Franklin Ohio Startup Costs Worksheet is a comprehensive tool that helps entrepreneurs in Franklin, Ohio estimate and plan the expenses required to start a new business. This worksheet includes various categories and line items that cover all aspects of starting a business, enabling individuals to have a clear understanding of the initial investment needed. The Franklin Ohio Startup Costs Worksheet is designed to provide entrepreneurs with a detailed breakdown of the expenses they can expect when launching their business. This includes one-time costs such as permits and licenses, equipment and technology purchases, renovations or leasehold improvements, legal and professional fees, initial inventory or supplies, marketing and advertising expenses, and any other necessary start-up expenses. In addition to one-time costs, the worksheet also considers recurring expenses that entrepreneurs need to budget for in order to keep the business running smoothly. These recurring costs may include rent or mortgage payments, utilities, insurance premiums, payroll and employee benefits, ongoing marketing campaigns, software subscriptions, and other operational expenses. The Franklin Ohio Startup Costs Worksheet aims to help entrepreneurs be financially prepared and make informed decisions about starting their business. It allows them to evaluate the feasibility of their venture, determine the amount of financing required, and develop a comprehensive business plan. Different types of Franklin Ohio Startup Costs Worksheets may include specific industry segments or targeted businesses. Some common examples include: 1. Retail Startup Costs Worksheet: This version of the worksheet focuses on costs specific to opening a retail store such as store fixtures, point-of-sale systems, and initial inventory. 2. Restaurant Startup Costs Worksheet: Designed for those planning to open a restaurant, this worksheet covers specialized costs such as kitchen equipment, furniture, initial food and beverage inventory, and permits related to food service. 3. Service-based Startup Costs Worksheet: This variation caters to entrepreneurs starting service-oriented businesses. It includes costs related to equipment or tools specific to the service, initial marketing and advertising campaigns, and any necessary certifications or licenses. 4. Online Business Startup Costs Worksheet: Tailored for entrepreneurs venturing into e-commerce or online businesses, this worksheet focuses on website development, digital marketing expenses, software subscriptions, and other virtual operational costs. The Franklin Ohio Startup Costs Worksheet, regardless of its type, serves as an essential tool for entrepreneurs to estimate and plan their initial investment and ongoing expenses accurately. This allows them to make strategic decisions and secure the necessary funding to successfully launch their businesses in Franklin, Ohio.

Franklin Ohio Startup Costs Worksheet

Description

How to fill out Franklin Ohio Startup Costs Worksheet?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Franklin Startup Costs Worksheet is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to obtain the Franklin Startup Costs Worksheet. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

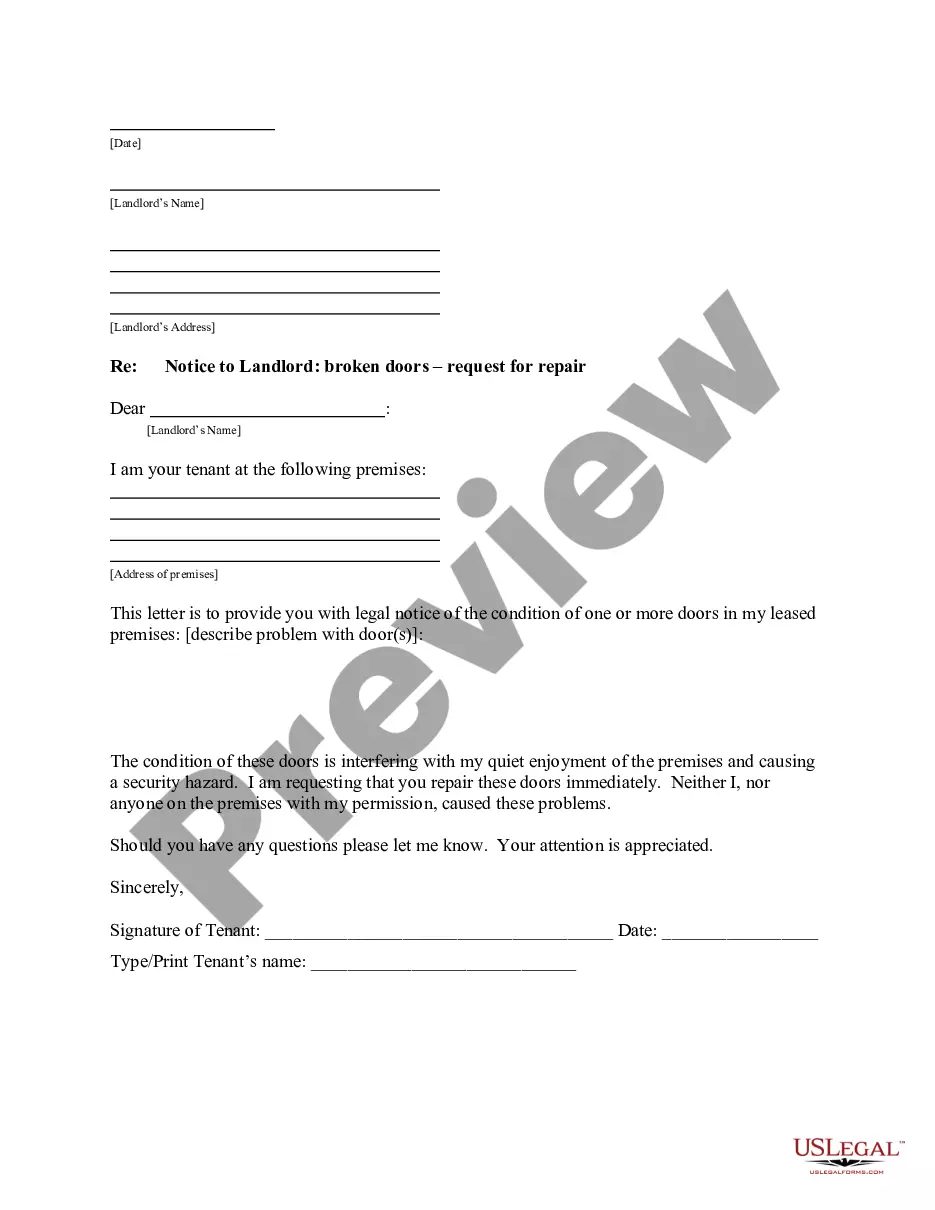

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Startup Costs Worksheet in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!