San Jose, California Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a document that homeowners can obtain to exempt them from reporting the sale or exchange of their principal residence to the Internal Revenue Service (IRS). This certification is specific to the city of San Jose, California, and is aimed at providing homeowners with a streamlined process for claiming certain tax exemptions. The San Jose Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is particularly useful for homeowners who have sold or exchanged their primary residence and meet certain eligibility criteria. By obtaining this certification, homeowners can avoid the hassle of reporting their transaction to the IRS, thereby saving time and effort. To qualify for this tax exemption, homeowners must meet certain requirements, including: 1. Ownership and Use: The property must have been the homeowner's primary residence for at least two of the last five years before the sale or exchange. 2. Individual or Married Filing Jointly: The homeowner must be an individual or married filing jointly. This certification is not available for corporations or partnerships. 3. Gain Exclusion: The homeowner must not have previously excluded gain from the sale or exchange of another residence within the past two years. By meeting these criteria and obtaining the San Jose Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners can benefit from the following: 1. Simplified Process: Homeowners are spared from the burden of reporting their sale or exchange to the IRS, saving them time and effort. 2. Tax Exemption: By qualifying for this certification, homeowners can potentially exclude up to $250,000 (or $500,000 for married couples filing jointly) of their gain from the sale or exchange of their principal residence. It is worth noting that the San Jose Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption may have different variations or types based on specific eligibility requirements or criteria. These variations could include: 1. Enhanced Exemption for Seniors: San Jose may offer an enhanced tax exemption for senior homeowners who meet certain age and residency requirements, allowing them to exclude a higher amount of gain from their tax liability. 2. Low-Income Homeowners Exemption: San Jose may provide an additional tax exemption for low-income homeowners, enabling them to exclude a portion of their gain from their tax liability based on their income level. 3. Special Circumstances Exemption: There may be specific circumstances or situations in which homeowners can qualify for a special exemption, such as cases where the homeowner is facing financial hardship or has experienced a natural disaster. In conclusion, the San Jose, California Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a valuable document for homeowners in San Jose who have sold or exchanged their primary residence. By meeting certain eligibility requirements and obtaining this certification, homeowners can simplify their tax reporting process and potentially qualify for tax exemptions. Variations of this certification may exist, such as enhanced exemptions for seniors, low-income homeowners, or special circumstances exemptions.

San Jose California Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out San Jose California Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

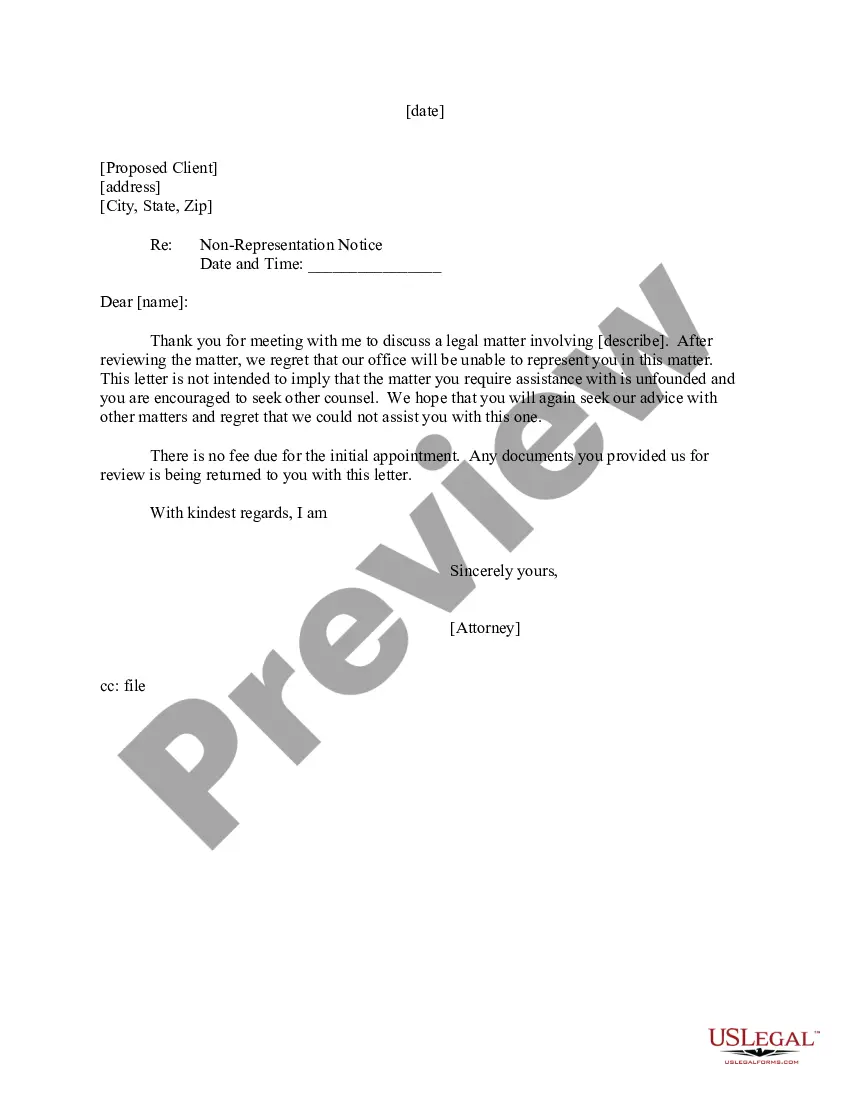

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the San Jose Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the recent version of the San Jose Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Jose Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your San Jose Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!