Title: Exploring San Diego California Commercial Partnership Agreement between an Investor and Worker Introduction: The San Diego California Commercial Partnership Agreement serves as a legally binding contract between an investor and worker or workers, outlining the terms and conditions for a mutually beneficial collaboration. This agreement allows parties to establish a business relationship, defining their respective roles, responsibilities, and profit-sharing arrangements. In San Diego, several types of commercial partnership agreements can be found, each catering to the unique needs of businesses in various sectors. Read on to delve into the details of these agreements and their key components. 1. General Partnership Agreement: A General Partnership Agreement is a commonly adopted structure between an investor and worker(s). This agreement outlines the roles and responsibilities of each party, capital contributions, profit-sharing ratios, decision-making processes, and exit strategies. It fosters a collaborative approach where both parties have equal say in the business operations and share both profits and liabilities. 2. Limited Partnership Agreement: In a Limited Partnership Agreement, the parties include a general partner (the investor) and limited partners (workers). The general partner assumes responsibility for management and decision-making, while limited partners contribute capital without actively participating in day-to-day operations. This agreement shields limited partners from personal liability, emphasizing the investor's sole liability for the business and its debts. 3. Joint Venture Agreement: A Joint Venture Agreement establishes a commercial partnership between an investor and worker(s) for a specific project or endeavor. It delineates the parties' roles, contributions, profit-sharing arrangements, and decision-making authority for the designated venture. Joint ventures allow for shared resources and expertise, maximizing the chances of success for both parties. 4. Cooperative Agreement: A Cooperative Agreement defines a partnership between an investor and worker(s) aiming to pool resources and expertise to produce goods or services. The agreement outlines the principles and objectives of the cooperative venture, membership requirements, profit-sharing policies, and management structures. This type of agreement promotes equitable distribution of profits among participants. Key Components of San Diego Commercial Partnership Agreements: — Identification of the parties involved (investor and worker(s)) — Business objectives and purpose of the partnership — Capital contributions made by each party — Profit-sharing and loss allocation methods — Decision-making processes and voting rights — Roles and responsibilities of each partner — Duration of the partnershiagreementen— - Dispute resolution mechanisms — Termination and exit strategies Conclusion: In San Diego, California, various types of Commercial Partnership Agreements cater to the specific needs of investors and workers in different industries. Understanding the nuances of these agreements, such as General Partnership, Limited Partnership, Joint Venture, and Cooperative Agreements, is essential for establishing successful collaborations. By clearly defining the rights, responsibilities, and profit-sharing arrangements, these agreements provide the framework for long-term, mutually beneficial partnerships.

San Diego California Commercial Partnership Agreement between an Investor and Worker

Description

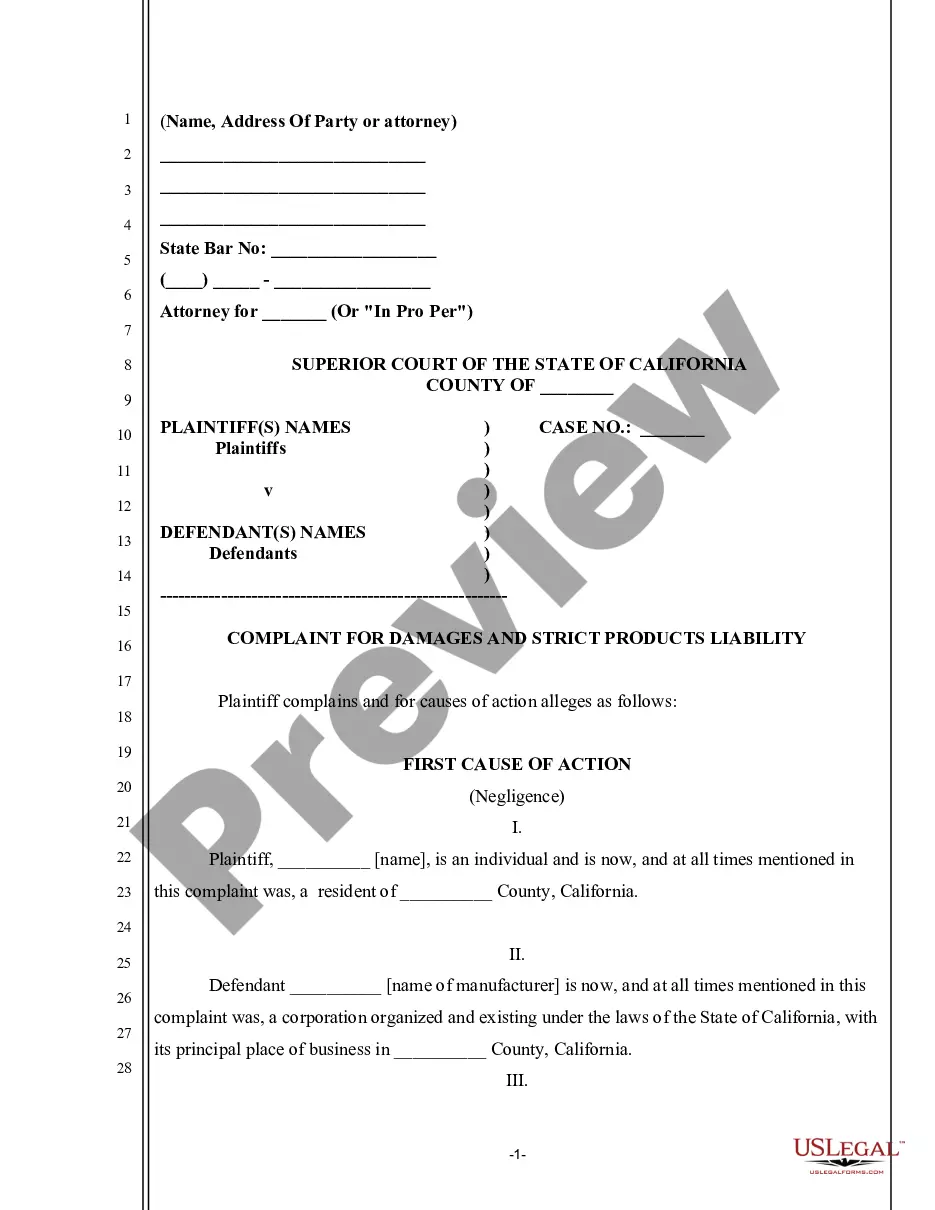

How to fill out San Diego California Commercial Partnership Agreement Between An Investor And Worker?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, finding a San Diego Commercial Partnership Agreement between an Investor and Worker suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Apart from the San Diego Commercial Partnership Agreement between an Investor and Worker, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your San Diego Commercial Partnership Agreement between an Investor and Worker:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Diego Commercial Partnership Agreement between an Investor and Worker.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!