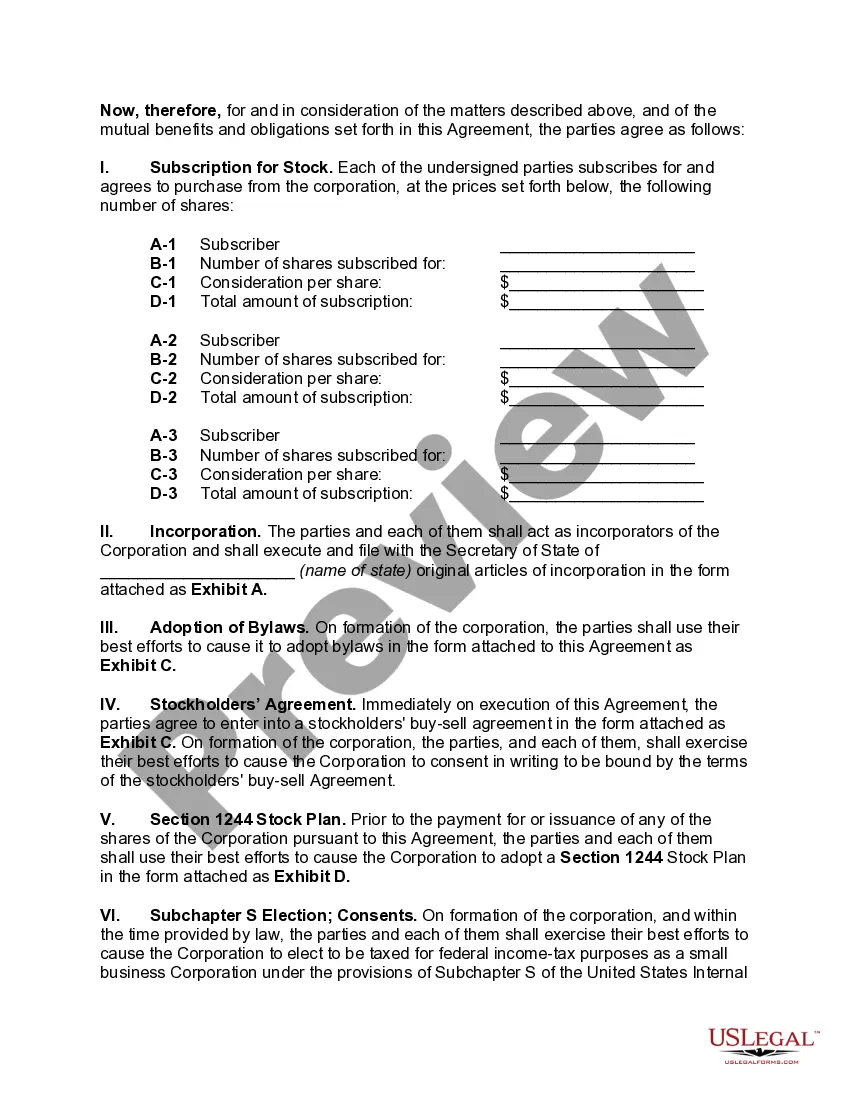

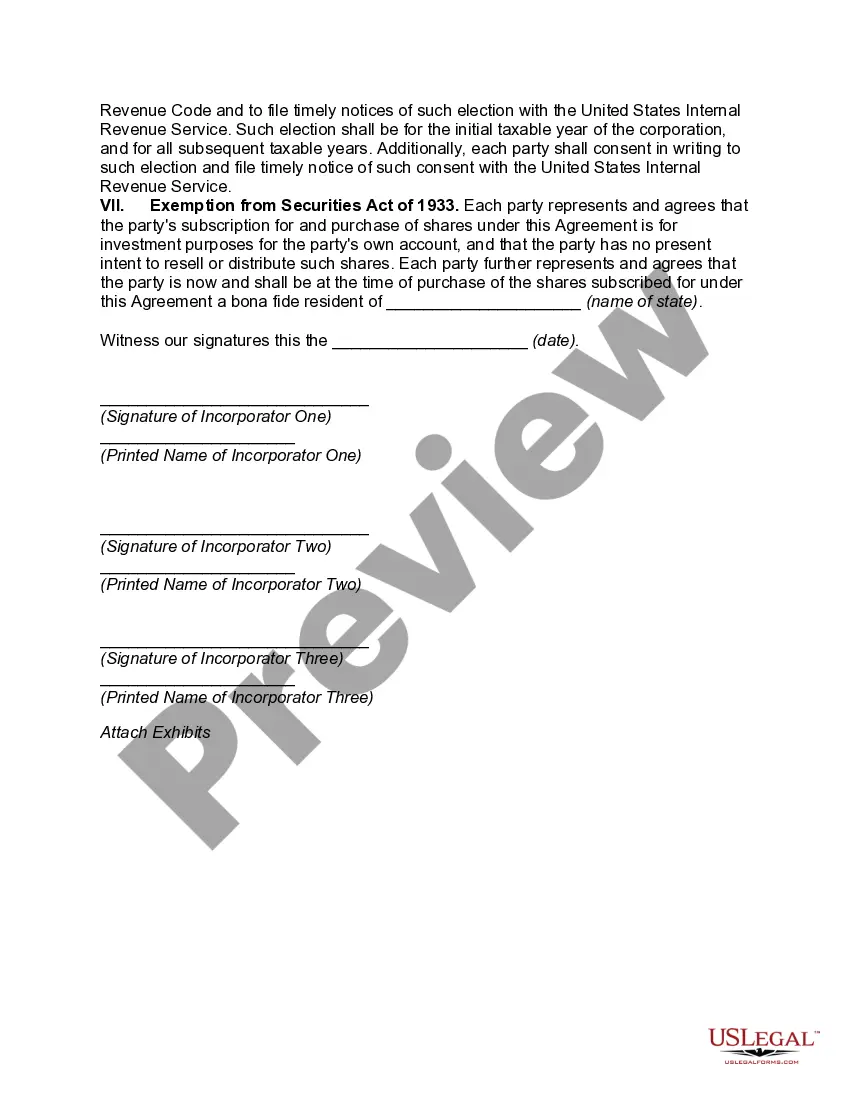

Title: Incorporating in Cuyahoga, Ohio: Agreement to Establish an S Corp and Small Business Corporation with Section 1244 Stock Qualification Introduction: Incorporating a small business as an S Corporation (S Corp) offers numerous benefits for entrepreneurs looking to enjoy pass-through taxation, limited liability, and flexibility in managing their operations. This article provides a detailed description of the Cuyahoga, Ohio Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock. We will explore the different types of agreements available for small business owners looking to structure their entities under these regulations. Key Phrases/Keywords: 1. Cuyahoga, Ohio incorporation 2. S Corporation (S Corp) 3. Small Business Corporation 4. Section 1244 Stock qualification 5. Agreement to Incorporate 6. Incorporation in Cuyahoga, Ohio 7. Small business incorporation 8. Cuyahoga S Corp agreement 9. Section 1244 stock benefits 10. Incorporation for pass-through taxation Types of Cuyahoga, Ohio Agreements to Incorporate as an S Corp and Small Business Corporation: 1. Basic Agreement: This agreement is designed for small business owners who wish to incorporate their entity as an S Corp in Cuyahoga, Ohio. It includes the necessary clauses and provisions to establish the corporation's structure, define shareholder rights, determine voting rights, outline distribution of profits, and specify the roles and responsibilities of directors and officers. 2. Small Business Corporation Agreement: For entrepreneurs seeking to qualify their small businesses as Small Business Corporations, this agreement goes beyond the basic provisions. It addresses additional requirements, such as meeting the eligibility criteria defined by the Small Business Administration (SBA), obtaining certifications, and adhering to specialized regulations. It ensures compliance with local and federal guidelines to enjoy the benefits of this designation. 3. Section 1244 Stock Qualification Agreement: This specific agreement is targeted at businesses that want to take advantage of Section 1244 of the Internal Revenue Code. By issuing Section 1244 stock, shareholders are granted certain tax advantages in the event of a business loss. This agreement outlines the necessary qualifications and guidelines for the company's stock issuance, as well as provides for the protection of shareholders' tax interests. 4. Comprehensive Incorporation Agreement: Designed for entrepreneurs seeking to combine the benefits of both S Corp and Small Business Corporation designations, this comprehensive agreement covers all necessary legal frameworks. It addresses S Corp requirements while simultaneously ensuring compliance with Small Business Corporation regulations, including Section 1244 stock provisions. This all-in-one agreement provides maximum flexibility and benefits for eligible small businesses with complex needs. Conclusion: Choosing to incorporate as an S Corp and Small Business Corporation in Cuyahoga, Ohio offers entrepreneurs numerous advantages in terms of taxation and liability protection. By understanding the different types of agreements available, business owners can select the most suitable option for their specific needs and goals. Whether opting for a standard agreement, Small Business Corporation-specific provisions, Section 1244 stock qualification, or a comprehensive incorporation agreement, entrepreneurs can rest assured their legal requirements are met while reaping the benefits of these designations.

Cuyahoga Ohio Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Cuyahoga Ohio Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Draftwing paperwork, like Cuyahoga Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, to manage your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for a variety of cases and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Cuyahoga Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Cuyahoga Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock:

- Ensure that your form is specific to your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Cuyahoga Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our website and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!