Subject: Important Notice of Charge Account Credit Limit Raise — Act Now! Dear [Customer's Name], We hope this letter finds you in good health and spirits. We are excited to notify you of some great news that will enhance your shopping experience at our esteemed [Store/Business Name], located in the heart of the magnificent city of Los Angeles, California. We value your loyalty and appreciate your continued patronage with us. After carefully reviewing your credit history and taking into consideration your exceptional payment record, we have recently decided to increase your charge account credit limit, granting you even more financial flexibility. The bustling city of Los Angeles, known for its vibrant culture, iconic landmarks, and diverse population, is home to our flagship store. Situated amidst the glamorous landscape of palm-lined streets, pristine beaches, and a thriving entertainment industry, Los Angeles offers an unparalleled experience for residents and visitors alike. With the upraised credit limit, you will now have access to greater purchasing power, enabling you to explore and enjoy the vast range of premium products and services that we offer. Whether you're seeking the latest fashion trends, cutting-edge electronics, or luxurious home decor, our store embodies the spirit of Los Angeles, catering to the discerning tastes of all our customers. By availing this increased credit limit, you can relish the freedom to fulfill your desires and shop with ease, ensuring that you make the most of what Los Angeles has to offer. Indulge yourself in the diverse culinary delights, visit world-renowned art galleries and museums, attend exclusive events and concerts, and immerse yourself in the city's unparalleled retail therapy. To extend the reach of this credit limit raise, we have also introduced a few specialized types of Los Angeles California Sample Letters for Notice of Charge Account Credit Limit Raise, tailored to cater to your preferences and requirements. These are: 1. Platinum Preferred Customers: If you have been categorized as a Platinum Preferred Customer, our most esteemed clientele, this unique letter specifically addresses the elite group and highlights the exclusive benefits and privileges they enjoy. It accentuates the extraordinary experiences that await them as they unlock the newfound credit limit. 2. Business Account Holders: For our esteemed business customers, we have crafted a separate letter that focuses on the benefits of the increased credit limit in facilitating smooth operations, meeting business demands, and seizing promising opportunities in the thriving business landscape of Los Angeles. We hope that this credit limit raise reflects our trust in your commitment and responsible financial management. Please note that this credit limit increase does not require any immediate action from your end. You can begin enjoying the extended limit from the effective date mentioned below. Effective Date: [Date] Thank you for choosing [Store/Business Name]. We remain dedicated to providing you with exceptional service and an extraordinary shopping experience. Should you have any queries or require further assistance, please do not hesitate to contact our customer service department. Once again, we congratulate you on this credit limit raise and hope it brings you utmost joy and convenience in your shopping endeavors. Wishing you delightful experiences in the unforgettable city of Los Angeles, California! Warm regards, [Your Name] [Your Title/Position] [Store/Business Name] [Contact Information]

Los Angeles California Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out Los Angeles California Sample Letter For Notice Of Charge Account Credit Limit Raise?

Preparing documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Los Angeles Sample Letter for Notice of Charge Account Credit Limit Raise without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Los Angeles Sample Letter for Notice of Charge Account Credit Limit Raise on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Los Angeles Sample Letter for Notice of Charge Account Credit Limit Raise:

- Look through the page you've opened and check if it has the sample you need.

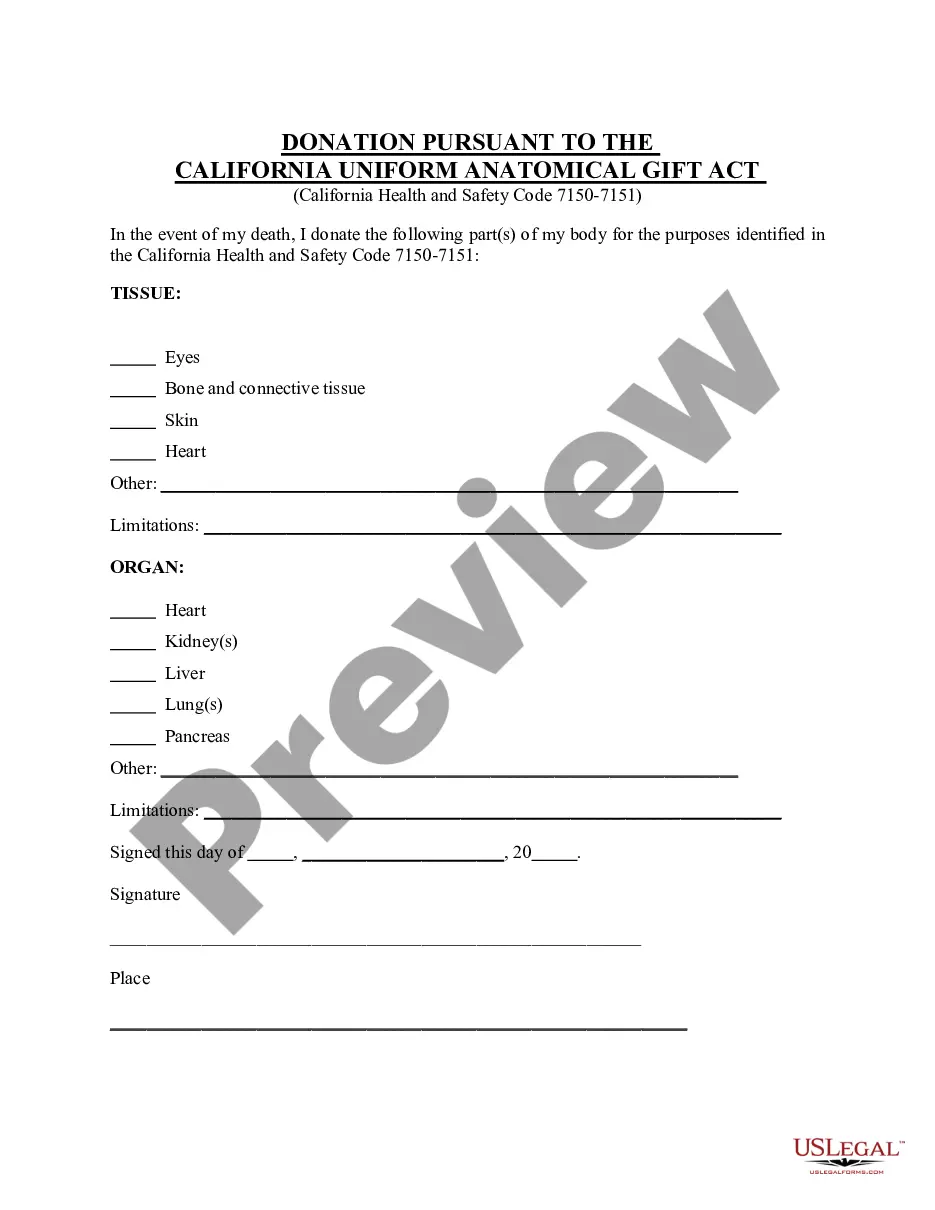

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

The card which I am using has a limit that cannot exceed (Amount of money). It is pertinent to mention here that I have expanded my business and need to make a transaction of amount more than its defined limit. Therefore, you are requested to please increase the limit of my credit card from ($xyz to %abc).

Generally if you make substantially more than your minimum monthly payment on time for three months you can reapply for a credit line increase. Add AutoPay and customized alerts to help you make more than your minimum payment on time each month. Use CreditWise from Capital One to help monitor your credit score.

How can you increase the credit limit on your Credit Card? Boost Your Credit Score.Repay dues on time.Be careful about the Credit Utilisation Ratio.Show proof of increase in income.Reduce the financial obligations you have.Apply for a new card.

The card which I am using has a limit that cannot exceed (Amount of money). It is pertinent to mention here that I have expanded my business and need to make a transaction of amount more than its defined limit. Therefore, you are requested to please increase the limit of my credit card from ($xyz to %abc).

You should explain why you think you deserve a higher credit limit, says Lohrenz. If your credit score has increased since you opened the card, point that out. You should also mention if you've had an increase in your financial means since you opened the account, she says.

Call your card issuer. Call the number on the back of your card and ask a customer service representative whether you're eligible for a higher credit limit. The rep may ask the reason for your request, as well as whether your income has gone up recently. Look for automatic increases.

I have been a credit card user of your bank since a really long time and have always been sincere at the time of payments and bills. I also have an account record of being punctual at the time of payments. I now request of an increase of Rs. XXXXXX on my credit card limits.

Increasing your credit limit can lower credit utilization, potentially boosting your credit score. A credit score is an important metric lenders use to determine a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

Interesting Questions

More info

QuickCheck enables you to determine your credit limit on your credit cards using common credit card statements. We have created an API for you to integrate QuickCheck directly into your credit card application or in your application template. A credit limit in the range of 2,000 to 50,000 is common in today's economy. If a client has a credit card with a 10,000 limit, we typically charge a 3,000 fee to do the job. That said, there are occasions when your organization may require a higher credit limit. In this guide we list the most popular credit limits for individuals, families, trusts, and corporations. Find out when you need to increase your credit limit without paying a single penny of fees. This guide describes the steps we can use to determine your card's credit limit, but QuickCheck is not a credit reporting tool. It cannot help you determine the accuracy of your credit report.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.