Title: Understanding the King Washington Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock Introduction: The King Washington Agreement to Incorporate as an S Corporation and as a Small Business Corporation with Qualification for Section 1244 Stock refers to the legal framework and requirements involved in establishing a company as both an S Corporation (S Corp) and a Small Business Corporation while seeking qualification for Section 1244 stock. This unique agreement combines the benefits of limited liability and potential tax advantages for qualifying small businesses. Types of King Washington Agreement to Incorporate as an S Corp and Small Business Corporation: 1. Basic King Washington Agreement to Incorporate as an S Corp and Small Business Corporation: This type of agreement outlines the general provisions and legal requirements for incorporating a business as both an S Corporation and a Small Business Corporation, allowing for the desired tax status and potential Section 1244 stock eligibility. 2. Comprehensive King Washington Agreement to Incorporate as an S Corp and Small Business Corporation with Qualification for Section 1244 Stock: This more detailed agreement takes into account the specific eligibility criteria for Small Business Corporations seeking Section 1244 stock qualification. It delves into the qualifying factors, such as maximum capitalization limits and the definition of "qualified small business." Key Considerations for Incorporating as an S Corp and Small Business Corporation with Section 1244 Stock Qualification: 1. Limited liability protection: By incorporating your business as an S Corp and Small Business Corporation, you can benefit from limited liability protection where the shareholders' personal assets are safeguarded against the company's debts and liabilities. 2. Tax advantages: As an S Corporation, profits and losses can pass through to shareholders' personal tax returns, avoiding double taxation. Many small businesses qualify for favorable tax treatment under specific IRS guidelines. 3. Meet Section 1244 stock eligibility: Section 1244 of the Internal Revenue Code provides tax benefits to investors when they incur losses on qualifying small business stock. By securing qualification for Section 1244 stock, investors may be able to offset these losses against ordinary income, offering potential tax benefits. 4. Fulfilling Small Business Corporation requirements: To qualify as a Small Business Corporation under Section 1244, your company must meet certain criteria, including limited capitalization, restrictions on stock ownership, and comply with specific trade or business provisions. 5. Seeking professional guidance: Given the complexity of incorporating as an S Corp and Small Business Corporation with Section 1244 stock qualification, it is advisable to consult with legal and tax professionals who specialize in corporate law and small business taxation. Their expertise ensures compliance with all legal and regulatory requirements. Conclusion: The King Washington Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock provides a unique opportunity for small businesses to combine limited liability protection and potential tax advantages. By following the legal framework and seeking qualification for Section 1244 stock, entrepreneurs can optimize their business structure and potentially benefit from tax savings.

King Washington Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out King Washington Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Drafting papers for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create King Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock without expert help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid King Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the King Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock:

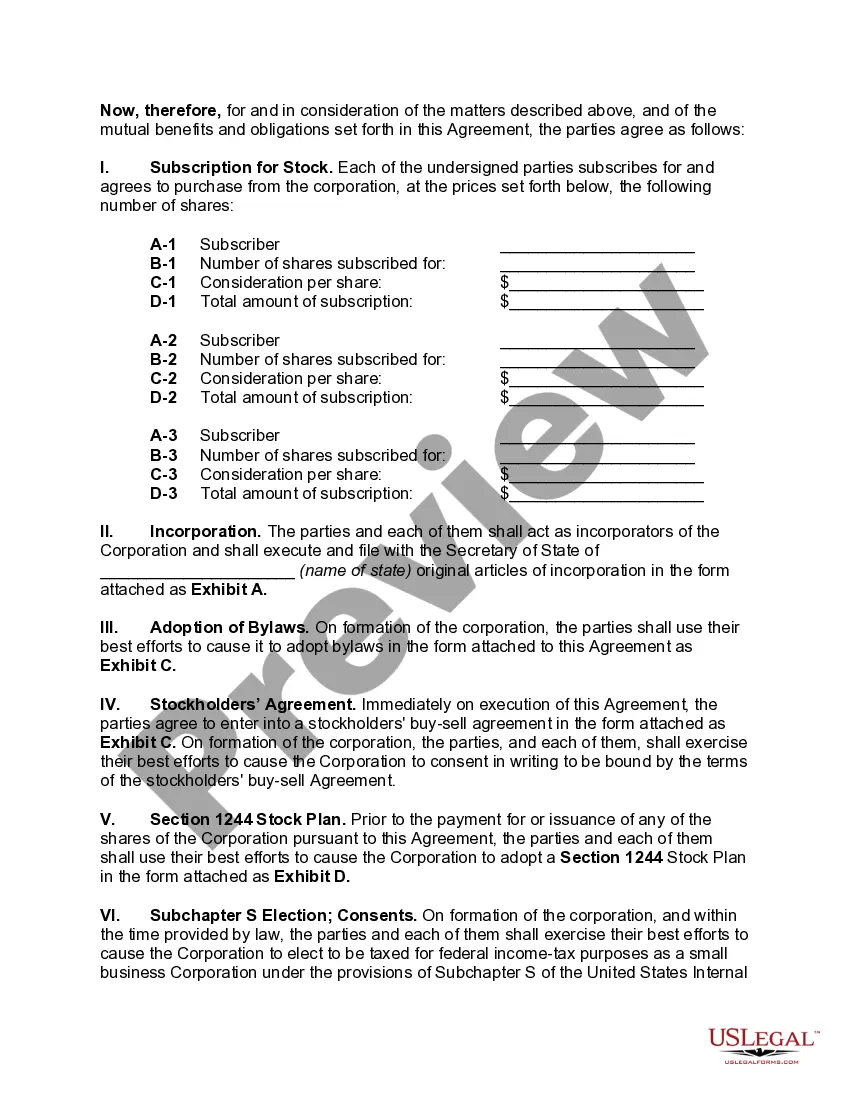

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!