Maricopa Arizona Price Setting Worksheet: A Comprehensive Analysis for Smart Financial Planning The Maricopa Arizona Price Setting Worksheet is a crucial tool designed to assist individuals, businesses, and organizations in effectively managing their finances and making informed decisions about pricing strategies. This comprehensive worksheet offers a detailed breakdown of costs, expenses, and potential revenue streams, enabling users to set competitive prices while maximizing profitability. Key Features of Maricopa Arizona Price Setting Worksheet: 1. Cost Analysis: This worksheet guides users through a meticulous examination of expenses associated with various products or services. It categorizes costs, such as raw materials, labor, overheads, and marketing, providing a clear understanding of the overall cost structure to determine a viable pricing strategy. 2. Profit Margin Calculation: The worksheet helps calculate profit margins by considering factors like production costs, desired profit levels, market trends, and competitors' pricing strategies. It facilitates the identification of optimal selling prices while ensuring realistic profit goals. 3. Market Research and Competitor Analysis: Maricopa Arizona Price Setting Worksheet offers guidance on conducting detailed market research to understand the demand and competition. By analyzing competitors' pricing strategies, users gain insights into industry benchmarks and market trends, aiding in setting accurate and competitive pricing. 4. Pricing Strategies: This worksheet furnishes various pricing strategies such as cost-plus pricing, value-based pricing, penetration pricing, and skimming pricing. Users can explore and evaluate different options based on their business objectives, target audience, and market dynamics. 5. Multiple Product/Service Scenarios: The Maricopa Arizona Price Setting Worksheet accommodates businesses with diverse product or service offerings. It allows users to create separate pricing scenarios for different products or services, ensuring a customized approach to price setting. 6. Sensitivity Analysis: By incorporating sensitivity analysis, this worksheet enables users to assess the impact of changing factors like costs, sales volume, or external influences on pricing decisions. It helps users determine the flexibility of the pricing model in response to varying market conditions. Types of Maricopa Arizona Price Setting Worksheets: 1. Product-based Price Setting Worksheet: Specifically designed for businesses dealing with multiple products or product lines, this worksheet emphasizes a product-specific pricing approach. It aids in evaluating costs, profitability, and pricing strategies for individual products, ensuring efficient price setting across the product portfolio. 2. Service-based Price Setting Worksheet: Tailored for service-based businesses, this worksheet focuses on estimating labor, overheads, and other costs involved in delivering services. It comes equipped with specialized formulas and calculations to help service providers set optimal service prices while maintaining profitability. 3. Industry-specific Price Setting Worksheet: This worksheet is designed to meet the requirements of specific industries, such as retail, manufacturing, hospitality, or healthcare. It considers industry-specific cost factors, pricing trends, and competitive landscapes, providing users with a targeted approach to price setting. The Maricopa Arizona Price Setting Worksheet acts as a reliable financial companion, offering a comprehensive framework for effective price setting strategies. By leveraging this tool's features and customizable options, individuals and businesses can make well-informed pricing decisions, resulting in enhanced profitability, competitiveness, and long-term financial success.

Maricopa Arizona Price Setting Worksheet

Description

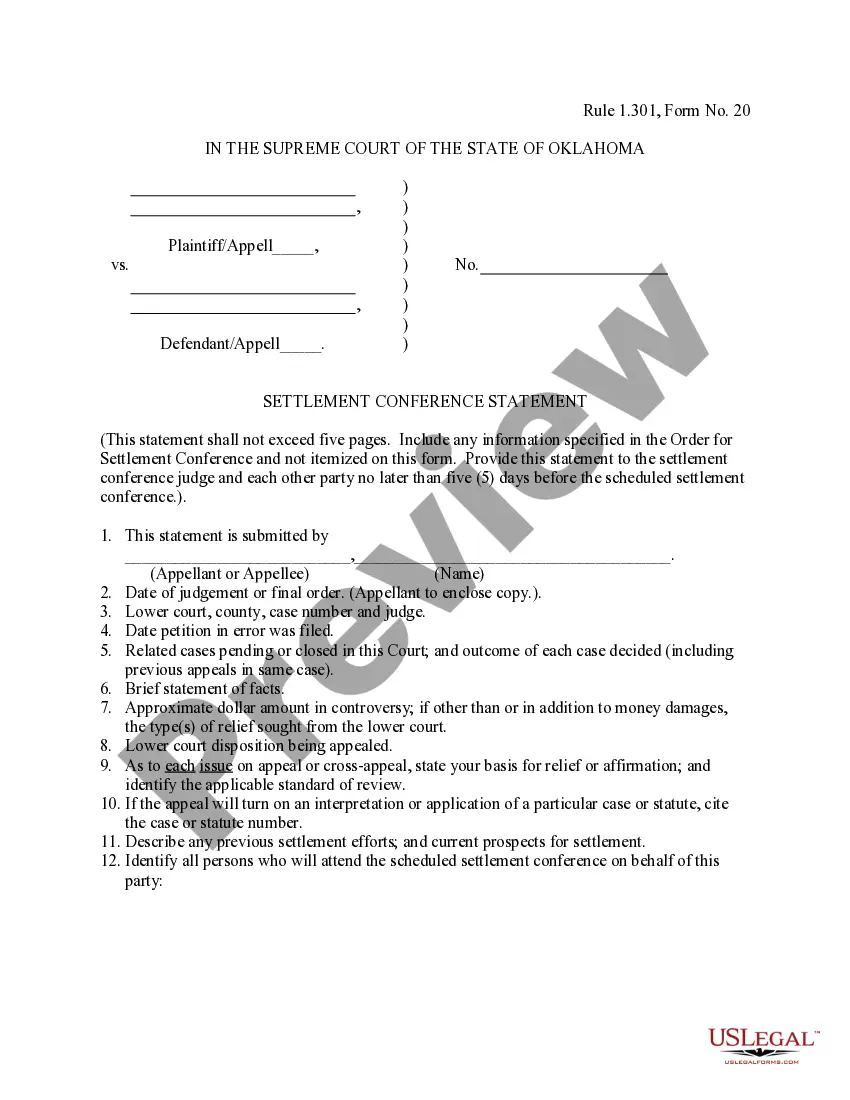

How to fill out Maricopa Arizona Price Setting Worksheet?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Maricopa Price Setting Worksheet is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Maricopa Price Setting Worksheet. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Price Setting Worksheet in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

A: Remember that the RPT rate in Metro Manila is 2% and for provinces, it is 1%. To get the real property tax computation, use this formula: RPT = RPT rate x assessed value. To compute how much in total real property tax (RPT) needs to paid, we multiply the RPT rate by the assessed value.

How are my Property Taxes computed? The Assessed Value divided by 100, times the tax rate (set in August of each year) determines property tax billed in September. The County Treasurer bills, collects and distributes the property taxes.

You can file documents with the Clerk of the Superior Court online, by mail or at one of our filing counter locations. Please note: Clerks are committed to assisting you in Superior Court. To ensure fairness, clerks do not give legal advice.

More than half of the state's population resides in Maricopa County, which includes the cities of Phoenix, Mesa, Glendale, Scottsdale, Tempe, Chandler, Peoria and the town of Gilbert.

Arizona counties calculate a full cash value of every house in the county, often based on the sales prices of nearby, comparable homes. Taxes are not based on the full cash value, however, but something called the Limited Property Value (LPV), which is based on cash value.

Requesting Copies (Copy Request Form) 50 per page for copy requests. The number of pages of a document may be ascertained by calling the Clerk's Office at (602) 452-6700 or by emailing the court at inform@appeals.az.gov. A certification fee of $17.00 is required if the request is for a Certified Copy of the document.

The Maricopa County property tax rate is 0.610% of the assessed home value.

In Maricopa County the assessment ratio for owner-occupied residential property is 10 percent of Full Cash (market) Value. So if your home is valued at $200,000, you will be charged property tax based on the assessed value of $20,000.

Paying Property Taxes It's important to remember that the Assessor determines the value of your property, but the treasurer is the one sending you the tax bill. Contact the treasurer's office if you have any questions once the assessed value is determined.

Many people have some confusion on how are property taxes are calculated. Arizona property taxes on owner-occupied residences are levied based on the Assessed Value, not current market value. In Maricopa County the assessment ratio for owner-occupied residential property is 10 percent of Full Cash (market) Value.