A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

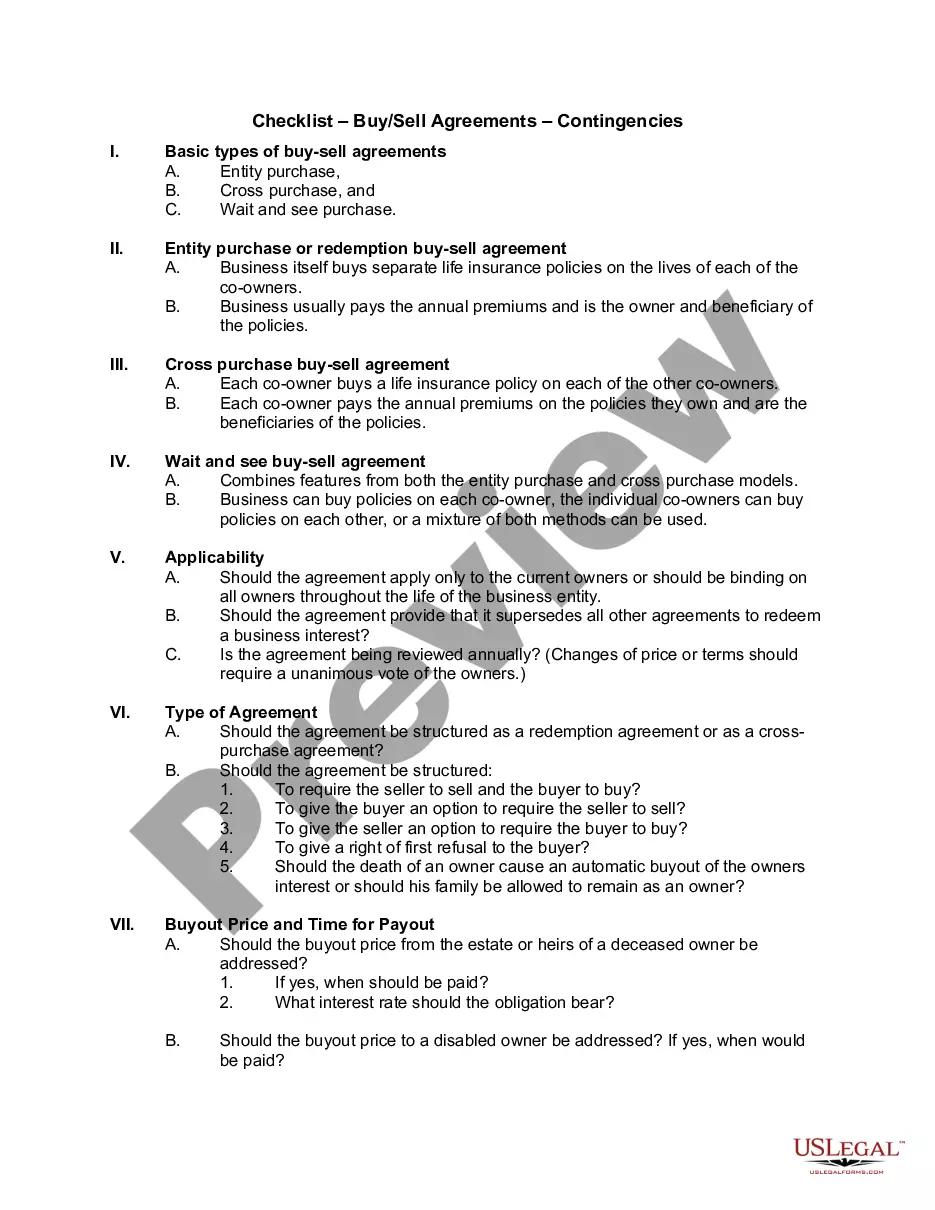

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

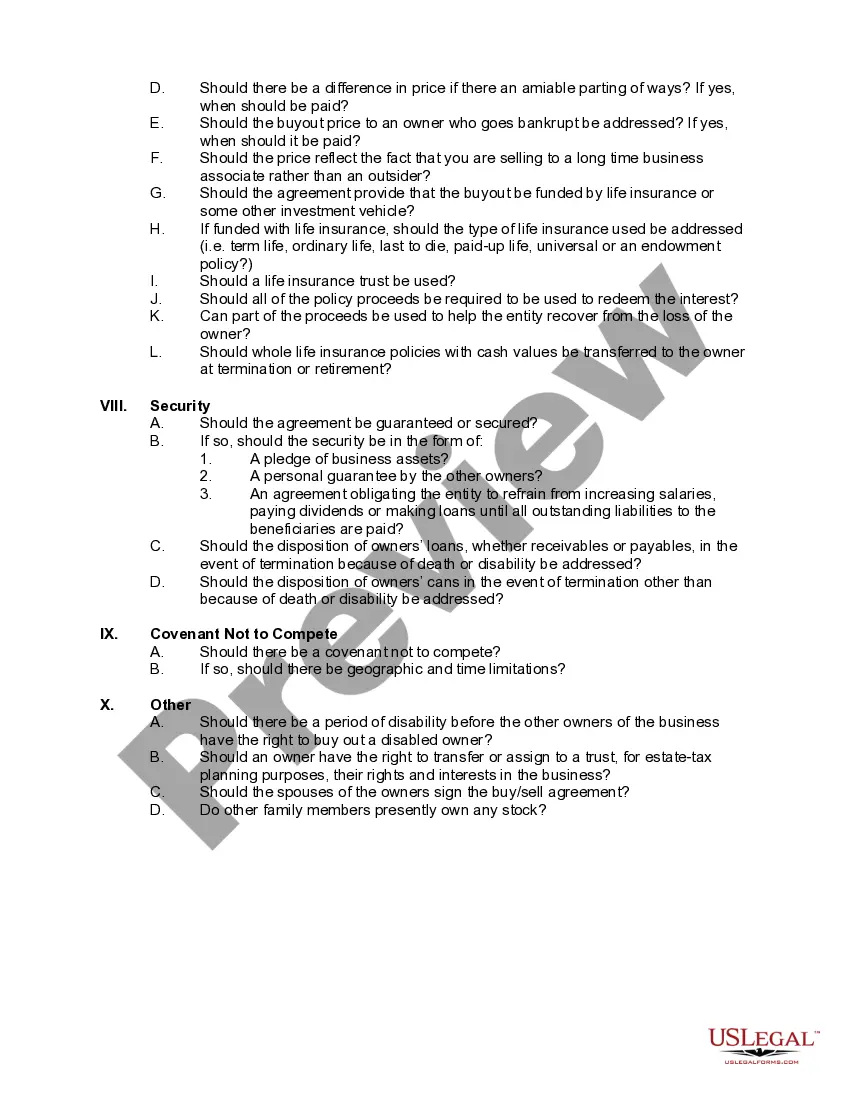

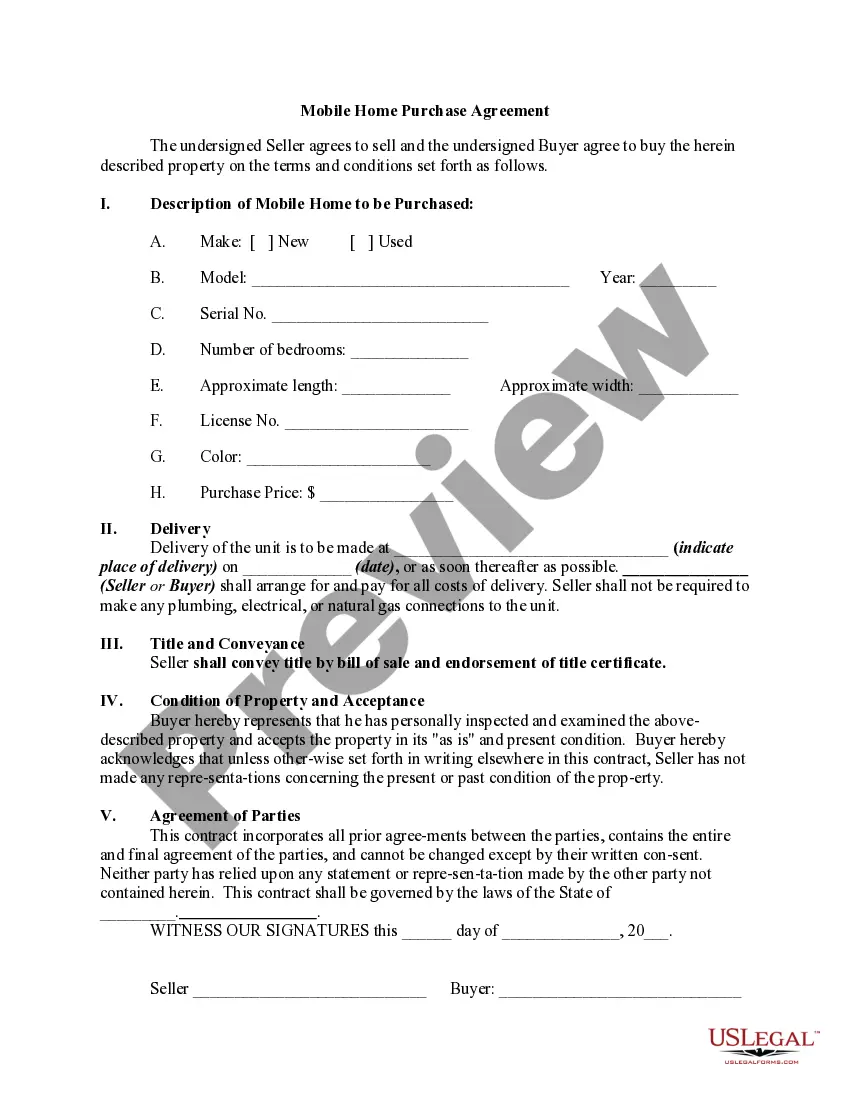

Chicago, Illinois is a bustling city known for its rich history, diverse culture, and flourishing real estate market. When it comes to Buy/Sell Agreements, a crucial aspect of any real estate transaction, there are several important contingencies that both buyers and sellers in Chicago should consider. Understanding these contingencies is vital to protect the interests of all parties involved and ensure a smooth and successful transaction. Here is a detailed description of the main types of Chicago Illinois Checklist — Buy/Sell Agreement— - Contingencies: 1. Financing Contingency: This contingency allows the buyer a specified period to secure financing for the purchase of the property. If the buyer fails to obtain the necessary funds within the agreed-upon timeframe, the contract can be terminated without any penalties. 2. Inspection Contingency: An inspection contingency allows the buyer to conduct a thorough inspection of the property to identify any issues or defects. Based on the inspection report, the buyer may request repairs, credits, or even cancel the contract if substantial issues are identified. 3. Appraisal Contingency: This contingency is essential for buyers relying on a mortgage loan. It allows the buyer to back out of the contract if the appraised value of the property falls short of the agreed-upon purchase price. This protects the buyer from overpaying for the property. 4. Title Contingency: A title contingency ensures that the property being sold has a clear title, free of any liens or encumbrances. If any unforeseen title issues arise during the due diligence process, the buyer has the right to address them or cancel the contract. 5. Home Sale Contingency: This type of contingency is commonly used when the buyer needs to sell their current property before purchasing a new one. It provides a specific timeframe for the buyer to sell their home and allows for the cancellation of the contract if they fail to do so. 6. Homeowner Association (HOA) Contingency: When purchasing a property that is part of a homeowner association, this contingency allows the buyer to review the HOA's rules, regulations, financial statements, and governing documents. If the buyer is dissatisfied with the HOA's terms or regulations, they can cancel the contract. 7. Financing Addendum: In addition to contingencies, Chicago Illinois Buy/Sell Agreements may include a financing addendum, which specifies the terms and conditions of the loan. This addendum may outline the loan amount, interest rate, down payment, and other relevant financial arrangements. It is important for both buyers and sellers in Chicago to carefully consider these contingencies and consult with a qualified real estate attorney or agent to ensure they are adequately addressed in the Buy/Sell Agreement. Having a comprehensive understanding of these contingencies can save time, money, and potential legal disputes, leading to a smoother and more successful real estate transaction in Chicago, Illinois.Chicago, Illinois is a bustling city known for its rich history, diverse culture, and flourishing real estate market. When it comes to Buy/Sell Agreements, a crucial aspect of any real estate transaction, there are several important contingencies that both buyers and sellers in Chicago should consider. Understanding these contingencies is vital to protect the interests of all parties involved and ensure a smooth and successful transaction. Here is a detailed description of the main types of Chicago Illinois Checklist — Buy/Sell Agreement— - Contingencies: 1. Financing Contingency: This contingency allows the buyer a specified period to secure financing for the purchase of the property. If the buyer fails to obtain the necessary funds within the agreed-upon timeframe, the contract can be terminated without any penalties. 2. Inspection Contingency: An inspection contingency allows the buyer to conduct a thorough inspection of the property to identify any issues or defects. Based on the inspection report, the buyer may request repairs, credits, or even cancel the contract if substantial issues are identified. 3. Appraisal Contingency: This contingency is essential for buyers relying on a mortgage loan. It allows the buyer to back out of the contract if the appraised value of the property falls short of the agreed-upon purchase price. This protects the buyer from overpaying for the property. 4. Title Contingency: A title contingency ensures that the property being sold has a clear title, free of any liens or encumbrances. If any unforeseen title issues arise during the due diligence process, the buyer has the right to address them or cancel the contract. 5. Home Sale Contingency: This type of contingency is commonly used when the buyer needs to sell their current property before purchasing a new one. It provides a specific timeframe for the buyer to sell their home and allows for the cancellation of the contract if they fail to do so. 6. Homeowner Association (HOA) Contingency: When purchasing a property that is part of a homeowner association, this contingency allows the buyer to review the HOA's rules, regulations, financial statements, and governing documents. If the buyer is dissatisfied with the HOA's terms or regulations, they can cancel the contract. 7. Financing Addendum: In addition to contingencies, Chicago Illinois Buy/Sell Agreements may include a financing addendum, which specifies the terms and conditions of the loan. This addendum may outline the loan amount, interest rate, down payment, and other relevant financial arrangements. It is important for both buyers and sellers in Chicago to carefully consider these contingencies and consult with a qualified real estate attorney or agent to ensure they are adequately addressed in the Buy/Sell Agreement. Having a comprehensive understanding of these contingencies can save time, money, and potential legal disputes, leading to a smoother and more successful real estate transaction in Chicago, Illinois.