Chicago Illinois Receipt and Withdrawal from Partnership: A Comprehensive Guide In Chicago, Illinois, the process of receipt and withdrawal from a partnership involves various legal procedures and documentation. This detailed description will outline the key aspects of this process, including relevant keywords. Receipt from Partnership: 1. Admission of New Partner: When a new partner is introduced into an existing partnership in Chicago, Illinois, a receipt occurs. This step involves adding a new individual or entity as a partner, which requires a formal agreement and documentation. 2. Capital Contribution: The new partner must contribute capital to the partnership, either in the form of cash, assets, or services, as specified in the partnership agreement. 3. Amended Partnership Agreement: With the admission of a new partner, the existing partnership agreement needs to be revised and amended to reflect the changes in ownership, profit sharing, and decision-making. Withdrawal from Partnership: 1. Voluntary Withdrawal: A partner has the option to voluntarily withdraw from a Chicago-based partnership. This can occur due to retirement, career change, disagreement, or any other reason agreed upon by the partners. 2. Notice of Intent: The withdrawing partner needs to provide a written notice to the other partners, indicating their intention to withdraw from the partnership. The notice should outline the proposed effective date of the withdrawal. 3. Partnership Dissolution: In some cases, a partner's withdrawal may lead to the dissolution of the partnership, especially if the partnership agreement specifies that the withdrawal of a partner shall dissolve the entire entity. This could result in the liquidation of assets and the distribution of profits among remaining partners. Different Types of Receipt and Withdrawal from Partnership in Chicago, Illinois: 1. Limited Partnership (LP): In an LP, one or more general partners manage the business while limited partners contribute capital but have limited liability. Receipt and withdrawal will adhere to the terms set forth in the partnership agreement. 2. Limited Liability Partnership (LLP): In an LLP, all partners have limited liability, and their withdrawal typically requires the agreement of the other partners or as outlined in the partnership agreement. 3. General Partnership (GP): A GP is an association where all partners have unlimited liability for the firm’s debts. Receipt and withdrawal processes in a GP generally follow the guidelines prescribed in the partnership agreement or state laws. Keywords: Chicago, Illinois, partnership, receipt, withdrawal, admission of new partner, capital contribution, amended partnership agreement, voluntary withdrawal, notice of intent, partnership dissolution, limited partnership, limited liability partnership, general partnership. Please note that the information provided above is a general overview, and engaging a legal professional is essential to navigate the specific requirements and procedures related to receipt and withdrawal from a partnership in Chicago, Illinois.

Chicago Illinois Receipt and Withdrawal from Partnership

Description

How to fill out Chicago Illinois Receipt And Withdrawal From Partnership?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Chicago Receipt and Withdrawal from Partnership meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Chicago Receipt and Withdrawal from Partnership, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Chicago Receipt and Withdrawal from Partnership:

- Check the content of the page you’re on.

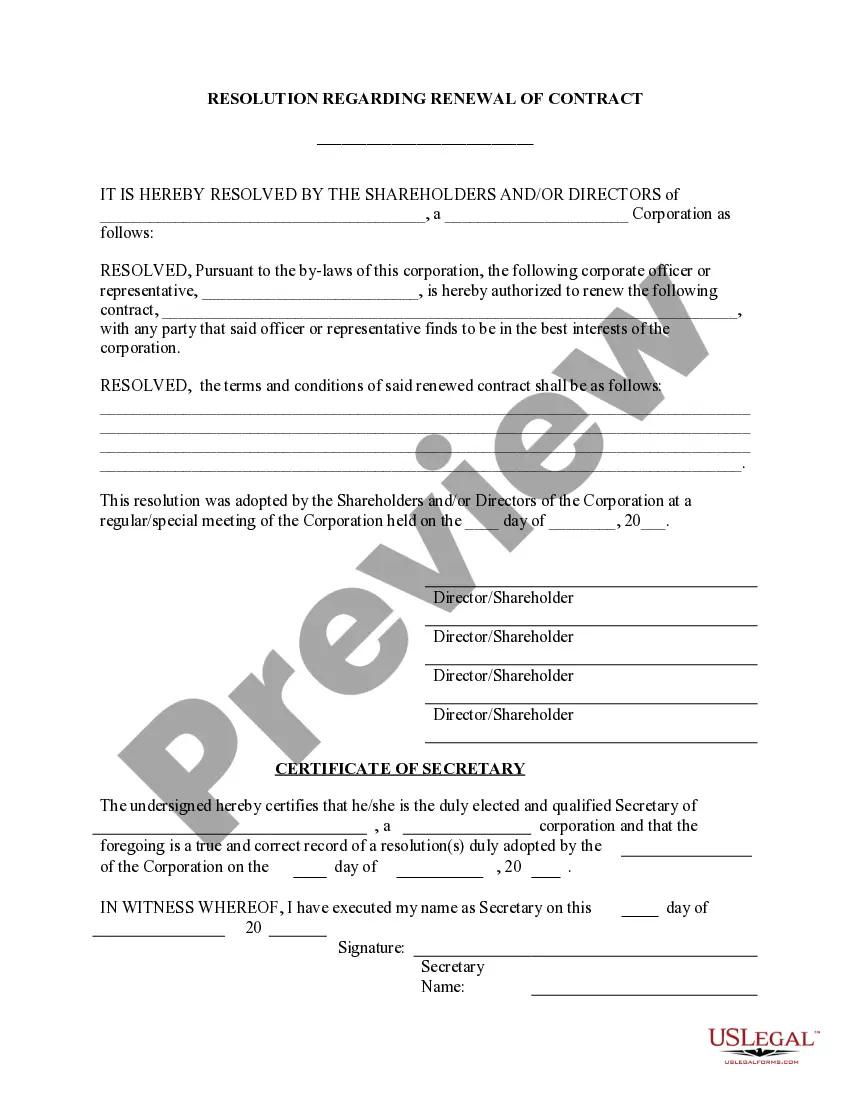

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Receipt and Withdrawal from Partnership.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!