The San Diego California Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a crucial document for homeowners in San Diego who wish to claim an exemption on the sale or exchange of their principal residence. This certification is required to ensure that the transaction meets the criteria for exemption from information reporting as per California state law. The certification serves as proof that the sale or exchange of a property meets the necessary requirements to be excluded from information reporting, thereby relieving homeowners from the burden of reporting the transaction to the tax authorities. By obtaining this certification, individuals can avoid the potential scrutiny that may come with reporting their home sale or exchange. There are several types of San Diego California Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, each catering to specific circumstances: 1. Regular Certification: This is the standard certification used by most homeowners who have sold or exchanged their primary residence in San Diego, California. It enables them to claim the tax exemption without reporting the transaction to the tax authorities. 2. Seniors Certification: Specifically designed for senior citizens aged 55 and above, this certification grants them a unique exemption and relieves them from reporting the sale or exchange of their principal residence. It recognizes the unique circumstances that seniors may face when downsizing or transitioning to a new living arrangement. 3. Disabled Certification: Individuals with disabilities may qualify for this certification, which provides them with the necessary documentation to claim their tax exemption while bypassing the reporting requirement. It acknowledges the additional challenges that disabled homeowners may face and offers them a streamlined process. To obtain the San Diego California Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners must submit the appropriate application along with supporting documentation. This may include proof of residency, identification, and any other documents required to verify the eligibility for the exemption. By utilizing the San Diego California Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners can benefit from a simplified process and avoid potential tax consequences associated with reporting the sale or exchange of their primary residence. This certification serves as an essential tool in ensuring compliance with tax laws while providing homeowners with the necessary relief from burdensome reporting requirements.

San Diego California Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out San Diego California Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

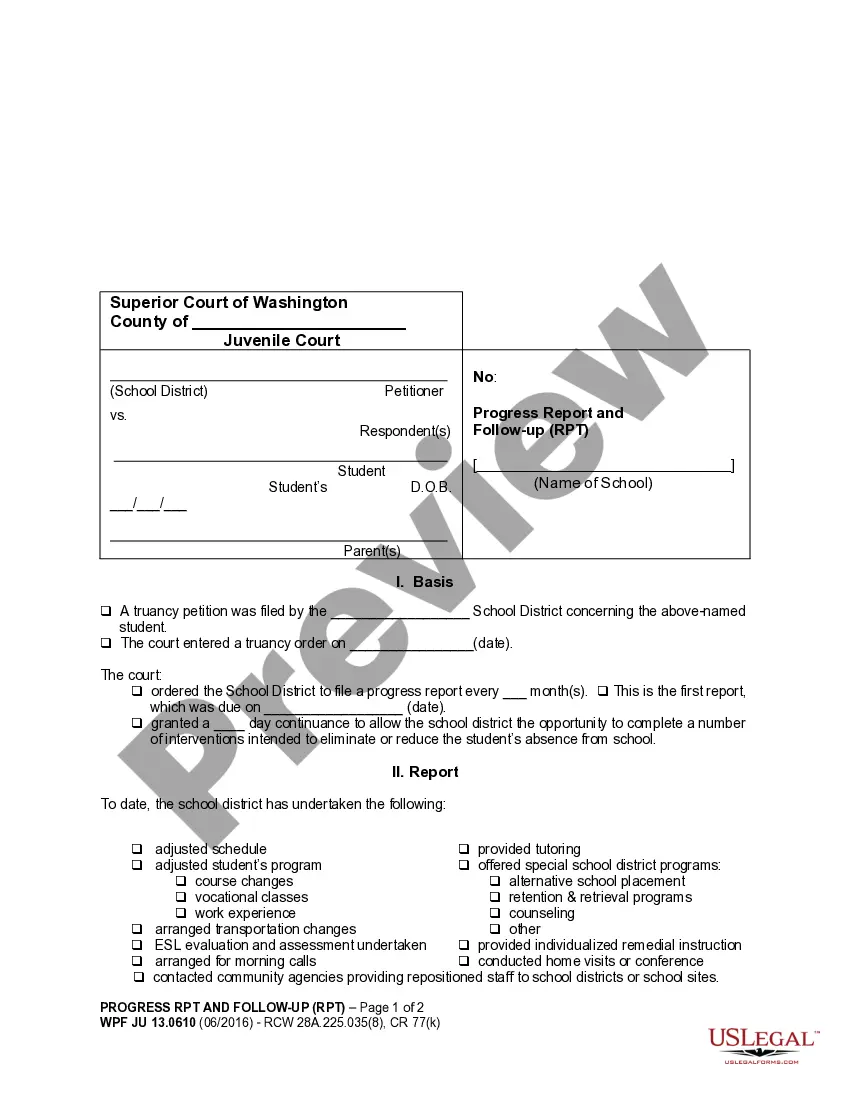

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a San Diego Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the San Diego Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your San Diego Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Diego Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place of residence of the owner on the lien date, January 1st.

Exemptions from Local Property Tax Properties certified as having a significant level of pyrite damage. Properties built using defective concrete blocks. Residential properties owned by a charity or a public body. Registered nursing homes. Commercial properties. Properties vacated by their owners due to illness.

What is the Homeowners' Property Tax Exemption? The Homeowners' Exemption provides for a reduction of $7,000 off the assessed value of your residence. This results in an annual property tax savings of approximately $70.

Nonetheless, owners of real property that qualify under Proposition 60 or 90 can still take advantage of those features until April 1, 2021. (If an owner never took advantage of these and were qualified, they might be able to get a refund of taxes already paid.

A claim must be filed with the Assessor of the county in which the replacement property is located. A claim for relief must be filed within 3 years of the date a replacement primary residence is purchased or new construction of that replacement primary residence is completed.

As of January 1, 2021, the California homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the prior year. However, it can be as high as $600,000 if the median sale price in your county was more than that amount.

ACTION TO CONSIDER: To avoid property tax reassessment, do not transfer real property from individuals to a legal entity unless the individuals have the same proportionate interest in the legal entity as they did in the real property.

There are two types of Homestead Exemptions: Automatic: applies only upon forced sale of the property. The automatic exemption requires continuous residence from the date the judgment creditor's lien attaches until the date the court determines that the dwelling is a homestead.

In order to transfer a base year value under Proposition 19, both the original primary residence and the replacement primary residence must be located in California. Thus, a base year value cannot be transferred from an original primary residence located in Georgia.

While Prop 19's provisions for seniors goes into effect on April 1, 2021, the administrative rollout is still underway. You'll need to apply for the benefit by filing a claim with the county assessor.

More info

A comprehensive look at how California's DVR bill will do less than the State thought it would. Learn how to make a website by taking this beginners guide. This website is a part of the California Virtual University. Get a FREE copy of the California Green Guide! This resource for environmental professionals includes current topics for professionals and an overview of the most popular environmental legislation in California. Explore the Green Building Guide and get a free Green Building Toolkit today! You received this message because you have subscribed to the online version of the Berkeley News.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.