Maricopa Arizona Collection Report is a comprehensive document that provides a detailed overview of the collection practices, procedures, and outcomes within Maricopa County, Arizona. This report serves as a valuable resource for understanding the status and trends of debt collection activities in this locale. The Maricopa Arizona Collection Report includes data and statistics derived from various sources, such as government agencies, financial institutions, collection agencies, and legal entities. It offers an in-depth analysis of collection efforts, including information about both consumer and commercial debts. This report aims to shed light on the effectiveness and efficiency of debt collection processes in Maricopa County. It provides insights into the collection rates, recovery rates, and overall success rates of different types of debts, such as credit card debt, medical debt, student loans, mortgage debt, and more. Moreover, the Maricopa Arizona Collection Report may be segmented into various sections or types, depending on the specific focus or area of interest. Some potential types of collection reports that can be derived from this broader report could be: 1. Consumer Debt Collection Report: This section specifically zooms in on the collection efforts made to recover debts owed by individual consumers. It presents details about the types of debts, collection strategies employed, and successful recovery rates. 2. Commercial Debt Collection Report: This section focuses on the collection practices and outcomes relating to outstanding debts owed by businesses, corporations, or commercial entities. It provides insights into the trends, challenges, and successes faced in recovering commercial debts. 3. Financial Institution Collection Report: This segment highlights the collection efforts carried out by banks, credit unions, and other financial institutions operating in Maricopa County. It may emphasize areas such as loan defaults, repayment patterns, and recovery strategies. 4. Government Debt Collection Report: This report digs into the collection efforts made by various government agencies, including tax collection, fines, penalties, and other outstanding dues. It examines the effectiveness of different government collection programs and their impact on revenue generation. 5. Legal Collection Report: This section provides an overview of the legal aspects of debt collection within Maricopa County. It includes information about lawsuits, court judgments, garnishment orders, and other legal interventions involved in the recovery process. In conclusion, the Maricopa Arizona Collection Report is a comprehensive document that offers a detailed analysis of debt collection practices and outcomes in Maricopa County. It serves as a valuable resource for businesses, financial institutions, policymakers, and researchers to understand the dynamics of debt collection, assess its impact on the local economy, and make informed decisions regarding debt management strategies.

Maricopa Arizona Collection Report

Description

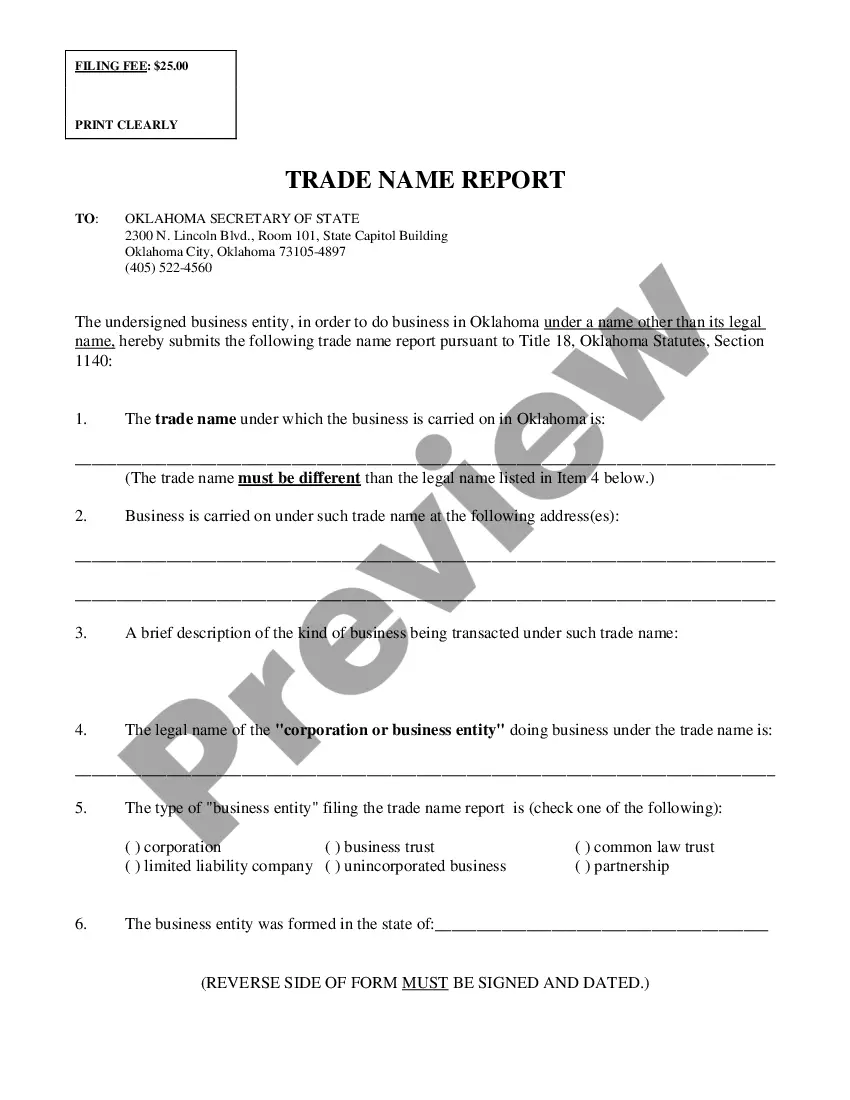

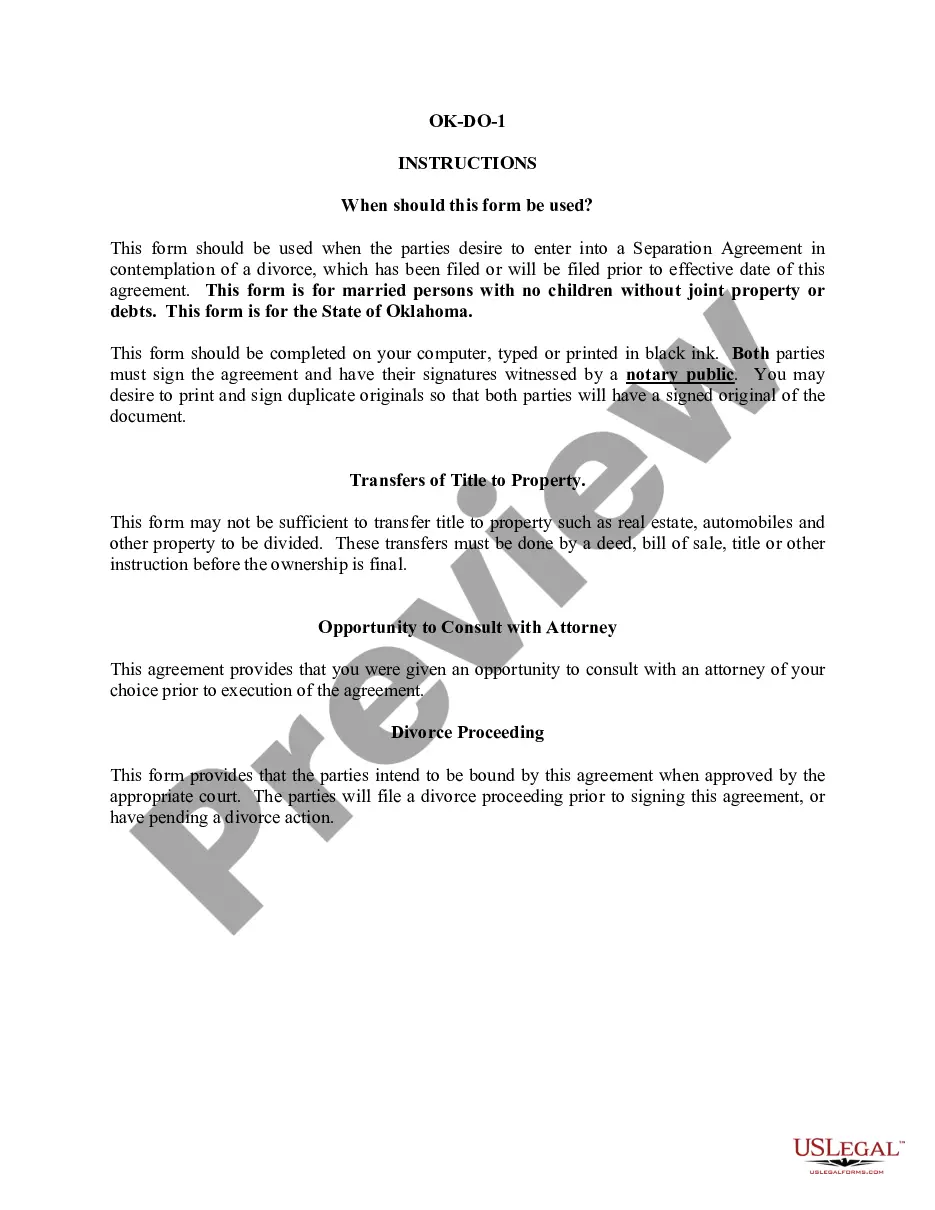

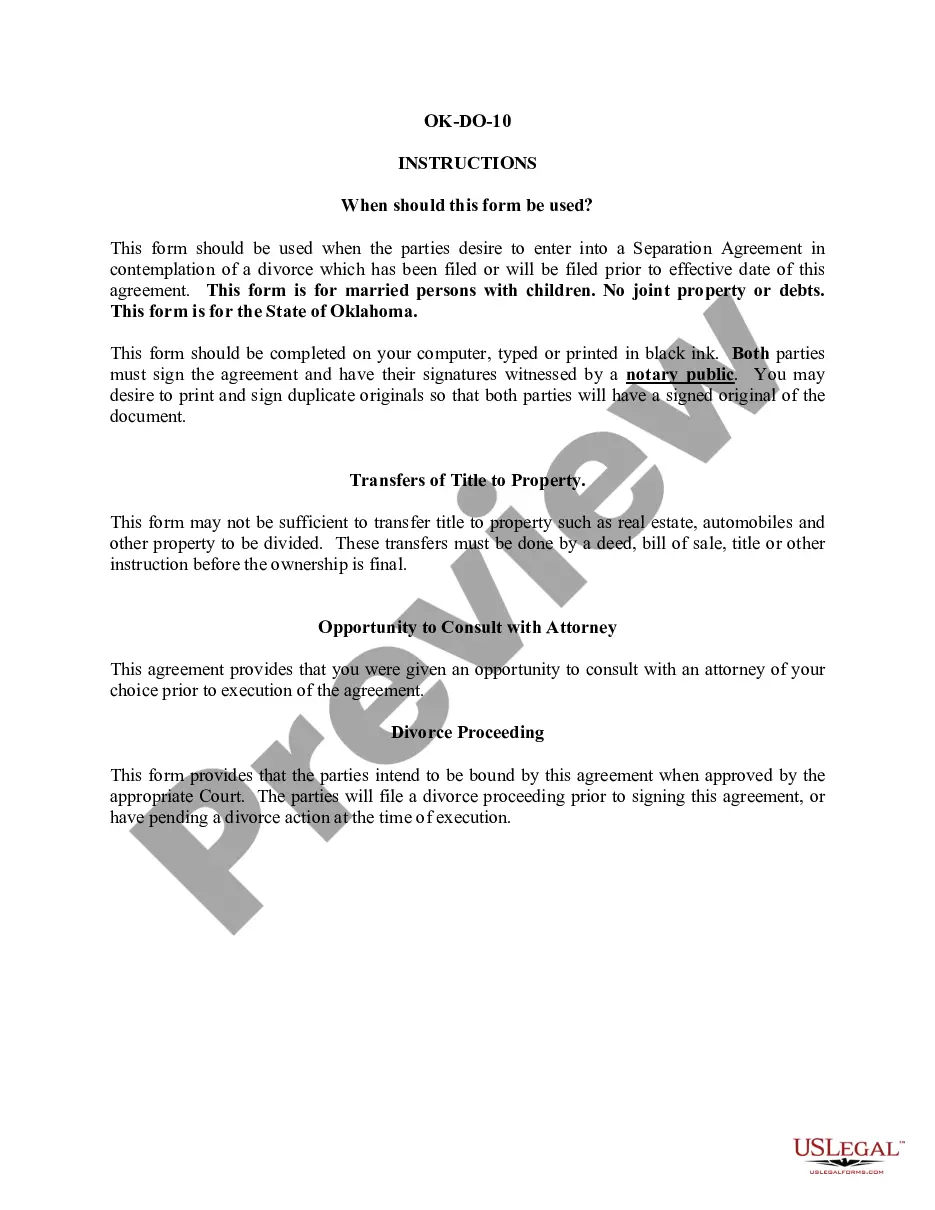

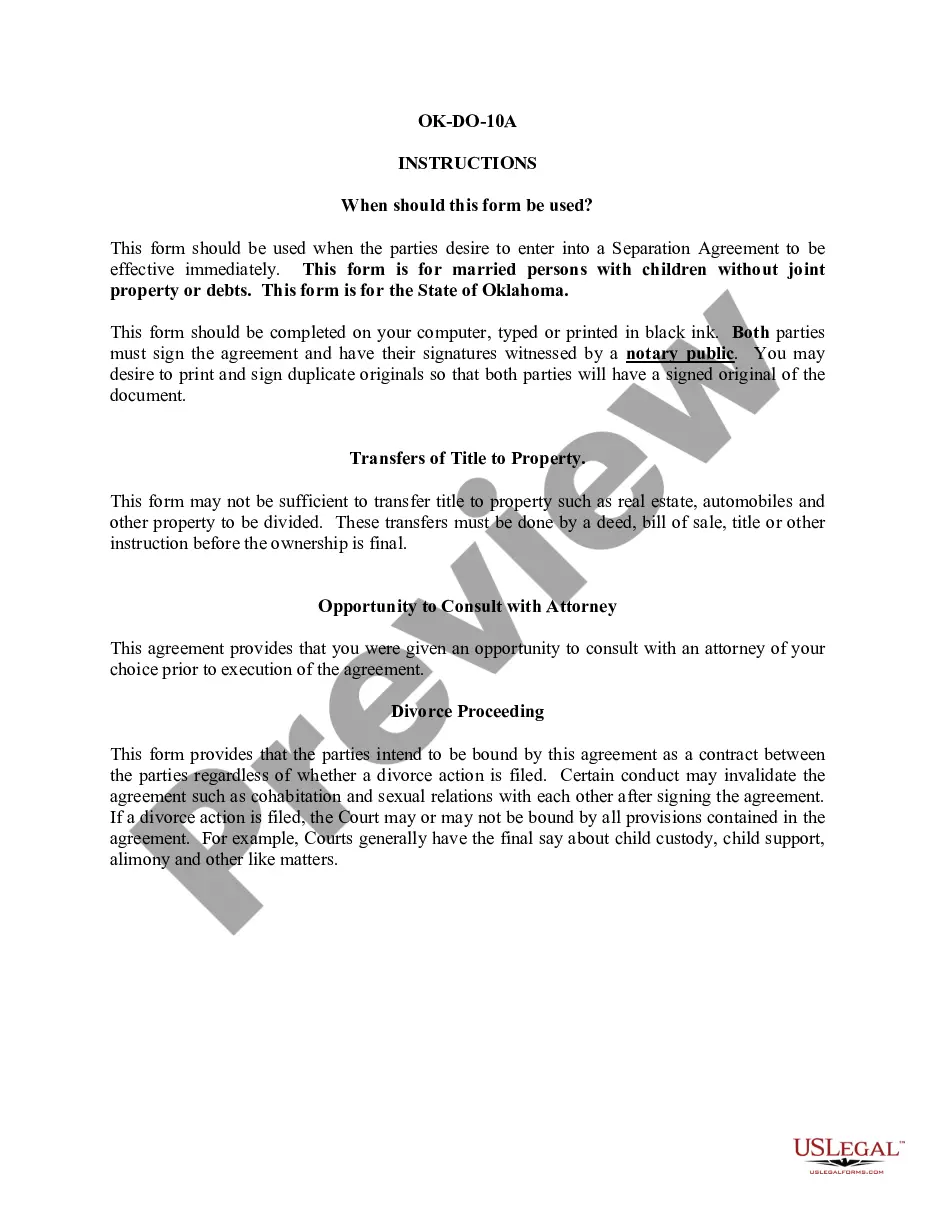

How to fill out Maricopa Arizona Collection Report?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Maricopa Collection Report is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to get the Maricopa Collection Report. Follow the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Collection Report in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!