[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Address] [City, State, ZIP] Subject: Request for Credit Limit Increase — Account Number: [Account Number] Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to formally request an increase in my charge account credit limit with [Name of the Financial Institution]. I have been a loyal customer for [number of years], and I believe this increase is justified based on my consistent payment history and responsible financial behavior. Furthermore, I have been utilizing my credit account responsibly by making prompt payments on time. Considering this, and my current financial position, I believe it is appropriate to request an increase in my credit limit. This would enable me to meet my growing financial obligations and take advantage of the various opportunities and benefits available within my credit account. As a resident of San Diego, California, I have consistently embraced the vibrant economic climate and diverse range of opportunities that this city offers. With its bustling business environment, extensive networking opportunities, and numerous events, San Diego has allowed me to continually grow both personally and professionally. It is essential to highlight that San Diego is known for its dynamic technological advancements, remarkable educational institutions, and various industries such as biotechnology, healthcare, defense, tourism, and finance. Consequently, being a part of this thriving community provides ample room for fiscal growth and development. I believe that an increased credit limit would not only benefit me personally but also enhance my ability to contribute to the flourishing economy of San Diego. By having access to a greater credit limit, I would be able to invest in local businesses, pay for advanced educational programs, promote innovative projects, and actively participate in community-driven initiatives. Furthermore, a credit limit increase will enable me to better manage unexpected financial emergencies and plan more effectively for extraordinary expenses. This will also assist me in maintaining a positive credit score, which aligns with my financial goals and aspirations. I kindly request that you review my request with utmost consideration and evaluate my payment history and financial stability demonstrated over the years. I would be grateful if you could raise my current credit limit from [current limit] to [requested limit]. Furthermore, I am confident that this adjustment will not only be mutually beneficial but also serve as an avenue for continued growth and collaboration. Furthermore, I appreciate your time and attention in reviewing this request and eagerly await a favorable response. Should you require any further documentation or information, please do not hesitate to reach out to me at [phone number] or [email address]. Thank you for your prompt attention to this matter. Yours sincerely, [Your Full Name]

San Diego California Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out San Diego California Sample Letter For Notice Of Charge Account Credit Limit Raise?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like San Diego Sample Letter for Notice of Charge Account Credit Limit Raise is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the San Diego Sample Letter for Notice of Charge Account Credit Limit Raise. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law requirements.

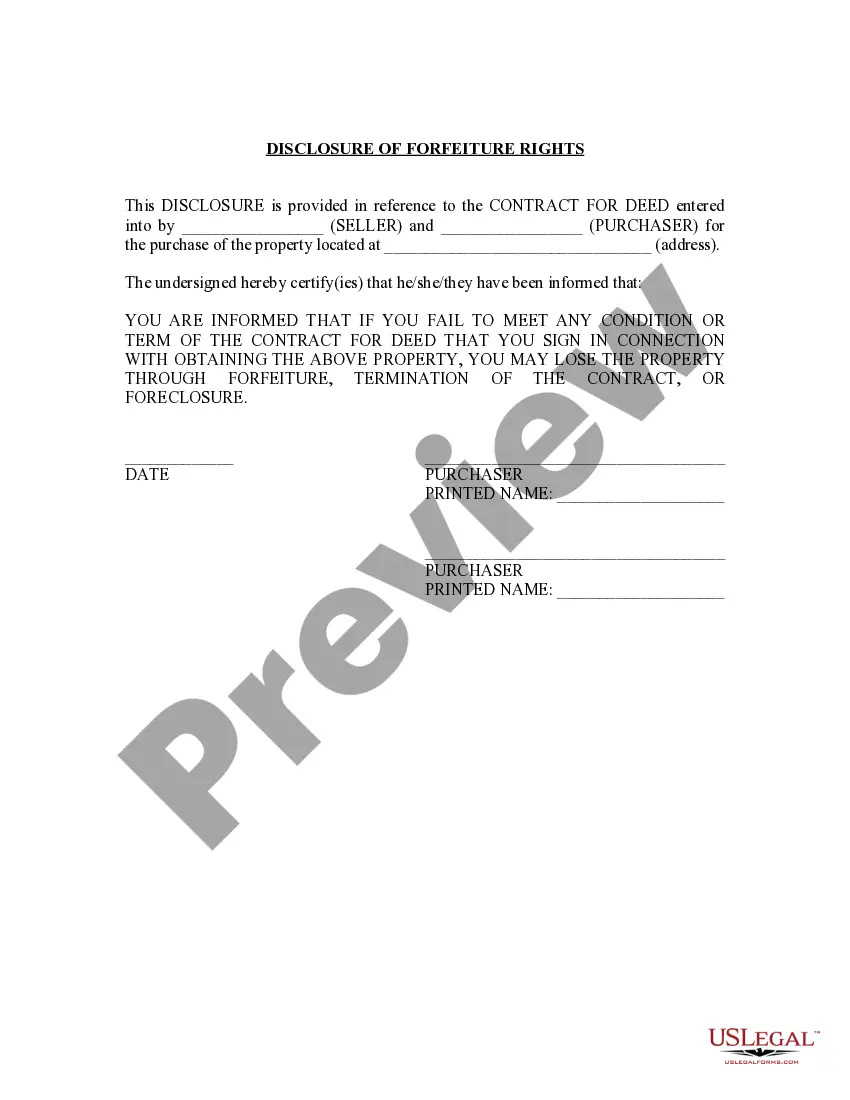

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Sample Letter for Notice of Charge Account Credit Limit Raise in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!