Montgomery Maryland is a county located in the central part of the state of Maryland. It is known for its rich history, diverse communities, and vibrant economy. With a population of over 1 million residents, Montgomery County is one of the most populous counties in Maryland. The county is home to various towns, including Bethesda, Rockville, Silver Spring, and Gaithersburg, each offering its own unique charm and attractions. Montgomery County is highly regarded for its top-rated public schools, excellent healthcare facilities, and a wide range of recreational activities. Bethesda, located in Montgomery County, is an upscale urban district known for its shopping, dining, and arts scene. The area boasts numerous high-end boutiques, well-regarded restaurants, art galleries, and theaters. Rockville, the county seat of Montgomery County, is a thriving city with a diverse population. It offers a mix of residential, commercial, and entertainment options. Silver Spring, another prominent part of Montgomery County, is a lively and culturally diverse community. It features a vibrant downtown area with trendy shops, restaurants, and entertainment venues. Gaithersburg, often referred to as the "Science City," is known for its strong presence in the biotechnology and research industry. It has a thriving economy and offers a variety of shopping centers, parks, and recreational facilities. Now, let's move on to the different types of Montgomery Maryland Sample Letters for Notice of Credit Limit — Conversion to C.O.D. Status: 1. Standard Sample Letter for Notice of Credit Limit — Conversion to C.O.D. Status: This letter is a general template used by businesses to notify their customers that their credit limit will be converted to C.O.D. status. It includes details such as the reason for the change, effective date, and any necessary instructions. 2. Sample Letter for Notice of Credit Limit Reduction — Conversion to C.O.D. Status: This type of letter specifically informs customers that their credit limit is being reduced, leading to a conversion to C.O.D. status. It highlights the reasons for the reduction and any terms to be considered. 3. Sample Letter for Notice of Credit Limit Suspension — Conversion to C.O.D. Status: This letter is sent to customers to inform them that their credit limit has been suspended, resulting in a conversion to C.O.D. status. It may outline reasons for the suspension and provide instructions for payment. 4. Sample Letter for Notice of Credit Limit Decrease — Conversion to C.O.D. Status: This type of letter notifies customers of a decrease in their credit limit, leading to a change in payment terms. It explains the reasons for the decrease and includes any relevant instructions or contact information. These various types of sample letters for notice of credit limit conversion to C.O.D. status cater to different scenarios and help businesses effectively communicate changes in credit terms to their customers in Montgomery Maryland.

Montgomery Maryland Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Description

How to fill out Montgomery Maryland Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

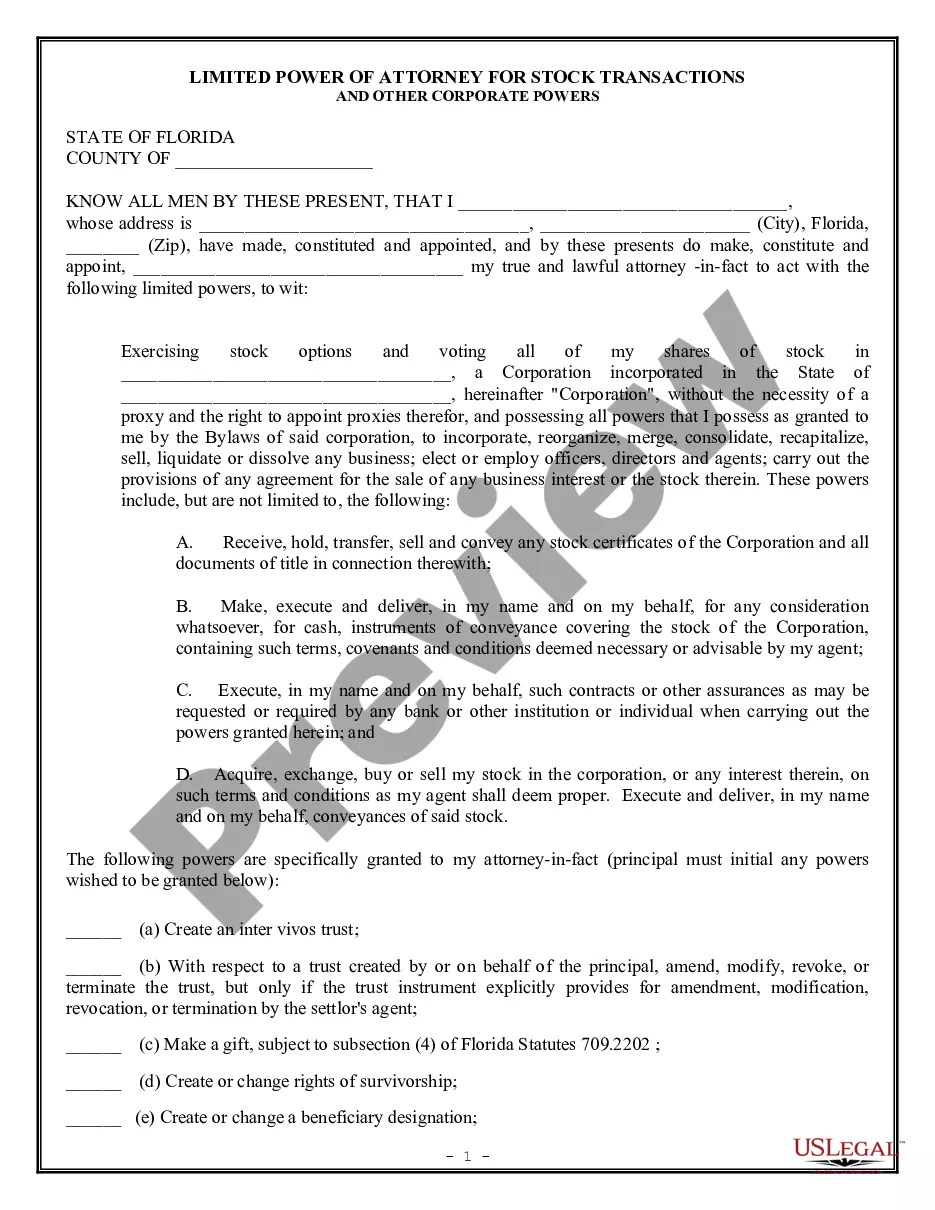

If you need to get a trustworthy legal paperwork supplier to obtain the Montgomery Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status, look no further than US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support make it simple to find and complete different papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to search or browse Montgomery Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status, either by a keyword or by the state/county the document is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Montgomery Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less costly and more affordable. Set up your first company, organize your advance care planning, create a real estate agreement, or complete the Montgomery Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

In this activity, you specify the customers for whom the credit limits are to be maintained and specify credit control area of the customers. SAP Menu => Logistics => Sales and Distribution => Credit Management => Master Data =>FD32-Change.

Regulation Z also requires mortgage lenders to provide borrowers with a written disclosure of rates, fees and other finance charges. Plus, if you have an adjustable-rate mortgage, they're required to let you know in advance if your rate will be changing.

A best practice it to limit the credit offered to 10% of the customer's net worth. The result will be 10% of the customer's net worth and a good benchmark for setting their credit limit. You may also consider basing their limit on 10% of the customer's working capital or average monthly sales.

Loan costs must be disclosed under Truth in Lending and Regulation Z. Title charges are closing costs disclosed under RESPA and Regulation X.

Credit History Most companies check your credit reports and gross annual income level to determine your credit limit. Factors that issuers like to consider include your repayment history, the length of your credit history and the number of credit accounts on your report.

Whenever the creditor changes the consumer's billing cycle, it must give a change-in-terms notice if the change affects any of the terms described in § 1026.9(c)(2)(i), unless an exception under § 1026.9(c)(2)(v) applies; for example, the creditor must give advance notice if the creditor initially disclosed a 28-day

Lenders must provide a Truth in Lending (TIL) disclosure statement that includes information about the amount of your loan, the annual percentage rate (APR), finance charges (including application fees, late charges, prepayment penalties), a payment schedule and the total repayment amount over the lifetime of the loan.

The credit card company has the right to change the terms of your credit card agreement. For significant changes, the card issuer generally must give you notice 45 days in advance.

While Regulation Z requires written disclosures to a consumer, the E-SIGN Act allows for disclosures to be provided electronically subject to certain conditions, including: (1) obtaining a consumer's affirmative consent to the electronic delivery; (2) providing certain disclosures required by the E-SIGN Act to the

Created to protect consumers from predatory lending practices, Regulation Z, also known as the Truth in Lending Act, requires that lenders disclose borrowing costs upfront and in clear terminology so consumers can make informed decisions.