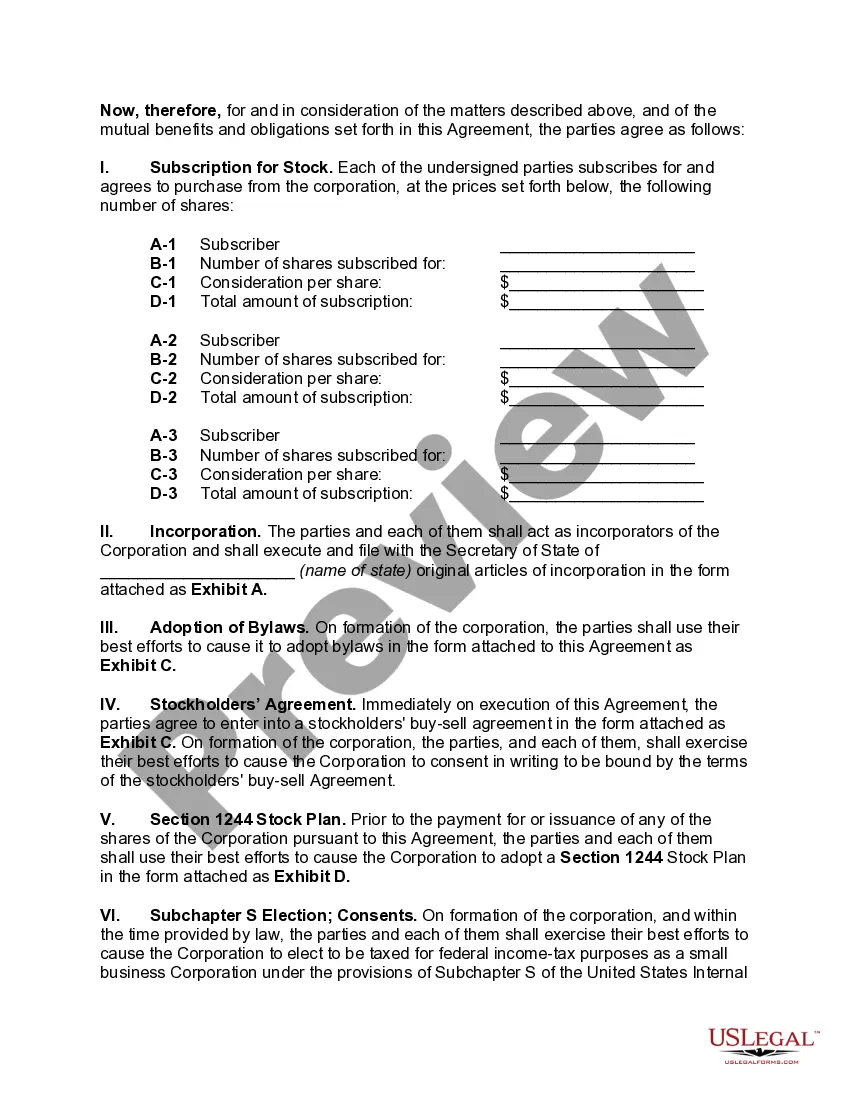

The Allegheny Pennsylvania Agreement to incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock is a legal document that outlines the process of incorporating a business in Allegheny County, Pennsylvania as an S Corporation and qualifying for Section 1244 stock status. This agreement provides businesses with various tax advantages and liability protections associated with being an S Corp and Section 1244 qualification. Keywords: Allegheny Pennsylvania Agreement, incorporate, S Corp, Small Business Corporation, Section 1244 Stock, legal document, tax advantages, liability protections. Types of Allegheny Pennsylvania Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock: 1. General Incorporation Agreement: This type of agreement is suitable for new businesses looking to incorporate in Allegheny County, Pennsylvania as an S Corporation and qualify for Section 1244 Stock. It covers the basic incorporation process, S Corp election, and Section 1244 qualification requirements. 2. Amendment Agreement: This agreement type is used when an existing business in Allegheny County, Pennsylvania wishes to convert its current corporate structure into an S Corporation and obtain Section 1244 Stock qualification. It outlines the necessary amendments to the existing articles of incorporation and bylaws to reflect the desired changes. 3. Qualification Agreement for Section 1244 Stock: In some cases, a business may already be an S Corporation but wishes to obtain Section 1244 Stock status. This agreement focuses solely on meeting the requirements for Section 1244 qualification, such as the issuance of stock to eligible stockholders and restrictions on transferring such stock. 4. Bylaws Agreement for S Corp and Section 1244 Stock: This agreement type supplements the incorporation agreement by providing detailed provisions regarding the regulations and governance of the S Corporation and the specific rules related to Section 1244 Stock. It covers topics like stockholder voting rights, distribution of profits, and restrictions on transfers. 5. Stock Issuance Agreement for Section 1244 Stock: For businesses that have already incorporated as S Corporations but need to issue or restructure their stock in compliance with Section 1244, this agreement outlines the terms, conditions, and procedures of issuing Section 1244 Stock, while ensuring compliance with state and federal securities laws. The specific type of Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock required will depend on the current status and needs of the business. It is essential to consult with an attorney or legal expert to determine the appropriate agreement and ensure compliance with all applicable laws and regulations.

Allegheny Pennsylvania Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Allegheny Pennsylvania Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Draftwing documents, like Allegheny Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, to manage your legal matters is a difficult and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for various cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Allegheny Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting Allegheny Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock:

- Make sure that your form is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Allegheny Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start utilizing our service and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can try and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!