San Jose is a vibrant city located in the heart of Silicon Valley, California. It is known for its thriving technology industry and plays a pivotal role in driving innovation and economic growth in the region. With a diverse population and a rich cultural heritage, San Jose offers a unique blend of urban amenities and natural beauty. A San Jose Shareholders Buy-Sell Agreement of Stock in a Close Corporation with an Agreement of Spouse is a legal arrangement that outlines the terms for buying and selling stock in a closely held corporation. This type of agreement allows shareholders to establish rules for future stock transactions, ensuring a smooth transition of ownership in the event of certain circumstances, such as the death, disability, retirement, or divorce of a shareholder. Keywords: San Jose, California, Shareholders, Buy-Sell Agreement, Stock, Close Corporation, Agreement of Spouse, legal arrangement, closely held corporation, ownership, transition, death, disability, retirement, divorce. Different types of San Jose Shareholders Buy-Sell Agreement of Stock in a Close Corporation with Agreement of Spouse may include: 1. Death Buy-Sell Agreement: This agreement comes into effect upon the death of a shareholder, ensuring a fair and smooth transfer of their stock to the surviving shareholders or their designated beneficiaries. 2. Disability Buy-Sell Agreement: This type of agreement is triggered when a shareholder becomes disabled and is unable to continue their active involvement in the corporation. It outlines the process of buying out the disabled shareholder's stock to maintain the corporation's stability. 3. Retirement Buy-Sell Agreement: This agreement is specifically designed to address the transition of stock ownership when a shareholder retires. It lays out the terms and conditions for the purchase of the retiring shareholder's stock by the remaining shareholders or the corporation itself. 4. Divorce Buy-Sell Agreement: In the event of a shareholder's divorce, this agreement outlines the procedures for the division of stock and addresses the possibility of a spouse becoming a shareholder or the distribution of stock to other shareholders. 5. Forced Buy-Sell Agreement: This type of agreement allows shareholders to establish predetermined triggers under which they can force the sale of another shareholder's stock. This trigger may be due to situations like a breach of contract, violation of the corporation's bylaws, or any other specified events agreed upon. By having a Shareholders Buy-Sell Agreement of Stock in a Close Corporation with an Agreement of Spouse in place, shareholders can protect their interests, maintain the stability of the corporation, and ensure a smooth transition of ownership during critical events. It is essential to seek legal advice when drafting such agreements to ensure compliance with state laws and to address the unique circumstances specific to each shareholder and corporation.

San Jose California Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse

Description

How to fill out San Jose California Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse?

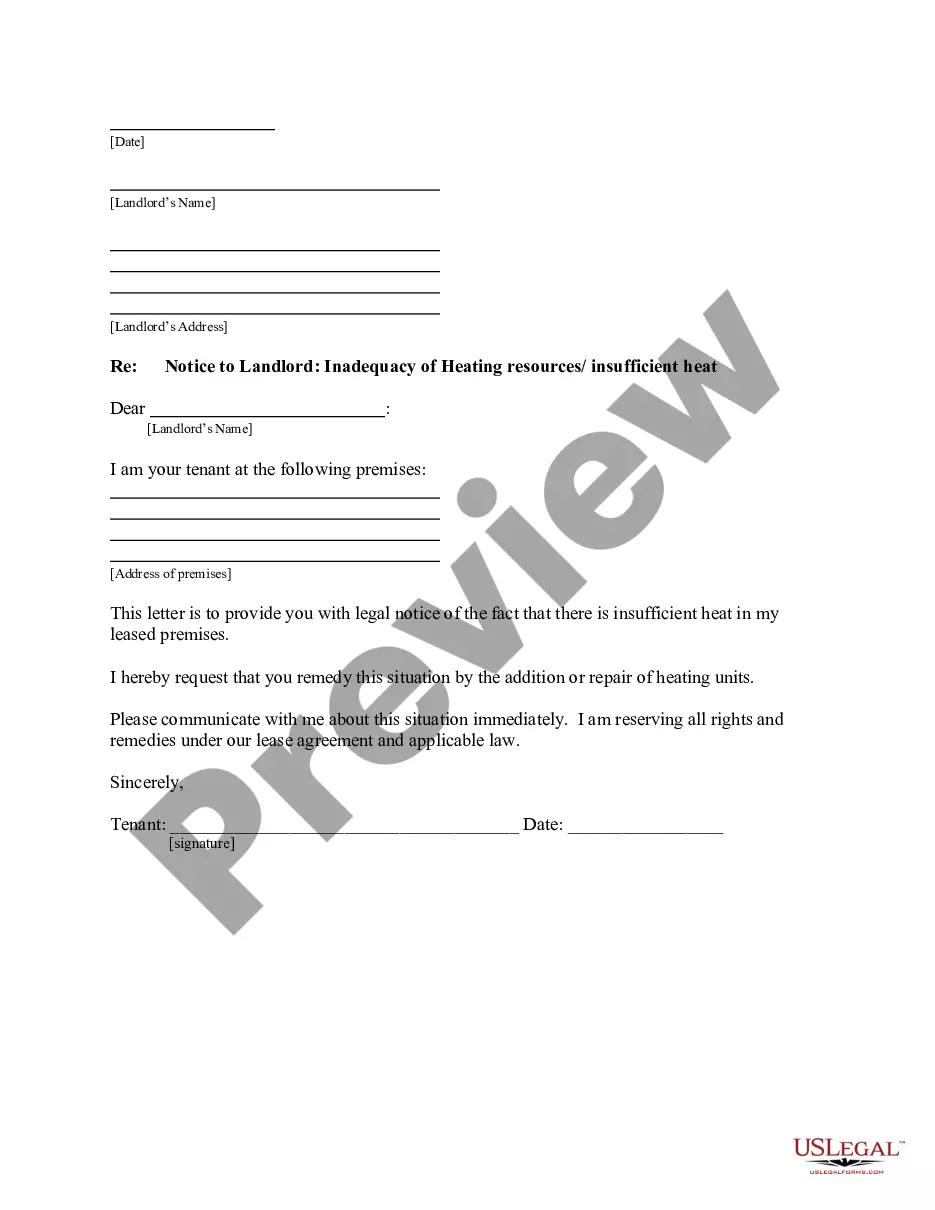

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a San Jose Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse meeting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Apart from the San Jose Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your San Jose Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Jose Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!