Houston Texas Receipt and Withdrawal from Partnership When it comes to business partnerships, it is essential to understand the process of receipt and withdrawal in Houston, Texas. A receipt refers to the acceptance of a new partner into an existing partnership, while withdrawal refers to a partner's decision to leave the partnership. This detailed description will outline the procedure, legal requirements, and possible types of receipt and withdrawal in Houston, Texas. Receipt of a new partner involves several critical steps. First and foremost, the existing partners must evaluate the potential partner's qualifications, skills, and financial capabilities through a thorough screening process. Once a suitable candidate is identified, an agreement or document is drafted, outlining the terms and conditions of the partnership. This agreement should clearly state the roles, responsibilities, profit-sharing arrangements, and any limitations or restrictions on the new partner's involvement. To complete the receipt process, the partnership agreement must be signed by all existing partners, as well as the newly admitted partner. Additionally, it is advisable to consult with a business attorney to ensure the legality and validity of the agreement. By following these steps, the partnership recognizes the new partner's inclusion and enables them to participate fully in the business's decisions, profits, and liabilities. On the other hand, withdrawal from a partnership is a significant decision that requires careful consideration. Partners may choose to leave a partnership for various reasons, including retirement, personal commitments, or disagreements with other partners. To withdraw from a partnership in Houston, Texas, partners must follow specific guidelines and legal requirements. A partner intending to withdraw must notify all other partners in writing, expressing their intention to leave the partnership, as well as the effective date of withdrawal. The partnership agreement should also be consulted to determine any specific withdrawal protocols or obligations, such as a notice period or buyout provisions. Failure to adhere to the agreement's terms may result in legal disputes or financial penalties. There are different types of Houston Texas Receipt and Withdrawal from Partnership, namely: 1. General Partnership: This is the most common type of partnership where all partners share equal responsibility for the business's management, profits, and liabilities. Receipt or withdrawal in a general partnership follows the standard procedure described above. 2. Limited Partnership: In a limited partnership, there are two types of partners: general partners and limited partners. General partners have an active role in managing the business and bear unlimited personal liability. Limited partners, however, contribute capital but have limited involvement in management and enjoy limited liability. Receipt and withdrawal in a limited partnership require compliance with relevant state laws and the partnership agreement. 3. Limited Liability Partnership (LLP): An LLP offers partners limited liability protection, similar to a corporation. This type of partnership is often preferred by professionals such as lawyers, accountants, or architects. The receipt and withdrawal process in an LLP must adhere to Texas state laws and any stipulations in the partnership agreement. In conclusion, Houston, Texas Receipt and Withdrawal from Partnership involves careful consideration, legal documentation, and adherence to partnership agreements. Whether it is admitting a new partner or deciding to withdraw, following the proper procedures is crucial to maintaining a smooth transition and avoiding potential conflicts or legal issues.

Houston Texas Receipt and Withdrawal from Partnership

Description

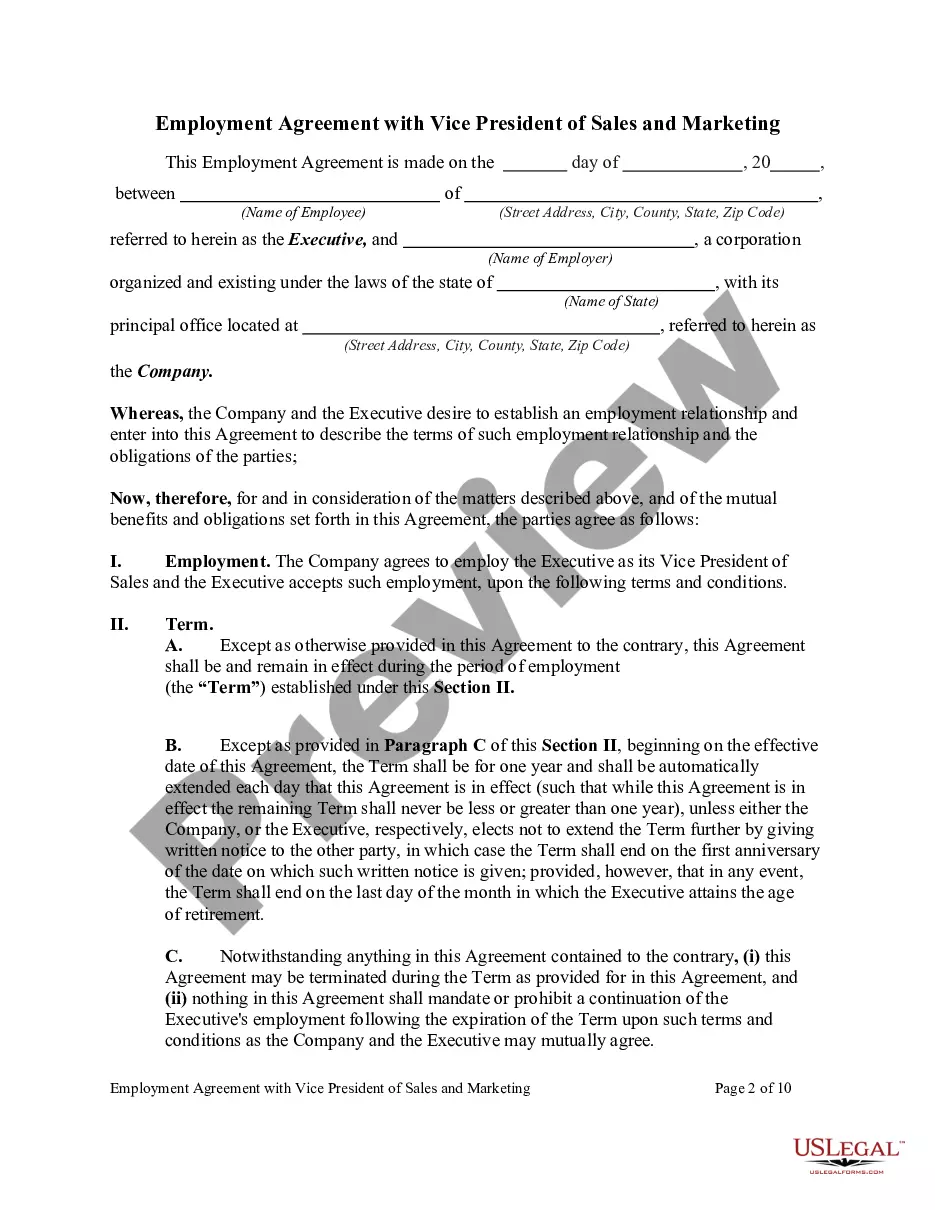

How to fill out Houston Texas Receipt And Withdrawal From Partnership?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Houston Receipt and Withdrawal from Partnership, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Houston Receipt and Withdrawal from Partnership from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Houston Receipt and Withdrawal from Partnership:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!