Nassau, New York Sample Letter for Notice of Credit Limit — Conversion to C.O.D. Status Dear [Customer's Name], We hope this letter finds you well. We are writing to inform you of an important update regarding your credit limit with [Company Name]. Due to recent changes in our credit policy, we have made the decision to convert your account to C.O.D. (Cash on Delivery) status. At [Company Name], we value our customers and strive to maintain positive and mutually beneficial business relationships. However, after careful consideration, we have found it necessary to implement this change to ensure the financial stability of our company and maintain fairness among all our customers. This decision was not made lightly, and we understand that it may inconvenience you in some way. We assure you that it is not a reflection of your past payment history or your overall credibility. Our goal is to maintain a balanced cash flow and manage credit risk effectively. Effective [Date], all future orders will be placed on C.O.D. terms until further notice. As a result, we kindly request that you make arrangements to submit payment upon delivery. This can be done by providing our delivery personnel with cash or a certified check made payable to [Company Name]. We apologize for any inconvenience this may cause and appreciate your understanding. Should you have any questions or concerns regarding this credit limit conversion, our customer service team is available to assist you. Please note that if payment is not made upon delivery, your order may be delayed or not be processed at all. We urge you to plan accordingly to ensure a smooth and uninterrupted supply of products or services from [Company Name]. To revert your account back to credit terms, we invite you to contact our credit department to discuss the possibility of reevaluation. We understand that circumstances may change, and we are open to exploring options that suit both parties. Thank you for your attention to this matter. We value your partnership and look forward to continued business with you. Sincerely, [Your Name] [Your Title] [Company Name] [Contact Information] Additional types of Nassau, New York Sample Letters for Notice of Credit Limit — Conversion to C.O.D. Status: 1. Nassau, New York Sample Letter for Notice of Credit Limit Increase — Conversion to C.O.D. Status: This letter can be used when a customer's credit limit is increased, but they are still required to make payments on a Cash on Delivery basis for a specific period or until further notice. 2. Nassau, New York Sample Letter for Notice of Credit Limit Decrease — Conversion to C.O.D. Status: This letter can be used when a customer's credit limit is decreased due to various reasons, and they are notified of the change and required to make payments on a Cash on Delivery basis. 3. Nassau, New York Sample Letter for Notice of Credit Limit Suspension — Conversion to C.O.D. Status: This letter can be used when a customer's credit limit is temporarily suspended, and they are informed of the conversion to Cash on Delivery terms until further notice or resolution of outstanding issues. 4. Nassau, New York Sample Letter for Notice of Credit Limit Restoration — Reconversion to Credit Terms: This letter can be used when a customer's credit limit is restored after a period of being on Cash on Delivery terms, allowing them to resume making purchases on credit. Note: The provided information and keywords are relevant for Nassau, New York, but can be customized according to the specific location or requirements.

Nassau New York Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Description

How to fill out Nassau New York Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

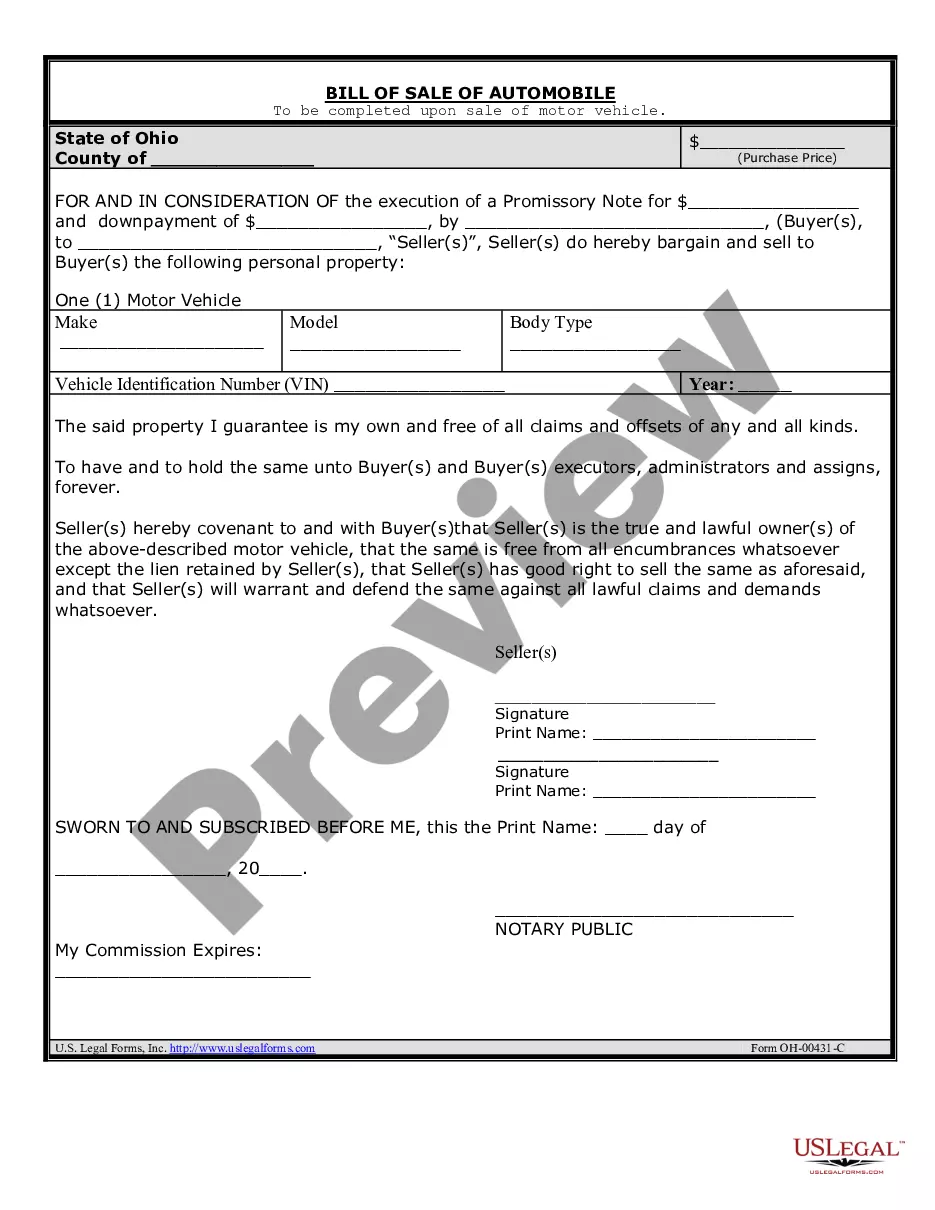

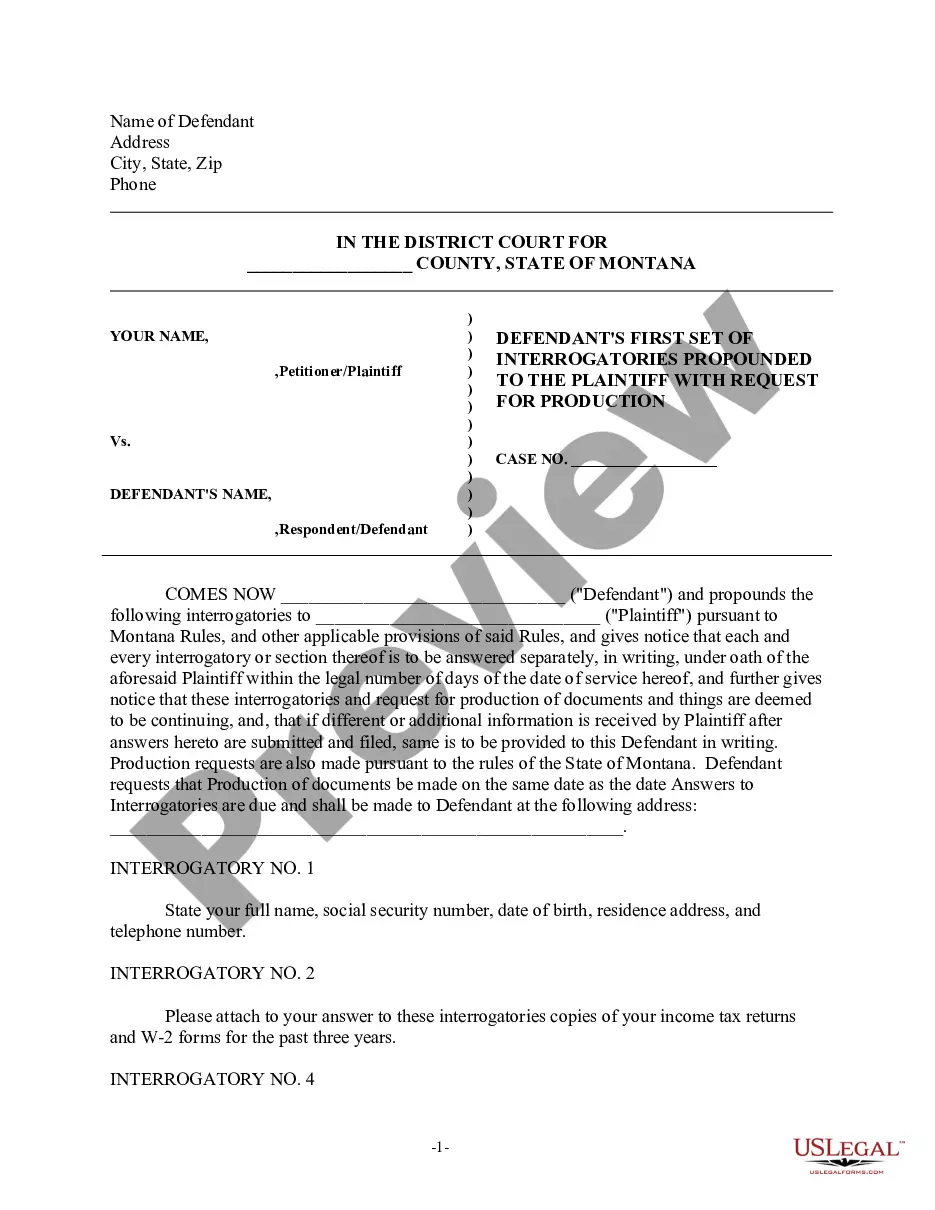

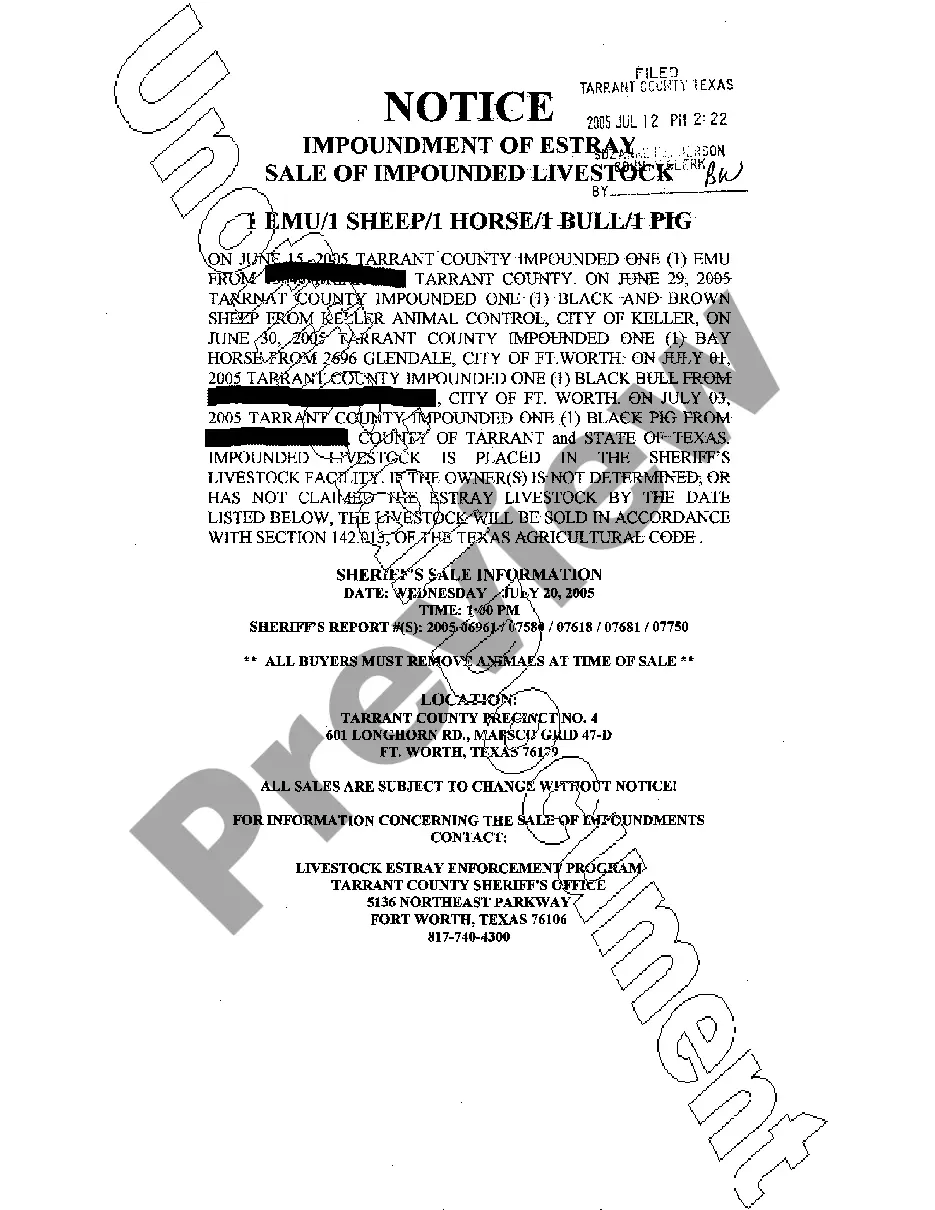

Do you need to quickly create a legally-binding Nassau Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status or probably any other document to take control of your own or business affairs? You can select one of the two options: hire a professional to draft a legal document for you or draft it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant document templates, including Nassau Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, carefully verify if the Nassau Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status is tailored to your state's or county's regulations.

- In case the document comes with a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were looking for by using the search box in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Nassau Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. In addition, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

When a customer is consistently late in making payments, has exceeded their credit limit, or is identified as a bad risk, you can prevent additional credit purchases by placing their account on credit hold.

Include the following details in your overdue invoice letter: Invoice number and date. Amount owing. Payment terms such as late fees. Reminders of previous letters. Instructions for payment (include links in emails) Your contact information.

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.

Editorial and user-generated content is not provided, reviewed or endorsed by any company. It's likely that Synchrony Bank lowered your credit limit because your recent credit history showed that you were a higher-risk customer than you had been in the past.

Sub: Credit Card Limit Increase Letter I have an account in your bank as reference no. 000-111-222. With given credit card and given credit limit I am unable to meet my monthly expenditure. Furthermore, I cannot carry additional cash all the time to pay for top-up expenditures.

1. Call your credit card company and ask for an explanation. Call your credit card issuer's customer service department and ask why your credit limit was decreased. Then, ask if it can increase your credit limit to the original credit limit amount.

A best practice it to limit the credit offered to 10% of the customer's net worth. The result will be 10% of the customer's net worth and a good benchmark for setting their credit limit. You may also consider basing their limit on 10% of the customer's working capital or average monthly sales.

The customer will need to be informed in writing of this decision. Reference the account number and the situation.Politely inform him that his credit is now on hold.Include a solution to the problem.Explain your position.End the letter positively.

Ideally, the holding statement should be no more than three to six sentences long. Again, the intent is to fill the information vacuum quickly and the longer the statement is, the greater the temptation will be to start editing. Longer, more detailed explanations can follow as the situation unfolds.

According to the Fair Credit Reporting Act, the only reason a card issuer needs to inform you about a credit limit decrease is because you missed a payment, are only making minimum payments on a high balance or took some other negative action that raised a red flag.