Middlesex Massachusetts Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a document that grants individuals exemptions from reporting the sale or exchange of their principal residence for tax purposes. This certification is applicable for individuals residing in Middlesex County, Massachusetts. The Middlesex County Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is aimed at relieving homeowners from the burden of reporting their sale or exchange of principal residence to the tax authorities. This exemption recognizes the importance of homeownership and aims to simplify the tax filing process for Middlesex County residents. There are different types of Middlesex Massachusetts Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption based on the specific circumstances of the homeowner. These types include: 1. Regular Exemption: This exemption is applicable for homeowners who have sold or exchanged their principal residence and meet the eligibility criteria set by the Middlesex County tax authorities. By obtaining this certification, homeowners can avoid reporting the sale or exchange of their property for tax purposes. 2. Low-Income Exemption: This type of certification is designed for homeowners with low incomes who have sold or exchanged their principal residence. It provides additional tax relief for individuals who meet the specified income limits, ensuring that they are not burdened by reporting requirements. 3. Senior Citizen Exemption: This certification is specifically tailored for senior citizens who have sold or exchanged their principal residence. It recognizes the unique circumstances of elderly homeowners and aims to simplify the tax filing process for this demographic. 4. Disability Exemption: Individuals with disabilities who have sold or exchanged their principal residence may qualify for this type of certification. It offers additional tax relief and exempts them from reporting the sale or exchange of their property. The Middlesex Massachusetts Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a valuable tool for homeowners in Middlesex County, Massachusetts, seeking to simplify their tax obligations. By obtaining the appropriate certification, individuals can breathe a sigh of relief knowing that they are not required to report the sale or exchange of their principal residence, depending on their eligibility for the different types of exemptions mentioned above. This helps promote homeownership and provides necessary tax relief to eligible individuals in Middlesex County.

Middlesex Massachusetts Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Middlesex Massachusetts Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Middlesex Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Middlesex Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from the My Forms tab.

For new users, it's necessary to make some more steps to get the Middlesex Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption:

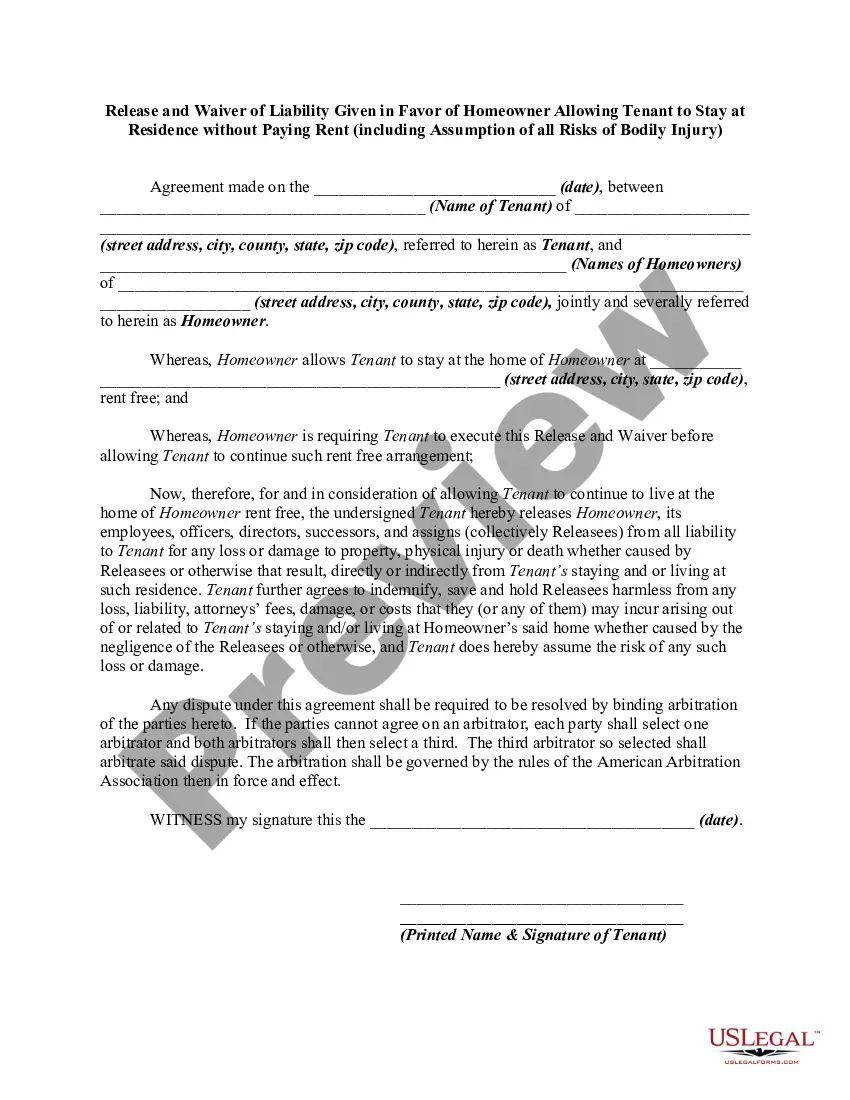

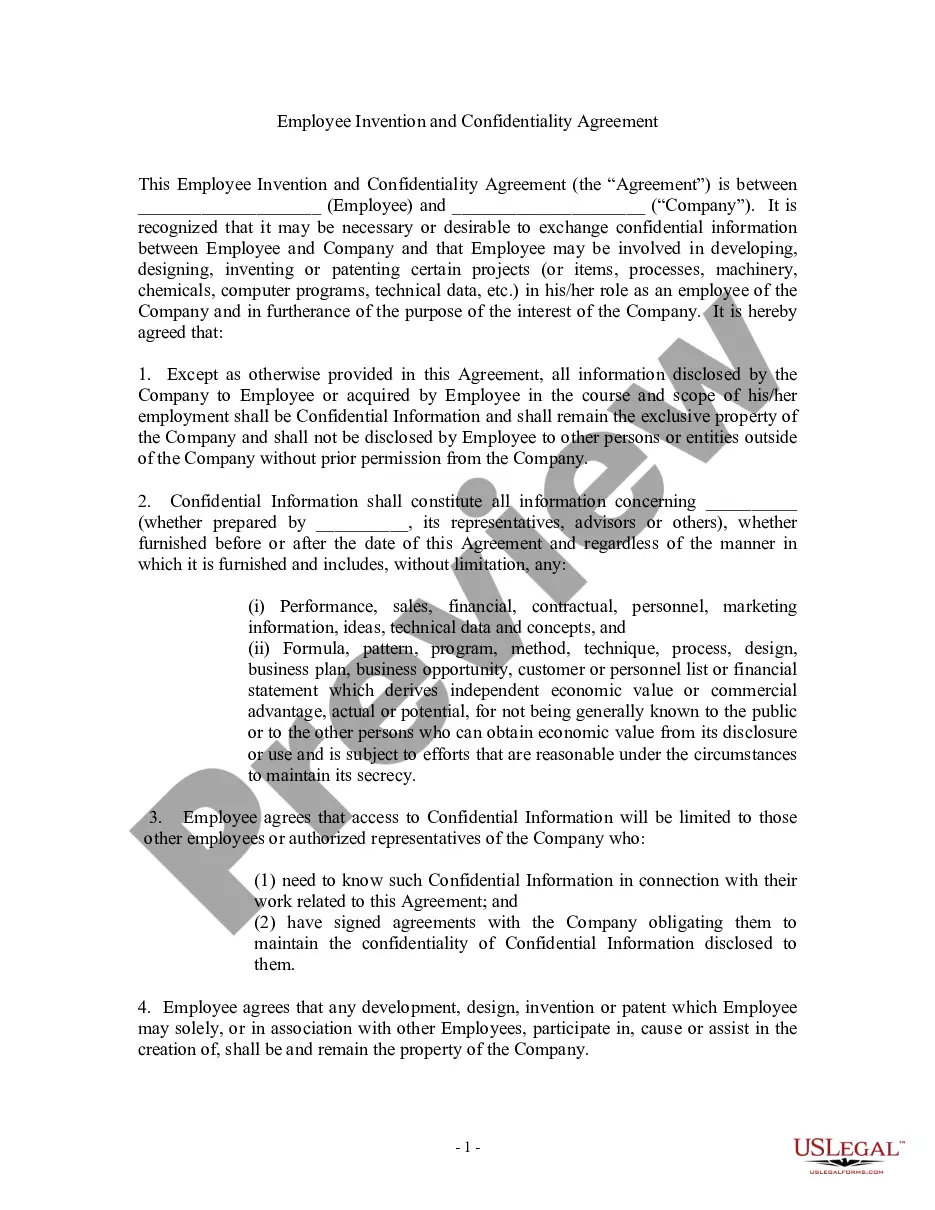

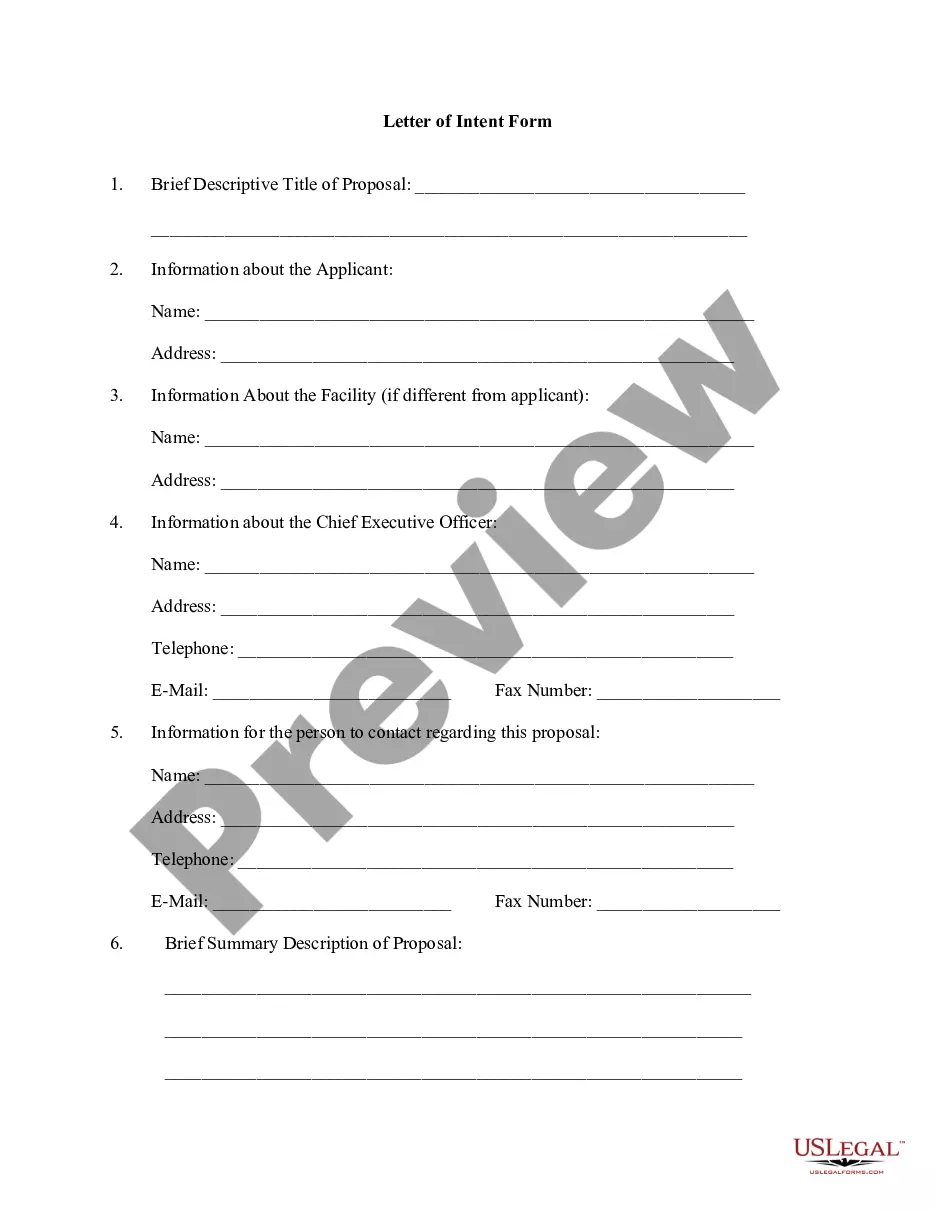

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!