The Suffolk New York Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an important document that homeowners in Suffolk County, New York may need to obtain in certain situations. This certification serves as proof that the homeowner is eligible for an exemption from reporting the sale or exchange of their principal residence to the Internal Revenue Service (IRS). By obtaining this certification, homeowners can ensure that they comply with tax regulations while enjoying the benefits of tax exemptions. The purpose of the Suffolk New York Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is to provide homeowners with a simplified process when selling or exchanging their principal residence. It relieves them from the burdensome task of reporting the transaction to the IRS, thus saving time and effort in fulfilling these tax obligations. This certification also plays a crucial role in maintaining the privacy of homeowners, as it prevents the IRS from obtaining unnecessary information about the transaction. Different types of Suffolk New York Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption may include: 1. Standard Certification: This is the most common type of certification that homeowners can obtain for the sale or exchange of their principal residence. It applies to regular residential properties and provides the necessary exemption from information reporting to the IRS. 2. Senior Citizen Certification: Specifically designed for senior citizens, this certification offers additional benefits and exemptions to eligible individuals aged 65 and older. It eases the tax reporting process for senior citizens who are selling or exchanging their principal residence. 3. Low-Income Certification: Aimed at individuals or families with low-income levels, this certification enables them to assert their eligibility for tax exemptions and relief from IRS information reporting requirements. It serves as a vital tool in supporting low-income homeowners in Suffolk County. 4. Disability Certification: This type of certification caters to individuals with disabilities, ensuring that they are not burdened by excessive reporting requirements when selling or exchanging their principal residences. It offers vital support to disabled homeowners and facilitates a smooth process during property transactions. By obtaining the Suffolk New York Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners can streamline the process of selling or exchanging their principal residence while availing themselves of various tax benefits and exemptions. It is crucial for individuals in Suffolk County, New York, to understand the specific requirements and qualifications for each type of certification to ensure compliance with relevant tax regulations.

Suffolk New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

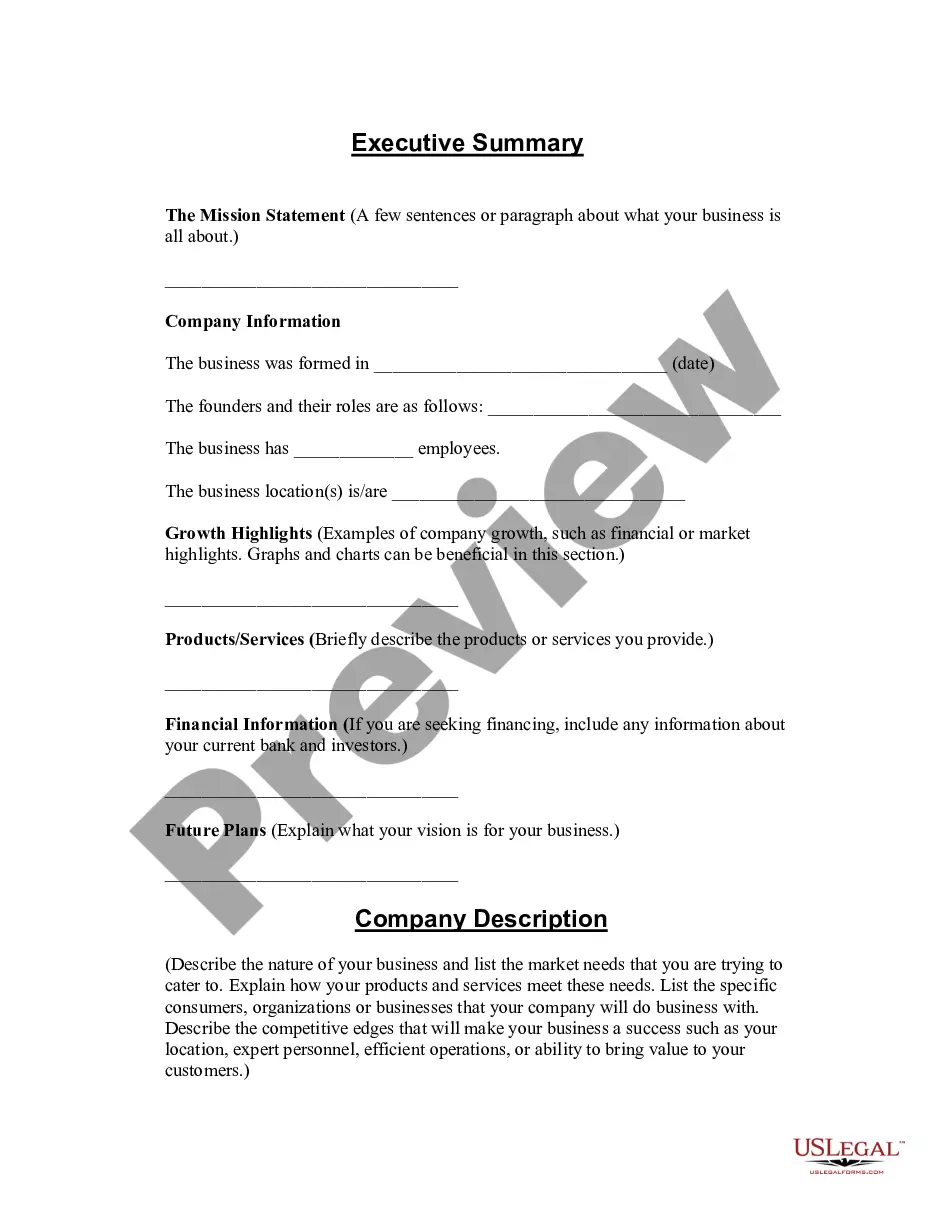

How to fill out Suffolk New York Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

If you need to find a trustworthy legal paperwork provider to get the Suffolk Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it simple to get and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Suffolk Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Suffolk Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less costly and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Suffolk Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption - all from the convenience of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

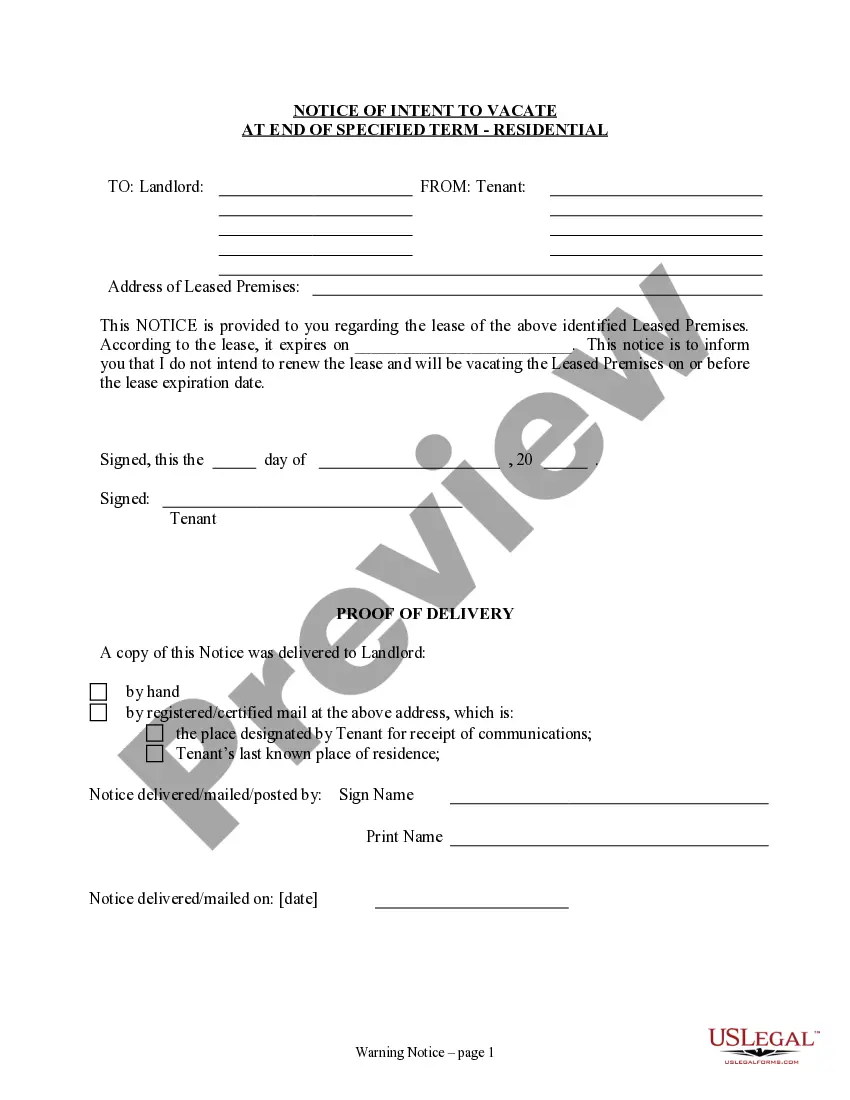

In order to fully protect the buyer's interest, the deed must be recorded at the office of the clerk of the county where the land is located. Recording the deed puts everyone on notice of the deed.

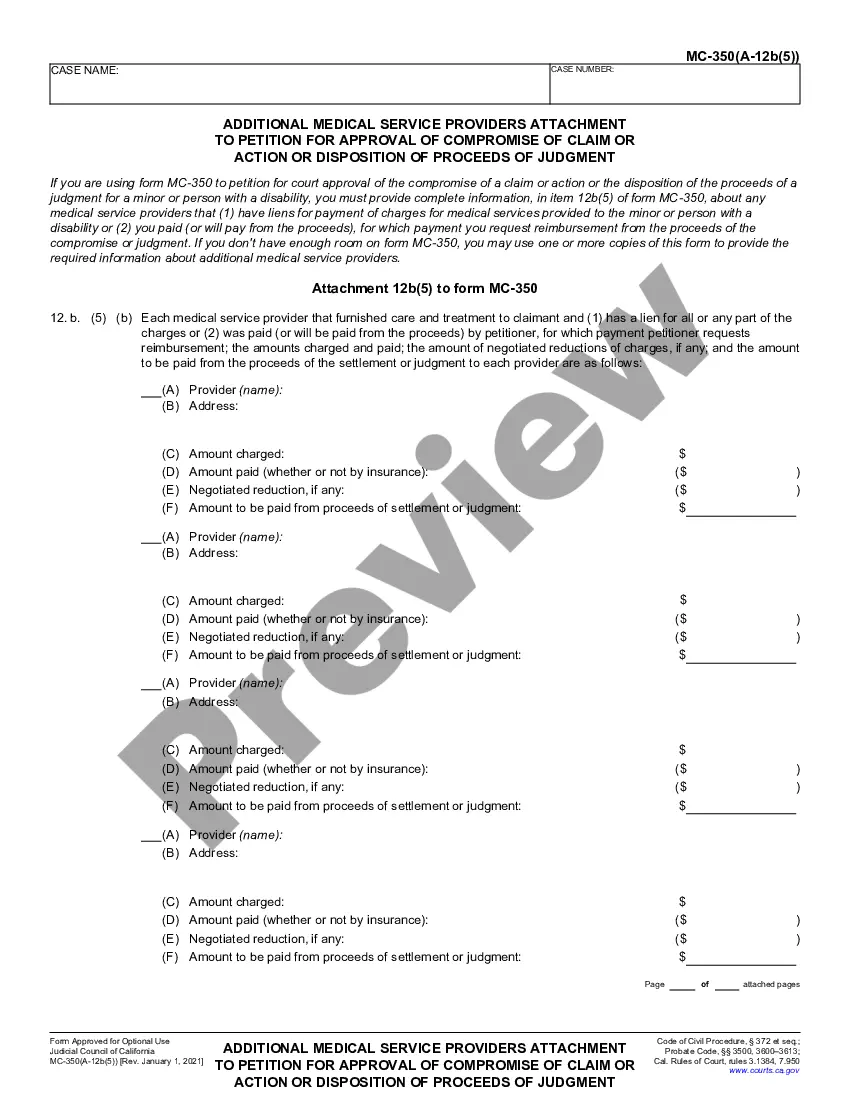

Must use Form IT-2663, Nonresident Real Property Estimated. Income Tax Payment Form, to compute the gain (or loss) and. pay the full amount of estimated tax due, if applicable. Use 2022. Form IT20112663 for sales or transfers of real property that occur after December 31, 2021, but before January 1, 2023.

If you receive an informational income-reporting document such as Form 1099-S, Proceeds From Real Estate Transactions, you must report the sale of the home even if the gain from the sale is excludable. Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income.

No 1099-S is required if the proceeds from the sale are less than $250,000 (or $500,000 if you are married), so you may not get one at all.

You can record property-related documents in person or online. To register a document, you must create a cover page in ACRIS, and submit document, supporting documents, and pay fees and taxes (if necessary). Learn more about recording documents, including required documentation and fees online.

Sign the deed in the presence of a notary public or other authorized official. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment.

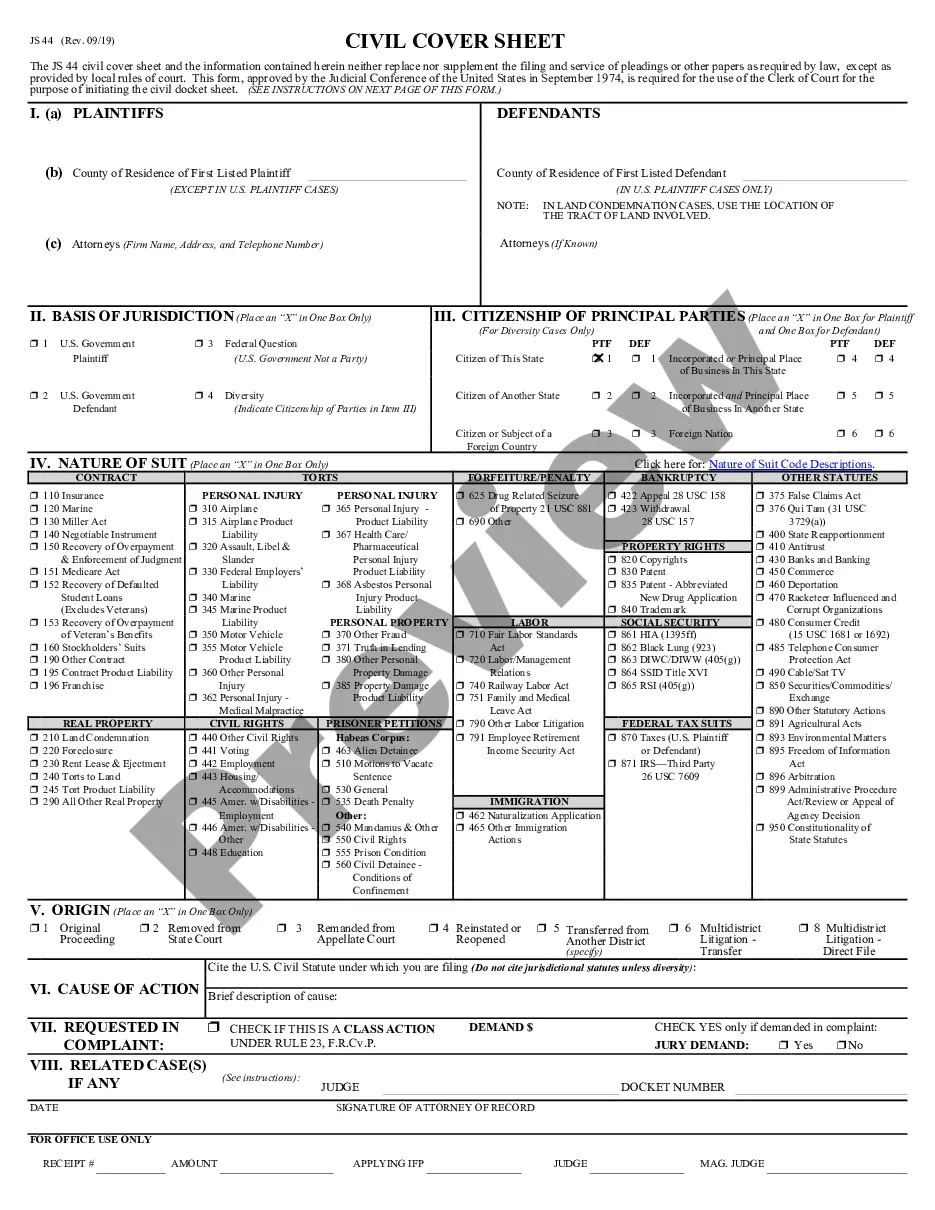

Recording Fees Document TypeFeeDeclaration of Trust$255Deed, Unit Deed, or Easement$155Mortgage$205Mortgage Foreclosure Deed & Affidavit$1559 more rows

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

Form TP-584 must be used to comply with the filing requirements of the real estate transfer tax (Tax Law Article 31); the tax on mortgages (Tax Law Article 11), as it applies to the Credit Line Mortgage Certificate; and the exemption from estimated personal income tax (Tax Law Article 22), as it applies to the sale or

The grantor must sign the deed form and that signature must be properly acknowledged by a notary public. All signatures must be original; we cannot accept photocopies. A complete description of the property including the village, town, county and state where the property is located must also be included on the form.