Lima, Arizona is a picturesque town located in Graham County, known for its scenic beauty and thriving economy. As a corporation operating in Lima, it is essential to comply with the tax regulations imposed by the state and local authorities. To assist corporations in fulfilling their tax obligations, the city offers various sample letters for corporation taxes, tailored to different tax scenarios. 1. Lima Arizona Sample Letter for Corporation Income Tax: This type of sample letter is specifically designed to address corporation income tax-related matters in Lima, Arizona. It provides a template that corporations can use to communicate with the tax authorities regarding income tax calculations, deductions, exemptions, and payment procedures applicable to their specific business operations. Keywords: Lima Arizona, sample letter, corporation income tax, calculations, deductions, exemptions, payment procedures. 2. Lima Arizona Sample Letter for Corporation Sales Tax: For businesses involved in retail or wholesale operations, collecting and remitting sales tax is a crucial aspect of conducting business in Lima, Arizona. The sales tax sample letter offers corporations a standardized format to communicate with tax authorities regarding sales tax reporting, collection procedures, late payment penalties, and any other sales tax-related issues. Keywords: Lima Arizona, sample letter, corporation sales tax, reporting, collection procedures, late payment penalties. 3. Lima Arizona Sample Letter for Corporation Property Tax: Corporations owning properties in Lima, Arizona are subject to annual property tax obligations. This type of sample letter helps corporations navigate the property tax requirements, including assessment disputes, property valuation inquiries, payment installments, and other property tax-related concerns. Keywords: Lima Arizona, sample letter, corporation property tax, assessment disputes, property valuation, payment installments. 4. Lima Arizona Sample Letter for Corporation Employer Taxes: Corporations in Lima, Arizona are responsible for various employer taxes, such as payroll taxes, unemployment insurance, and social security taxes. The sample letter for corporation employer taxes aids businesses in communicating with the tax authorities regarding employee withholding, tax calculations, compliance inquiries, and other employer tax-related matters. Keywords: Lima Arizona, sample letter, corporation employer taxes, payroll taxes, unemployment insurance, social security taxes, compliance inquiries. In conclusion, Lima, Arizona offers a range of sample letters for corporation taxes to assist businesses in fulfilling their tax obligations efficiently. These sample letters cover different tax aspects, including corporation income tax, sales tax, property tax, and employer taxes. By utilizing these sample letters, corporations can ensure proper communication with the tax authorities while meeting their tax responsibilities effectively.

Pima Arizona Sample Letter for Corporation Taxes

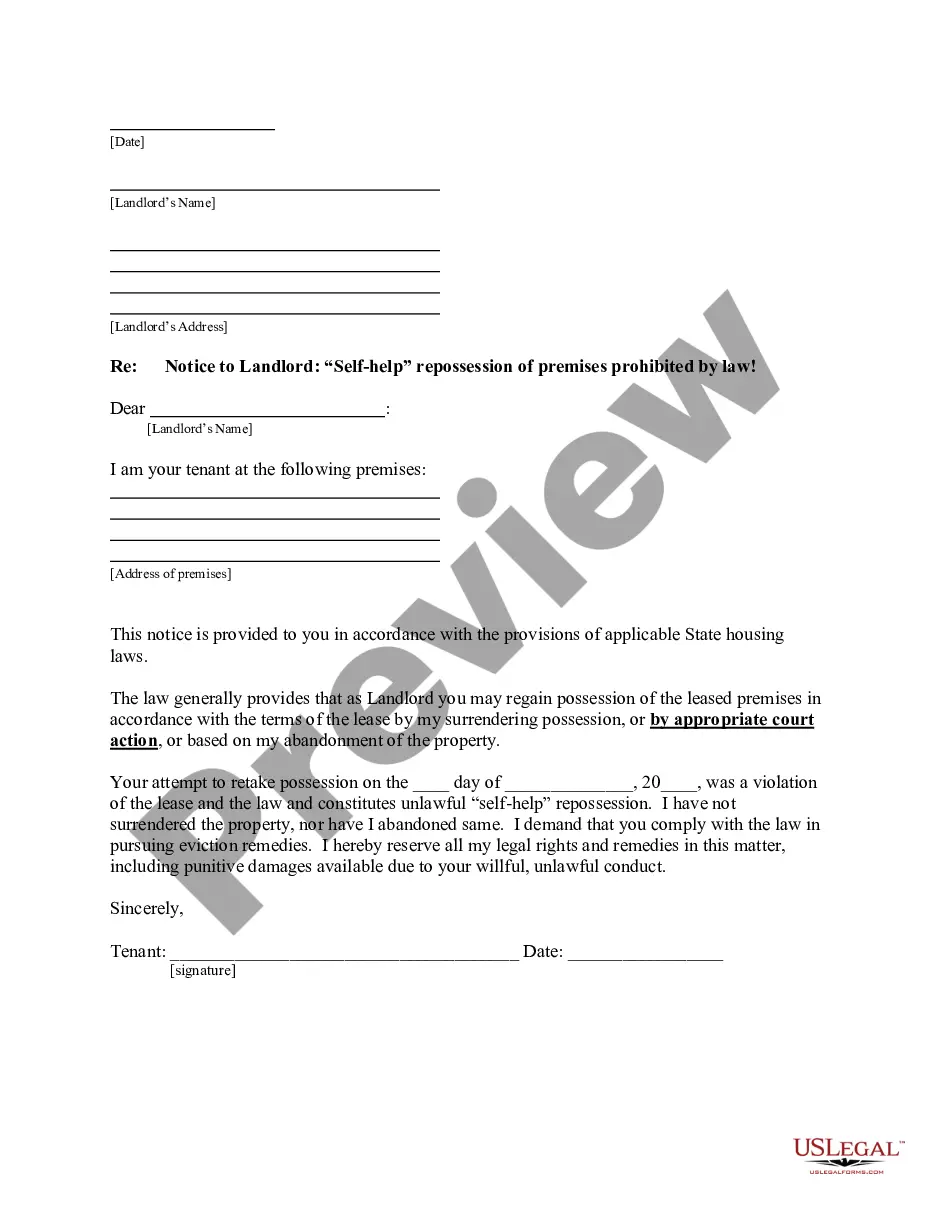

Description

How to fill out Pima Arizona Sample Letter For Corporation Taxes?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Pima Sample Letter for Corporation Taxes suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Aside from the Pima Sample Letter for Corporation Taxes, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Pima Sample Letter for Corporation Taxes:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Pima Sample Letter for Corporation Taxes.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!