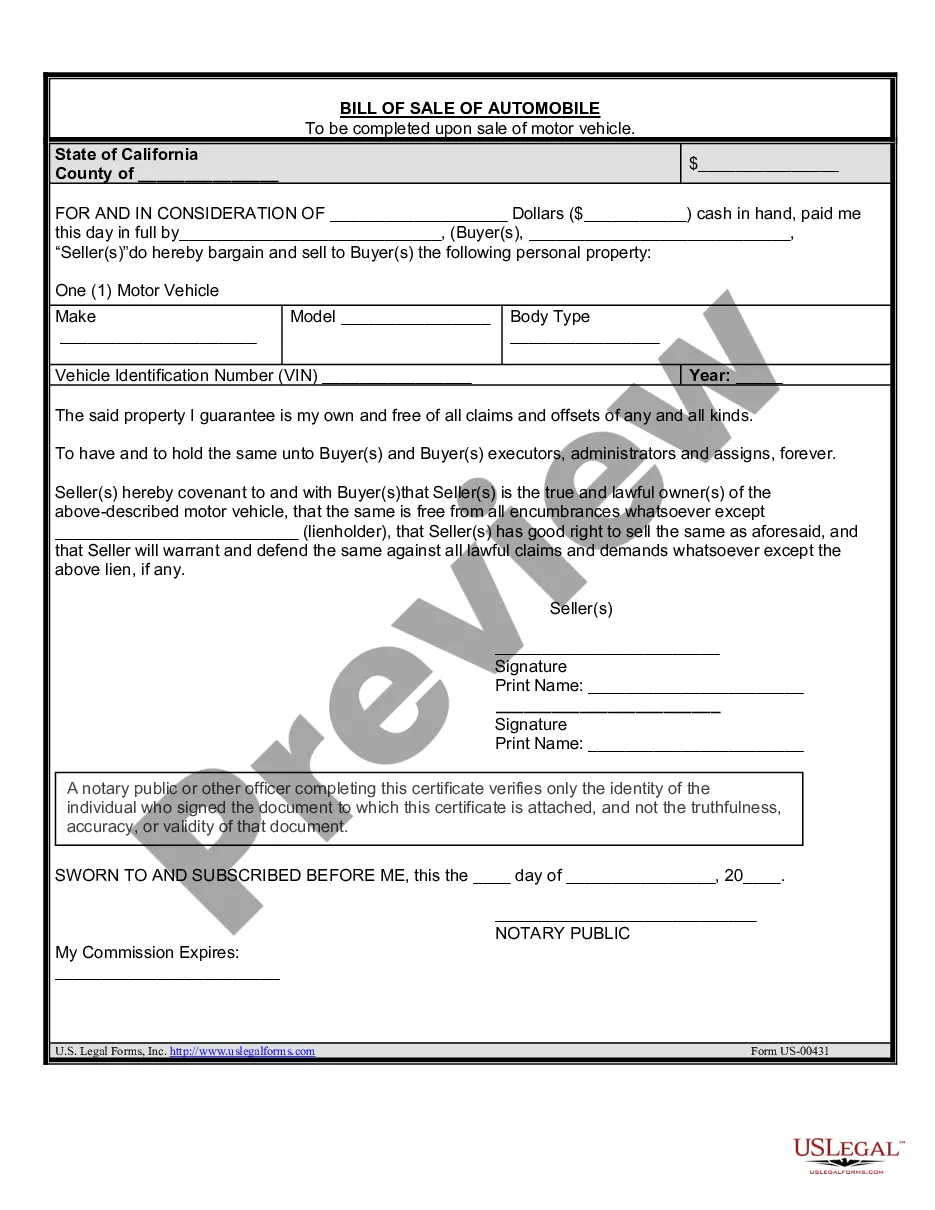

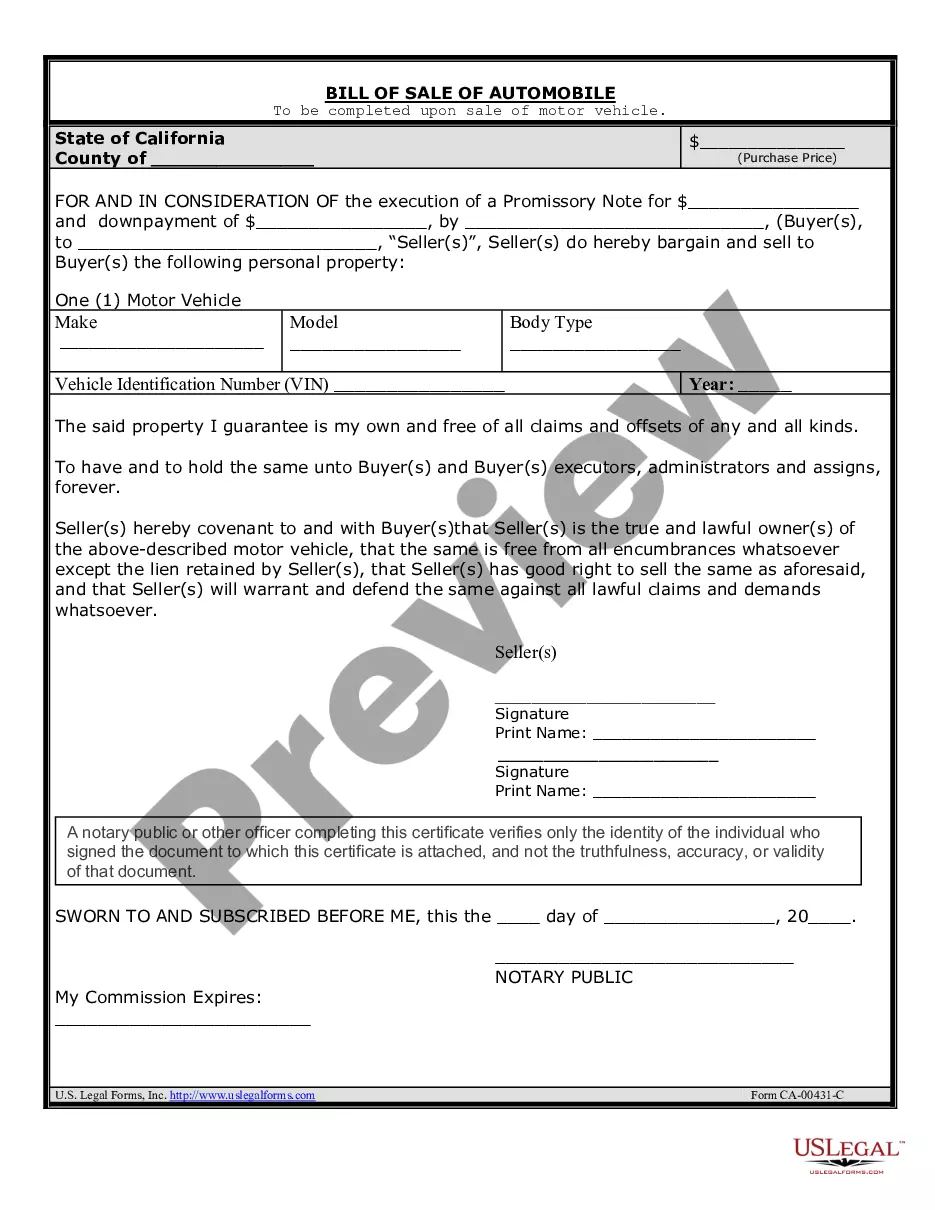

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

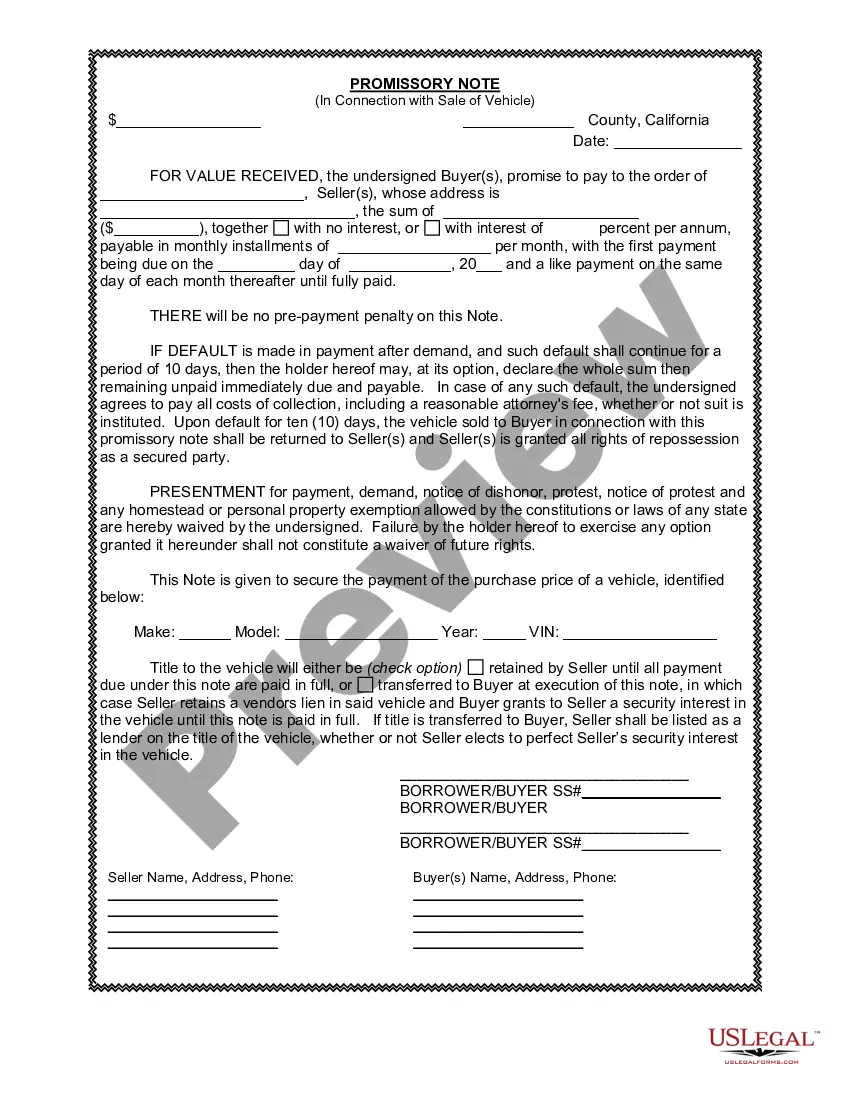

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the latest version of the San Diego Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your San Diego Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!