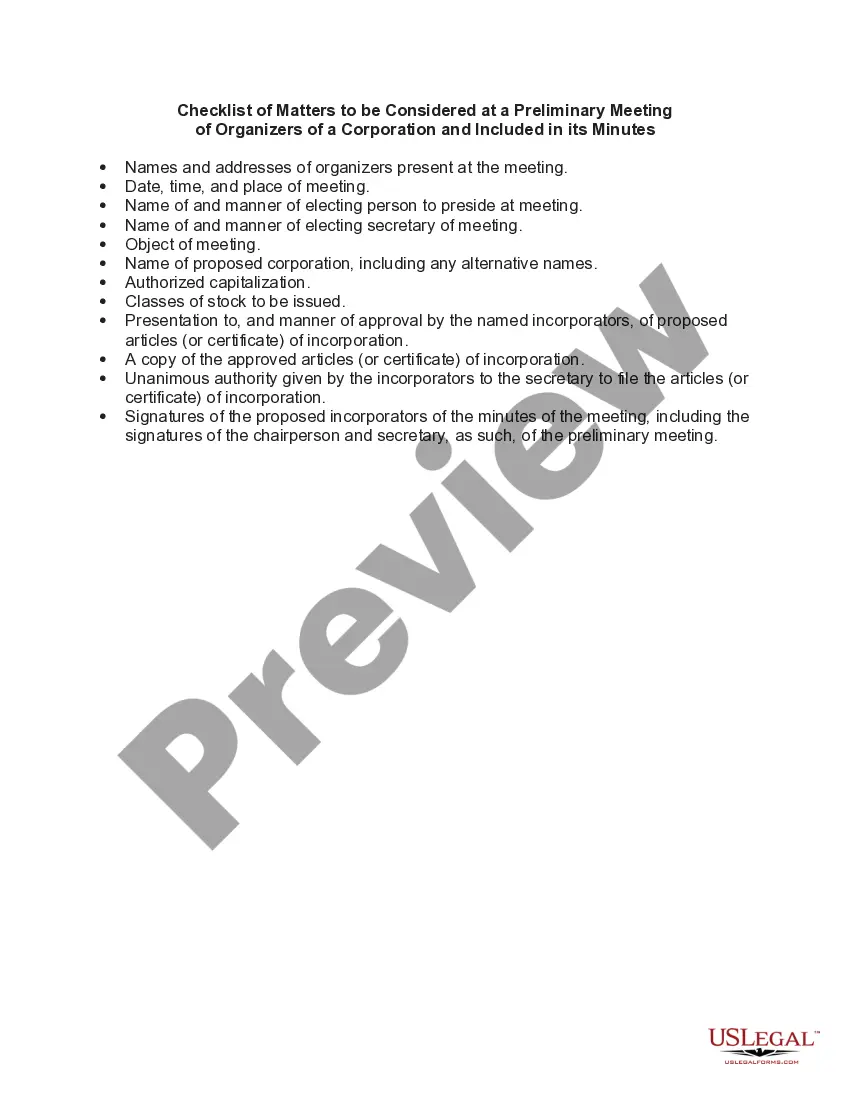

San Jose, California is the third-largest city in California and the economic, cultural, and political hub of Silicon Valley. It is known for its thriving tech industry, diverse population, and beautiful surroundings. This checklist provides a detailed description of matters to be considered at a preliminary meeting of organizers of a corporation in San Jose, California, and highlights keywords for easy reference. 1. Corporation Formation: Determine the type of corporation to be formed, such as a C corporation, S corporation, or limited liability company (LLC). Consider the benefits and drawbacks of each type in the context of San Jose's business environment. 2. Legal Compliance: Discuss compliance requirements for starting a corporation in San Jose, including obtaining necessary licenses, permits, and certifications, and understanding local, state, and federal regulations. 3. Articles of Incorporation: Review the process of drafting and filing articles of incorporation with the California Secretary of State. Consider specialized language, authorized shares, and the corporation's purpose and name. 4. Shareholders and Directors: Identify initial shareholders and board of directors. Discuss their roles, responsibilities, and potential liabilities. Consider board composition and diversity to ensure compliance with corporate governance guidelines. 5. Bylaws and Operating Agreements: Discuss the development of corporate bylaws or operating agreements for LCS. Address important matters like shareholder rights, director meetings, voting procedures, and profit distribution. 6. Stock Issuance: Review the rules and regulations surrounding the issuance of stock and determine if additional filings or qualifications are necessary. Decide the initial allocation of shares among founders and investors. 7. Business Operations: Discuss the company's operations, including identifying physical location, lease agreements, necessary equipment, and staffing requirements. Consider the availability of skilled workers in San Jose and potential sources of funding. 8. Intellectual Property: Evaluate the need to protect intellectual property, such as patents, trademarks, and copyrights. Understand San Jose's industries and potential infringement risks. 9. Tax Obligations: Review federal, state, and local tax obligations, including income tax, sales tax, payroll tax, and compliance with tax filing requirements. Identify potential tax incentives or benefits available in San Jose. 10. Financial Planning: Develop a financial plan that includes budgeting, forecasting, and securing necessary financing. Consider local banking options, investor networks, and available resources for startups in San Jose. 11. Marketing and Branding Strategy: Discuss marketing and branding strategies to promote the corporation's products or services. Consider San Jose's competitive landscape and target audience. 12. Corporate Governance: Establish a framework for corporate governance, outlining decision-making processes, roles of officers, and holding regular meetings. Consider any special requirements or expectations for corporations formed in San Jose. Different types of San Jose California Checklist of Matters: 1. Checklist for Tech Startups: Focuses on unique considerations for tech-based corporations in San Jose, such as intellectual property protection, product development, and collaboration opportunities with established tech companies. 2. Checklist for Socially Responsible Corporations: Emphasizes factors like sustainability, corporate social responsibility, and community engagement, aligning with San Jose's commitment to environmental initiatives and social progress. 3. Checklist for Import/Export Corporations: Addresses considerations related to global trade, customs regulations, international shipping, and distribution networks, catering to companies involved in import/export activities in San Jose. 4. Checklist for Food and Beverage Corporations: Highlights regulatory compliance specific to the food and beverage industry, permits for food establishments, health codes, and considerations for sourcing local ingredients in San Jose. 5. Checklist for Non-profit Corporations: Focuses on the unique requirements related to forming a non-profit organization in San Jose, including tax-exempt status, board composition, and compliance with IRS regulations. These different types of checklists cater to the specific needs and nuances of corporations in various industries, allowing organizers to consider relevant matters specific to their business ventures in San Jose, California.

San Jose California Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes

Description

How to fill out San Jose California Checklist Of Matters To Be Considered At A Preliminary Meeting Of Organizers Of A Corporation And Included In Its Minutes?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a San Jose Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the San Jose Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your San Jose Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the San Jose Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!