Maricopa Arizona Agreement to Incorporate as an S Corp and Small Business Corporation with Qualification for Section 1244 Stock is a legal document that outlines the terms and conditions for establishing a small business corporation as an S corporation, while also qualifying for Section 1244 stock classification. This document is important for small business owners in Maricopa, Arizona, who wish to take advantage of the tax benefits and flexibility provided by these classifications. Creating an S corporation allows businesses to avoid double taxation, as the corporation's income and losses pass through to the shareholders' personal tax returns. Additionally, qualifying for Section 1244 stock classification provides the shareholders with potential tax advantages in case of business losses. There are different types of Maricopa Arizona Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock, depending on the specific needs and objectives of the business. Some of these variations include: 1. Standard Maricopa Arizona Agreement to Incorporate as an S Corp and Small Business Corporation with Qualification for Section 1244 Stock: This is the most common type, suitable for businesses that want to establish an S corporation structure while also qualifying for Section 1244 stock classification to minimize potential losses. 2. Maricopa Arizona Agreement to Incorporate as an S Corp and Small Business Corporation with Qualification for Section 1244 Stock for Start-ups: This type of agreement is tailored for newly incorporated businesses that aim to classify themselves as an S corporation from the beginning and take advantage of Section 1244 stock classification for potential losses. 3. Maricopa Arizona Agreement to Incorporate as an S Corp and Small Business Corporation with Qualification for Section 1244 Stock for Conversion: This type of agreement is relevant for existing businesses that wish to convert their current legal structure to an S corporation and simultaneously qualify for Section 1244 stock to maximize tax benefits. In all types of Maricopa Arizona Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, significant details and clauses are typically included. These may include the names of shareholders, their respective ownership percentages, the business's purpose, the authorized share amounts, the roles and responsibilities of directors and officers, how meetings will be conducted, and provisions for dissolution or sale of the corporation. It is crucial to consult with a legal professional or attorney experienced in Maricopa, Arizona, corporate law to ensure that the Agreement meets all legal requirements and addresses the specific needs of the business.

Maricopa Arizona Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Maricopa Arizona Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

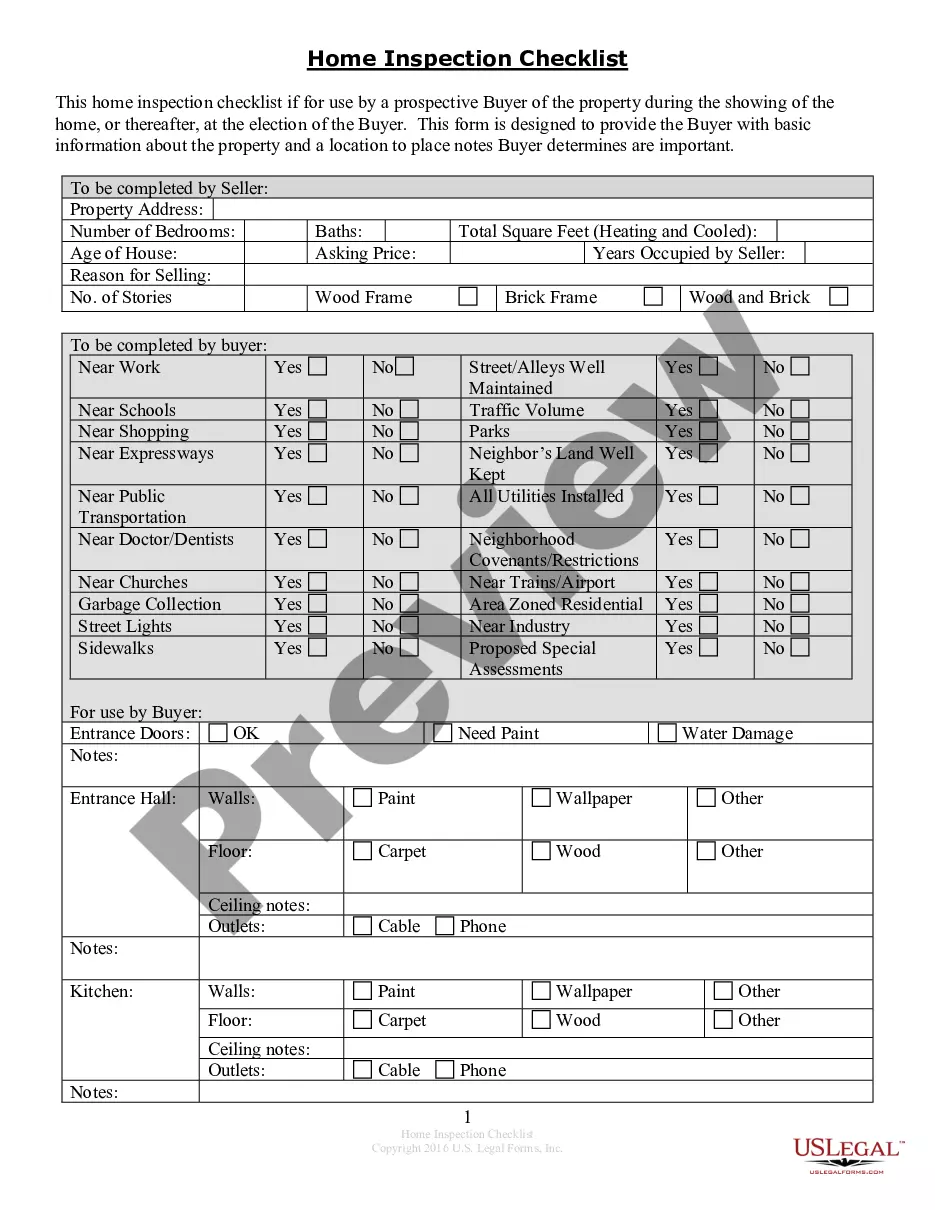

Do you need to quickly draft a legally-binding Maricopa Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock or probably any other document to manage your personal or corporate affairs? You can select one of the two options: contact a professional to draft a legal paper for you or draft it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you receive neatly written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including Maricopa Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Maricopa Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Maricopa Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the documents we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!