Philadelphia, Pennsylvania Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock Philadelphia, Pennsylvania offers an attractive environment for entrepreneurs and small businesses looking to incorporate as an S Corporation (S Corp) and qualify for Section 1244 stock. With its thriving economy, diverse talent pool, and business-friendly policies, Philadelphia provides a solid foundation for startups to establish themselves as small business corporations. Incorporating as an S Corporation in Philadelphia has numerous benefits. One of the primary advantages is the pass-through taxation, where business profits and losses are directly reported on the owners' personal tax returns. This eliminates the double taxation typically associated with traditional corporations. Moreover, by meeting certain criteria, S Corporations can gain qualification for Section 1244 stock, offering investors additional tax advantages in the case of business losses. To incorporate as an S Corp and qualify for Section 1244 stock in Philadelphia, entrepreneurs must follow a specific agreement process. The agreement involves a thorough documentation of the company's formation, structure, and bylaws. It is important to consult an attorney or a professional specializing in corporate law to ensure compliance with Philadelphia's regulations and to make the most of the available benefits. The Philadelphia Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock encompasses several types, each tailored to different business needs and structures. Here are some variations: 1. Standard S Corporation Agreement: This agreement outlines the basic provisions required by the state of Pennsylvania for incorporating as an S Corporation. It includes the company's name, purpose, shareholders' rights and responsibilities, corporate governance, and tax-related provisions. 2. Section 1244 Qualification Agreement: This specialized agreement is crucial for businesses seeking qualification of their stock under Section 1244 of the Internal Revenue Code. It involves providing detailed documentation on the nature of the company's business, the capital structure, shareholders' investment, and anticipated risks. 3. Small Business Corporation Agreement: This agreement specifically caters to small businesses in Philadelphia aiming to incorporate as an S Corporation. It emphasizes the unique benefits available to small businesses, such as simplified record keeping and potential tax credits. 4. Investor Agreements: Depending on the specific fundraising requirements, businesses may need to include additional provisions in their incorporation agreements to satisfy investor needs. This could involve provisions related to equity ownership, transfer restrictions, and investment terms. Philadelphia's Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock is a crucial step for entrepreneurs looking to establish their businesses and maximize tax advantages. By adhering to the guidelines and utilizing the appropriate agreement type, businesses can position themselves for success in Philadelphia's dynamic and supportive business ecosystem.

Philadelphia Pennsylvania Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Philadelphia Pennsylvania Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

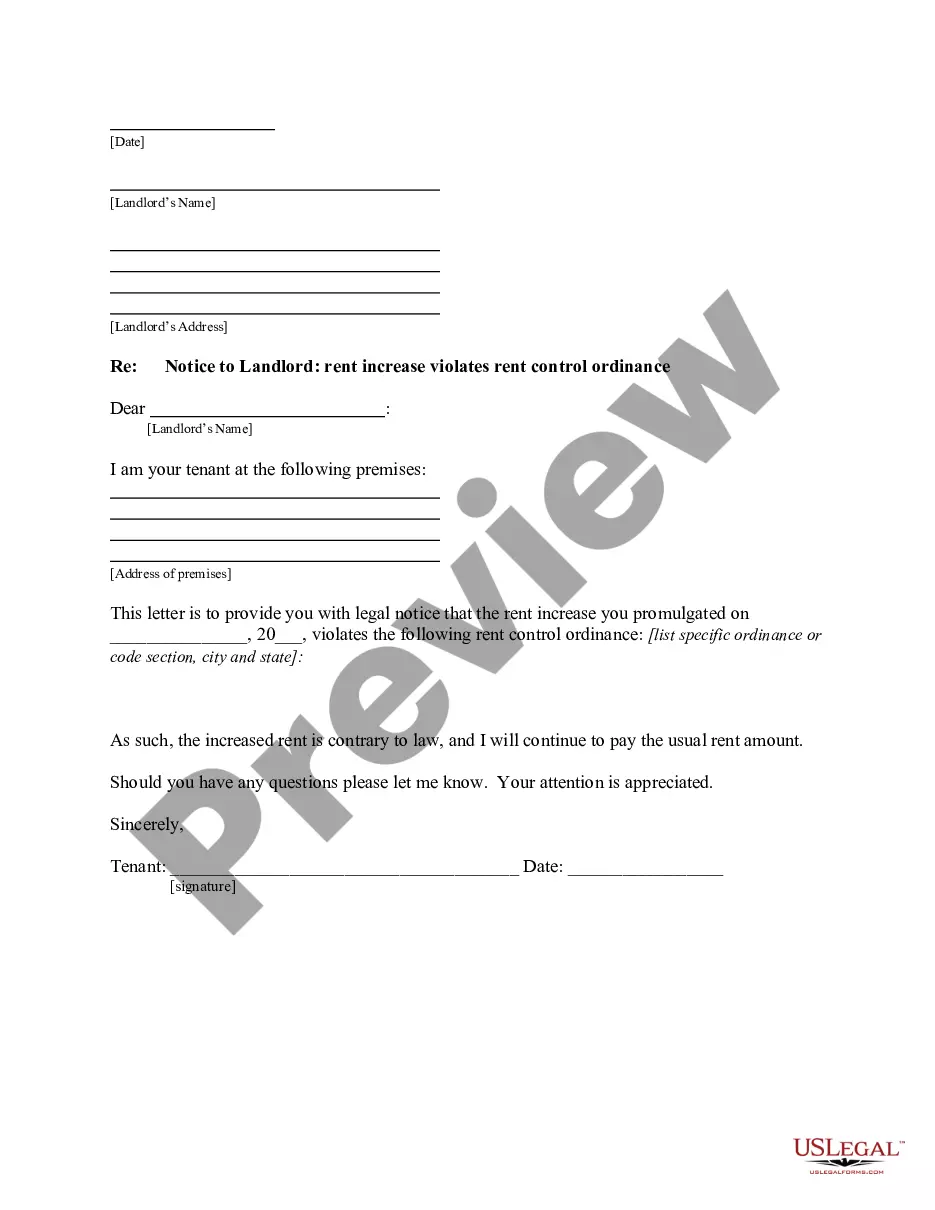

Are you looking to quickly create a legally-binding Philadelphia Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock or maybe any other form to take control of your personal or corporate affairs? You can select one of the two options: hire a legal advisor to draft a valid document for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal papers without having to pay sky-high prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant form templates, including Philadelphia Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra hassles.

- To start with, double-check if the Philadelphia Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock is tailored to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the document isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Philadelphia Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the templates we provide are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!