Subject: Important Notice Regarding Credit Limit — Change to C.O.D. Status Dear Valued Customer, We hope this letter finds you in good health and high spirits. We appreciate your continued support as a valued customer of Fairfax Virginia. We are writing to inform you of an important change in our credit policy. After careful consideration, we have made the decision to convert your existing credit limit to Cash On Delivery (C.O.D.) status. This conversion is necessary due to certain factors that we believe require more secure payment arrangements. While we understand that changes in payment terms may cause inconvenience, we assure you that this decision has been taken in order to protect the financial well-being of our company and continue delivering the highest level of service to all of our customers. As a result of this change, any future orders placed with Fairfax Virginia will require immediate payment upon receipt of the goods. This means that the delivery driver will collect the payment at the time of delivery. We kindly request your cooperation in this matter to avoid any delays in the processing and fulfillment of your orders. We want to express our gratitude for your past reliance on credit terms, and we hope that you will understand the necessity of this adjustment. Although this decision may cause temporary inconveniences, please be assured that it is essential for us to maintain a healthy and sustainable business operation. If you have any questions or concerns regarding this change or would like further information to expedite the transition, please do not hesitate to contact our customer service department at [phone number] or [email address]. We are committed to providing you with the necessary assistance during this transition period. We greatly value your continued loyalty as our customer and hope to maintain a long-lasting and prosperous relationship. Thank you for your understanding, and we look forward to serving you soon. Sincerely, [Your Name] [Your Title] [Company Name] [Company Address] [City, State, ZIP] [Phone Number] [Email Address] (Note: The provided sample letter is for a general notice of credit limit conversion to C.O.D. status for Fairfax Virginia. There may not be different types of such letters specifically for Fairfax Virginia.)

Fairfax Virginia Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Description

How to fill out Fairfax Virginia Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

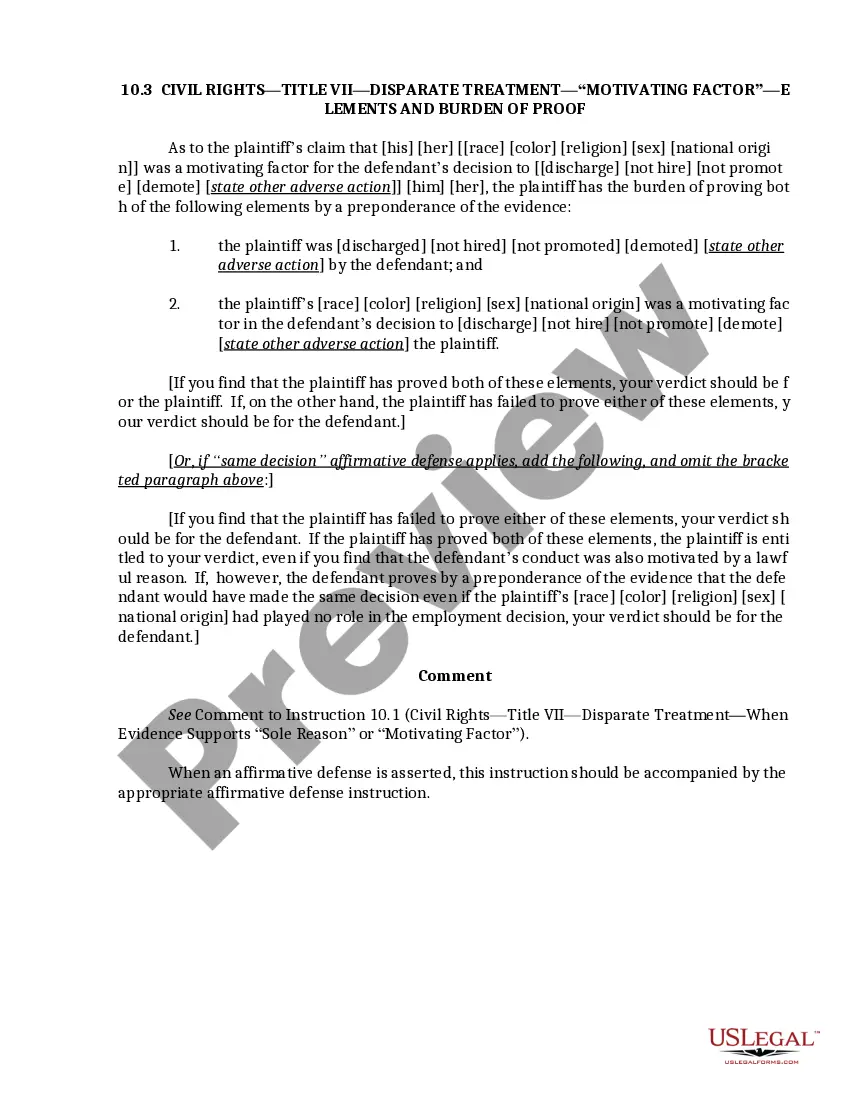

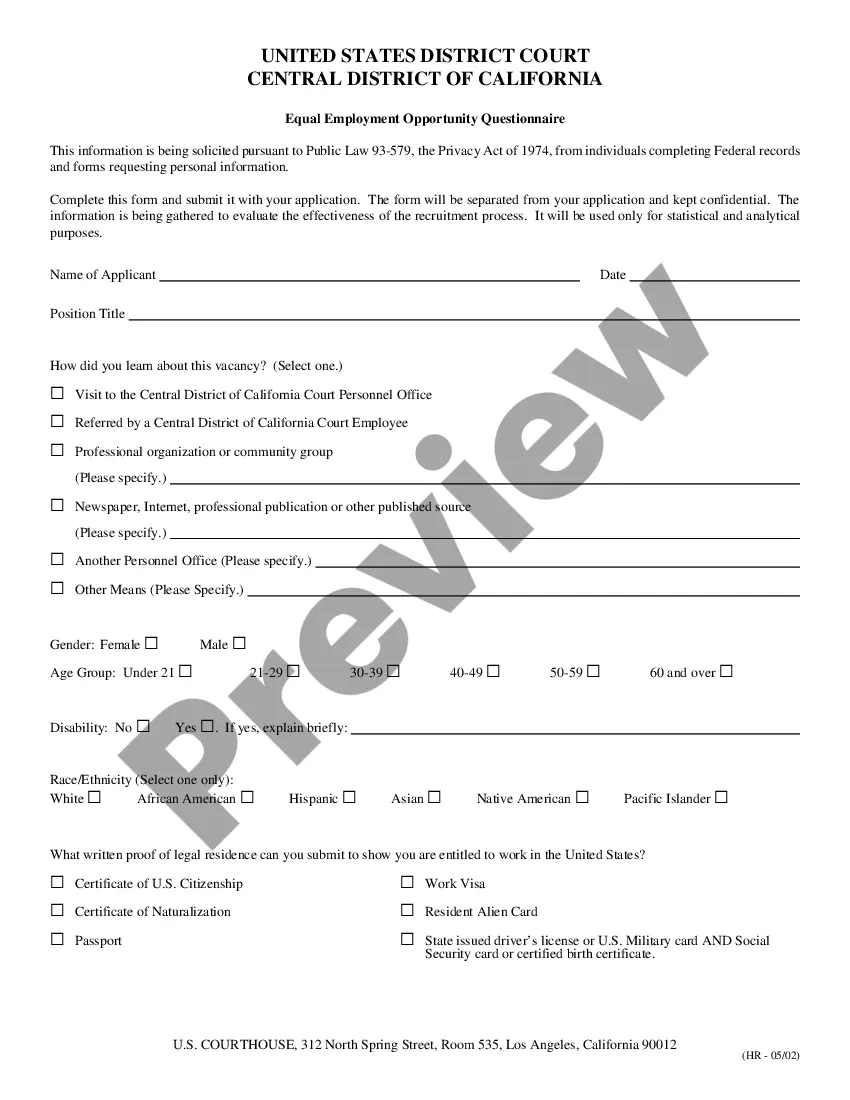

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Fairfax Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Fairfax Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fairfax Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status:

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Your credit card issuer can lower your credit limit at any time, regardless of how well you manage your account. Issuers might cut credit limits to minimize risk in an uncertain economy, as many cardholders have experienced during the COVID-19 pandemic in 2020.

Increasing your credit limit can lower credit utilization, potentially boosting your credit score. A credit score is an important metric lenders use to determine a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.

Your credit card issuer can lower your credit limit at any time, regardless of how well you manage your account. Issuers might cut credit limits to minimize risk in an uncertain economy, as many cardholders have experienced during the COVID-19 pandemic in 2020.

Card issuers can change your credit limit without notice "Lenders aren't required to notify cardholders regarding credit limit decreases unless the reason for the decrease was based on adverse information on a credit report," Tayne tells CNBC Select.

Credit card companies generally can increase or decrease credit limits without giving you notice, including reducing your credit limit so that you no longer have any available credit. If you no longer have any available credit, you cannot make any charges until you pay off some of your existing balance.

Requesting a credit limit increase can hurt your score, but only in the short term. If you ask for a higher credit limit, most issuers will do a hard pull, or hard inquiry, of your credit history. A hard inquiry will temporarily lower your credit score.

I, hereby request you to consider raising the credit limit on my card as there has been a quantum leap in my salary, since the issuance of the credit card/or in the last few months....Subject: Request for increase in credit card limit Payslips for the past 6 months. Bank statement for the past 6 months. IT returns.

The reasons why a card issuer would reduce the amount you can charge vary, but credit limit decreases often happen because a cardholder is suddenly seen to be at a higher risk of default. Banks can also lower credit limits for multiple customers to decrease risk exposure amid economic uncertainty.

Dear Sir/Madam, I am holding a savings bank account mention account details here in your branch since mention month & year account was opened. I also have a credit card linked to my savings account since mention the length of time you have had the card, with a credit limit of mention the limit here.

WalletHub, Financial Company You may be eligible for a credit limit increase without asking after 6-12 consecutive months of on-time bill payments with a new credit card account. Credit card companies need evidence that you can handle your current spending limit responsibly before giving you the ability to borrow more.