San Jose, California Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock When establishing a business in San Jose, California, entrepreneurs have the option to incorporate as an S Corporation and as a Small Business Corporation with Qualification for Section 1244 Stock. Incorporating under these designations offers numerous benefits, including tax advantages and liability protection. This detailed description will explain the various aspects of these agreements, outlining their functionalities and advantages. 1. S Corporation: The S Corporation designation is a type of corporate structure that allows entrepreneurs to avoid double taxation. This means that the corporation's profits and losses pass through to the shareholders' personal tax returns, which can help reduce the overall tax burden. To qualify as an S Corporation, the entity must meet specific requirements, including being a domestic corporation, having only allowable shareholders (such as individuals, certain trusts, and estates), and limiting the number of shareholders to 100. Additionally, S Corporations cannot have nonresident aliens as shareholders. Incorporating as an S Corporation in San Jose, California grants businesses the advantage of limited liability protection, ensuring that shareholders are not personally liable for the company's debts or legal obligations. This protection extends to shareholders' personal assets, safeguarding their financial security. 2. Small Business Corporation with Qualification for Section 1244 Stock: A Small Business Corporation allows entrepreneurs to avail certain tax benefits while limiting personal liability. In addition, qualifying the corporation's stock under Section 1244 of the Internal Revenue Code provides further advantages. Specifically, Section 1244 allows individuals investing in small businesses to deduct losses from the sale or exchange of these stocks up to a specified amount ($50,000 for single taxpayers and $100,000 for married taxpayers filing jointly), subject to certain limitations. By incorporating as a Small Business Corporation with Qualification for Section 1244 Stock, business owners in San Jose, California can stimulate investment, attract potential shareholders, and encourage economic growth. Investors will be enticed by the tax benefits and potential deductions, which can enhance the availability of capital. Moreover, incorporating as a Small Business Corporation protects shareholders from personal liability, similar to the S Corporation designation, ensuring that their personal assets remain separate from the corporation's liabilities. Overall, the San Jose, California Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock enables entrepreneurs to benefit from advantageous taxation policies, liability protection, and potential investment opportunities. By selecting the appropriate designation, individuals can navigate the complex business landscape more effectively while maximizing their financial prospects. (Note: While there are no specific types of San Jose, California Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, these designations are defined categories with specific requirements and benefits. The content above covers the general aspects of these agreements.)

San Jose California Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out San Jose California Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Drafting paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft San Jose Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock without expert help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid San Jose Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the San Jose Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock:

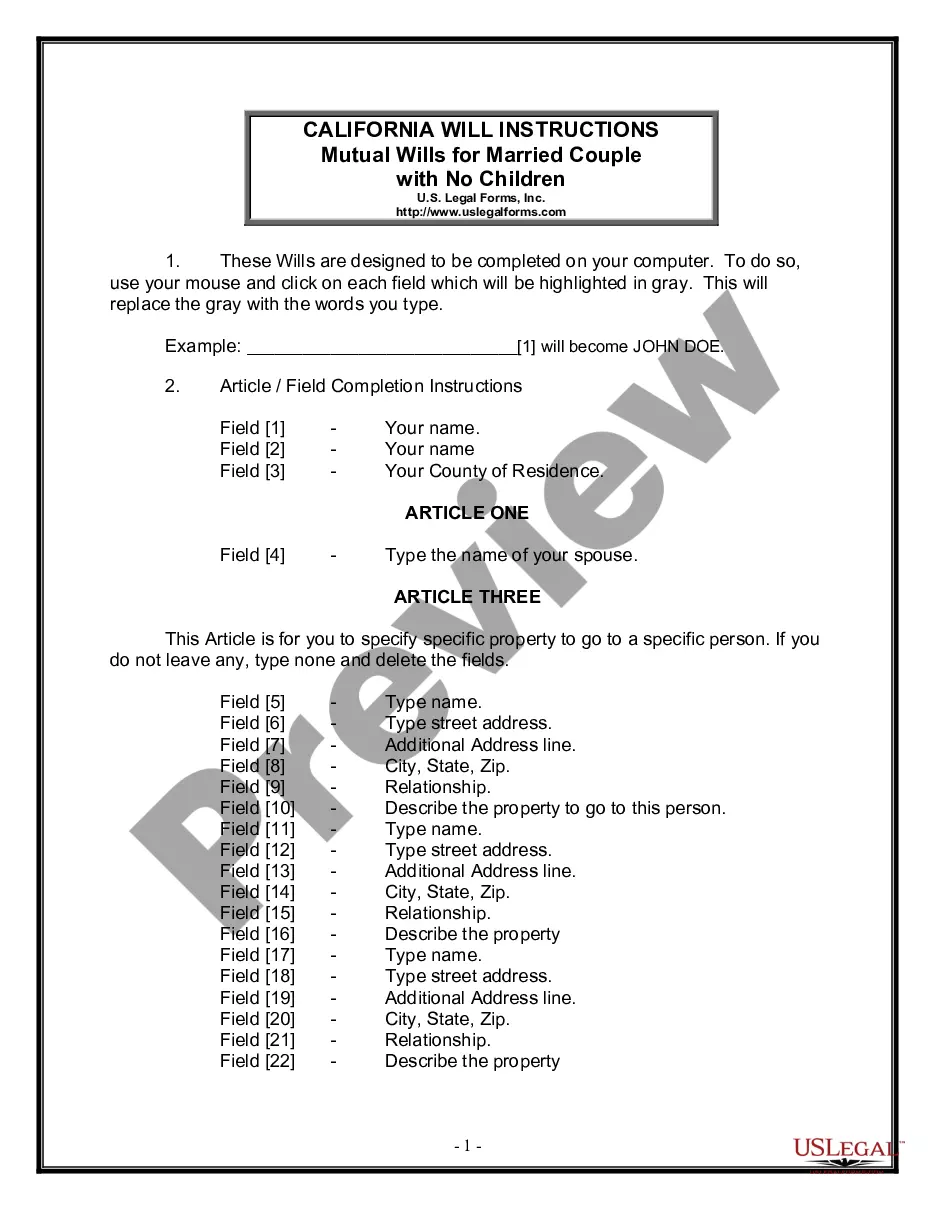

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!