The Nassau New York Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock is a legal document that outlines the process and requirements for forming an S corporation and qualifying for Section 1244 stock status in Nassau, New York. This agreement is crucial for small businesses seeking tax advantages and limited liability protection. Keywords: Nassau New York, Agreement to Incorporate, S Corp, Small Business Corporation, Section 1244 Stock, legal document, tax advantages, limited liability protection. Types of Nassau New York Agreements to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock: 1. Nassau New York Agreement to Incorporate as an S Corp: This agreement focuses on the process of incorporating as an S corporation in Nassau, New York. It covers the necessary steps, such as filing articles of incorporation, obtaining an employer identification number (EIN), and electing S corporation status with the Internal Revenue Service (IRS). It also outlines the rights and responsibilities of shareholders, officers, and directors within the S corporation structure. 2. Nassau New York Agreement to Incorporate as a Small Business Corporation: This agreement specifically caters to small business corporations in Nassau, New York. It provides a comprehensive framework for incorporating as a small business corporation, which typically aims to maximize tax benefits for qualifying businesses. The agreement will outline the criteria and requirements that need to be met to qualify as a small business corporation under the state laws of Nassau, New York. 3. Nassau New York Agreement for Section 1244 Stock Qualification: This agreement pertains to the qualification of stock under Section 1244 of the Internal Revenue Code. Section 1244 allows shareholders of small business corporations to treat losses on the sale or worthlessness of their stock as ordinary losses rather than capital losses, providing potential tax benefits. The agreement will include provisions outlining the conditions for stock to qualify under Section 1244 and the rights and entitlements of shareholders regarding such stock. In conclusion, the Nassau New York Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock caters to small businesses in Nassau, New York, looking to form an S corporation, maximize tax advantages, and qualify for Section 1244 stock status. Different types of agreements address specific aspects of this incorporation process, ensuring legal compliance and providing relevant guidelines for business owners.

Nassau New York Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Nassau New York Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

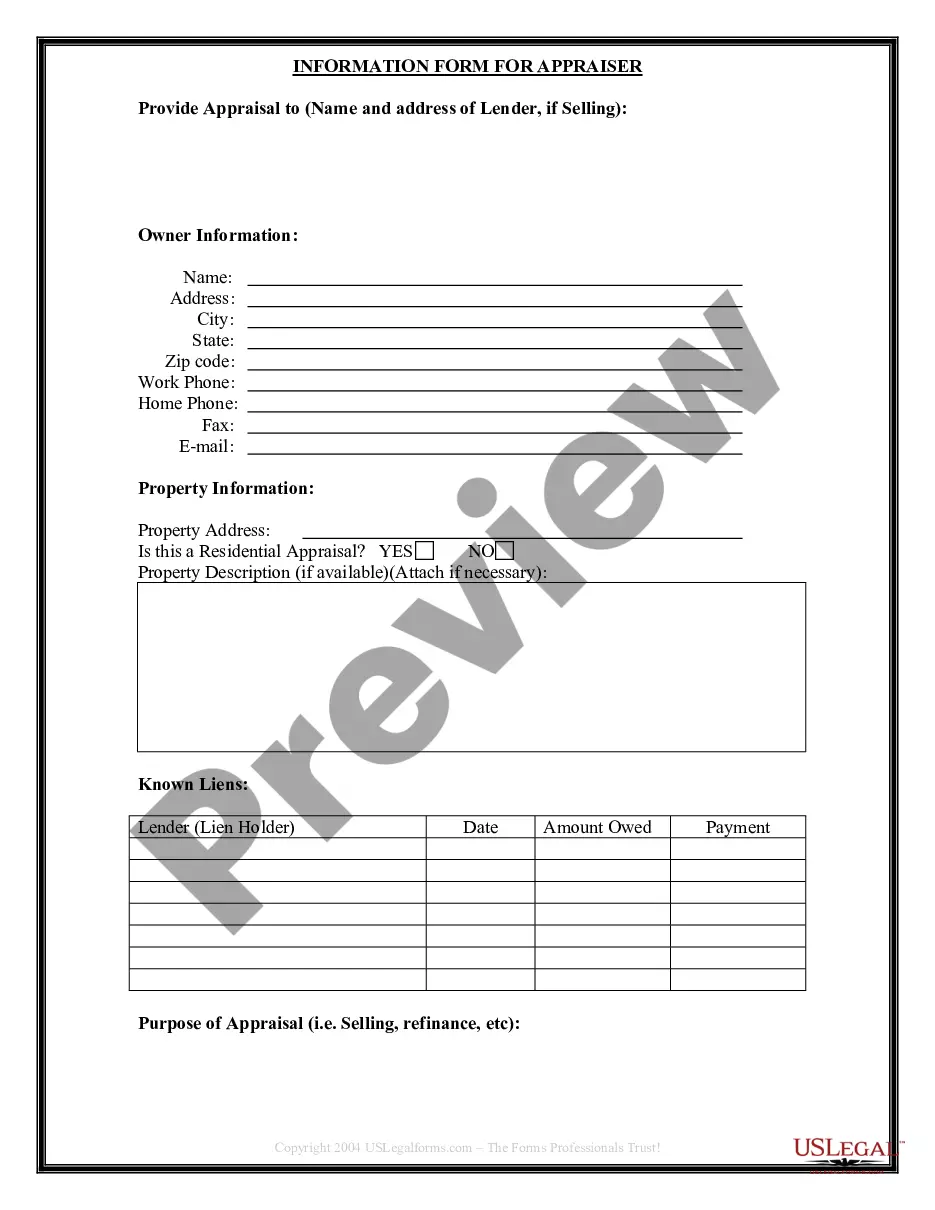

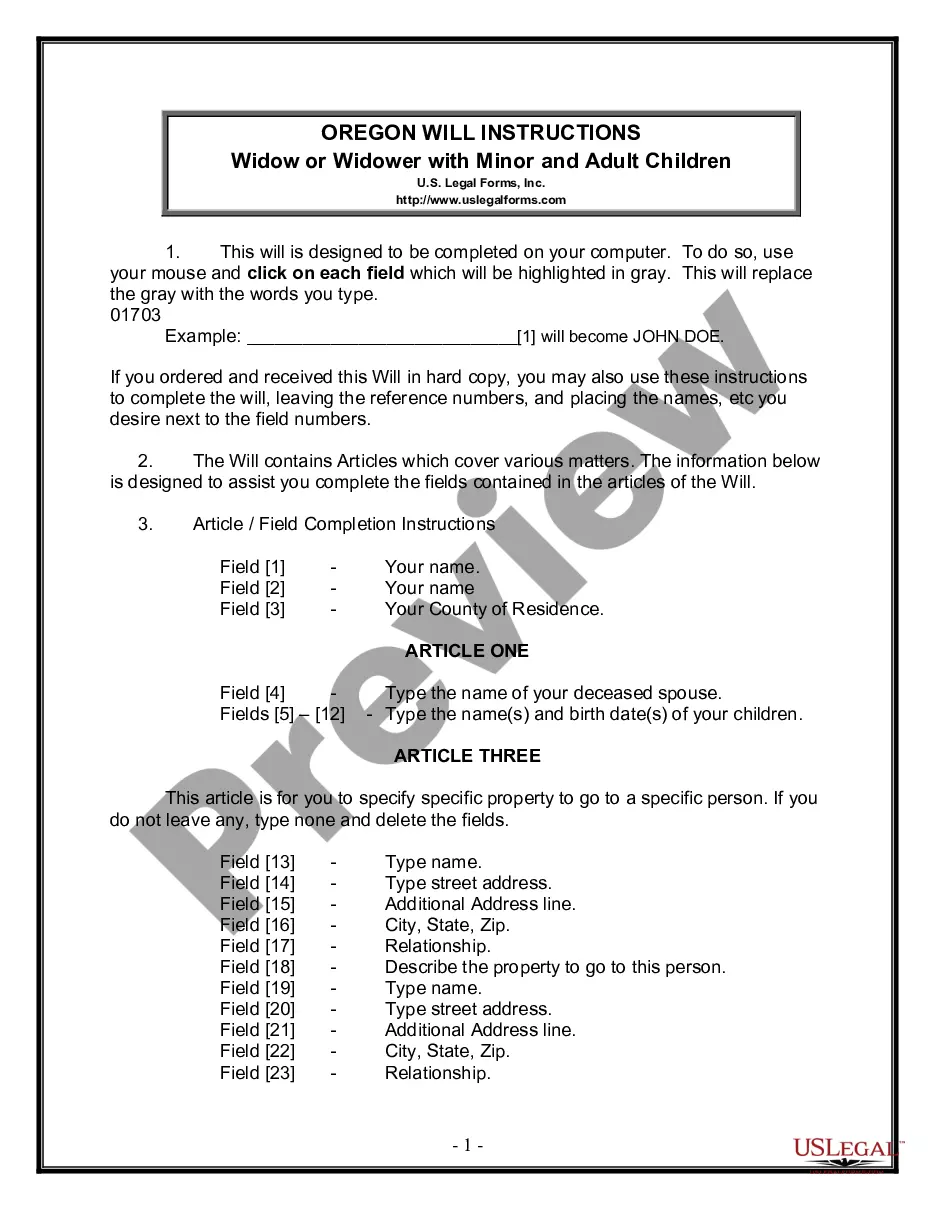

Do you need to quickly draft a legally-binding Nassau Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock or probably any other form to take control of your own or corporate matters? You can select one of the two options: contact a legal advisor to draft a legal paper for you or create it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you receive professionally written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant form templates, including Nassau Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, carefully verify if the Nassau Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the template isn’t what you were seeking by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Nassau Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the paperwork we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!