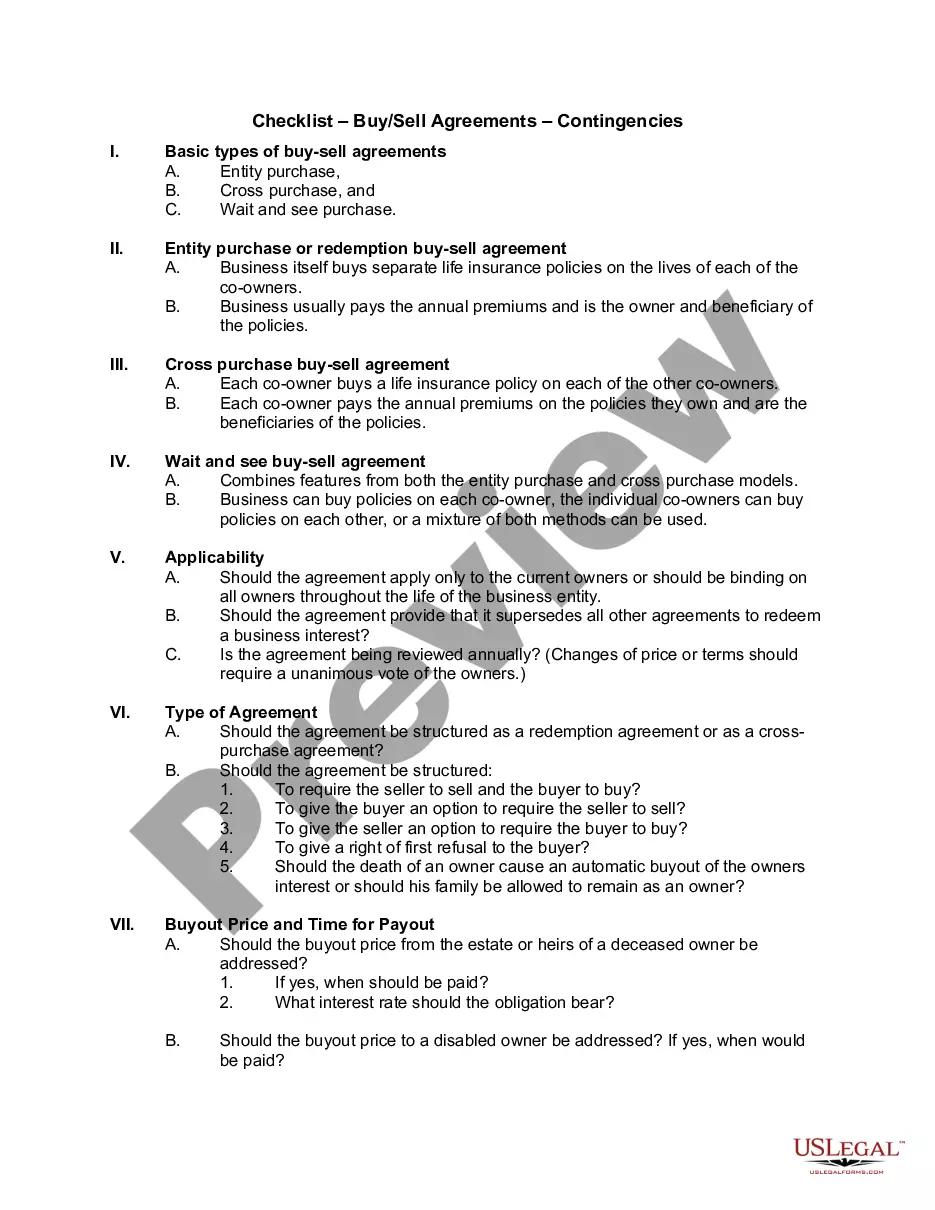

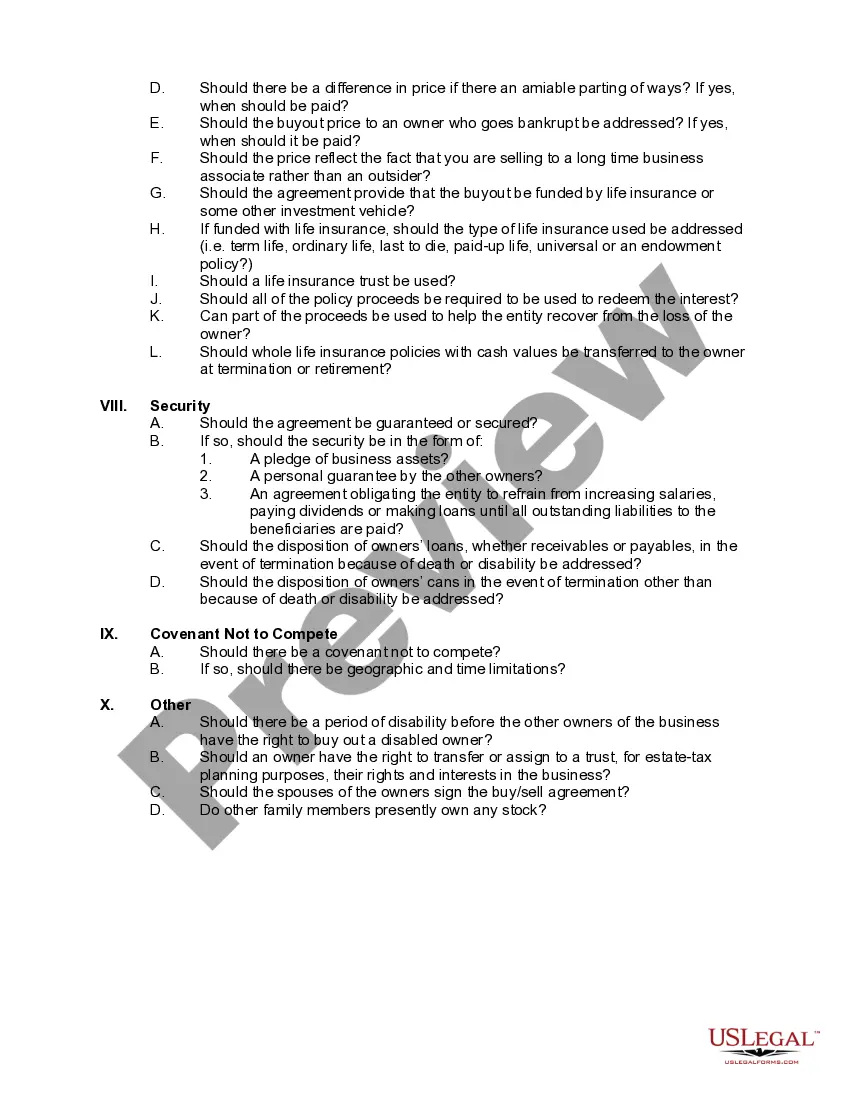

A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

Collin Texas Checklist — Buy/Sell Agreement— - Contingencies: A Comprehensive Guide for Real Estate Transactions Are you planning to engage in a real estate transaction in Collin, Texas? Understanding the essential checklist for buy/sell agreements and contingencies is crucial for a smooth and successful transaction. This detailed description provides valuable information on what Collin Texas Checklist — Buy/Sell Agreement— - Contingencies entail, ensuring you have a comprehensive understanding of each aspect involved. 1. Buy/Sell Agreements: Buy/sell agreements are legally binding contracts that outline the terms and conditions of a real estate transaction in Collin, Texas. These agreements serve as a blueprint for buyers and sellers, ensuring both parties are protected and their rights and responsibilities are clearly defined. The primary elements of a buy/sell agreement may include: — Identification of the property: A detailed description of the property being bought or sold, including its address and legal description. — Purchase price and terms: The agreed-upon purchase price, payment terms, and any contingencies related to financing or seller financing. — Closing date and possession: The date when the transaction will be finalized, and when the buyer will take possession of the property. — Due diligence and inspections: The buyer's rights to conduct inspections and investigations, and the seller's responsibilities to disclose any known issues. — Title and survey requirements: The buyer's right to receive clear and marketable title, typically after a title search and survey are conducted. — Default and remedies: Procedures for handling potential breaches of the agreement and the available remedies for the affected party. — Signatures and conditions: Signatures of all parties involved in the transaction, along with any additional terms and conditions agreed upon during negotiations. 2. Contingencies: Contingencies are conditions or requirements that must be met for the real estate transaction to proceed. They act as safeguards and allow the parties involved in the transaction to legally back out if specific conditions are not met. Common contingencies in Collin, Texas, include: — Financing contingency: This contingency provides the buyer with a specific time frame to secure suitable financing for the property. If financing cannot be obtained under agreed-upon terms, the buyer can withdraw from the transaction without penalty. — Inspection contingency: Buyers typically have the right to conduct inspections on the property within a specified time frame. If significant issues are discovered during the inspection, the buyer may negotiate repairs, credits, or even withdraw from the agreement if the seller refuses to address the concerns adequately. — Appraisal contingency: This contingency allows the buyer to withdraw from the contract if the property does not appraise for the agreed-upon purchase price. It ensures that the buyer does not overpay for the property based on its market value. — Title contingency: The buyer has the right to receive a clear and marketable title to the property. If title issues arise, the buyer can either request remediation or cancel the transaction. — Home sale contingency: When a buyer needs to sell their current property to finance the purchase, this contingency allows them to withdraw from the agreement if they cannot successfully sell their home within a specified period. The above-described Collin Texas Checklist — Buy/Sell Agreement— - Contingencies provides crucial guidance for anyone involved in a real estate transaction in Collin, Texas. By carefully understanding and implementing these important elements, both buyers and sellers can protect their interests, minimize risks, and ensure a successful closing.Collin Texas Checklist — Buy/Sell Agreement— - Contingencies: A Comprehensive Guide for Real Estate Transactions Are you planning to engage in a real estate transaction in Collin, Texas? Understanding the essential checklist for buy/sell agreements and contingencies is crucial for a smooth and successful transaction. This detailed description provides valuable information on what Collin Texas Checklist — Buy/Sell Agreement— - Contingencies entail, ensuring you have a comprehensive understanding of each aspect involved. 1. Buy/Sell Agreements: Buy/sell agreements are legally binding contracts that outline the terms and conditions of a real estate transaction in Collin, Texas. These agreements serve as a blueprint for buyers and sellers, ensuring both parties are protected and their rights and responsibilities are clearly defined. The primary elements of a buy/sell agreement may include: — Identification of the property: A detailed description of the property being bought or sold, including its address and legal description. — Purchase price and terms: The agreed-upon purchase price, payment terms, and any contingencies related to financing or seller financing. — Closing date and possession: The date when the transaction will be finalized, and when the buyer will take possession of the property. — Due diligence and inspections: The buyer's rights to conduct inspections and investigations, and the seller's responsibilities to disclose any known issues. — Title and survey requirements: The buyer's right to receive clear and marketable title, typically after a title search and survey are conducted. — Default and remedies: Procedures for handling potential breaches of the agreement and the available remedies for the affected party. — Signatures and conditions: Signatures of all parties involved in the transaction, along with any additional terms and conditions agreed upon during negotiations. 2. Contingencies: Contingencies are conditions or requirements that must be met for the real estate transaction to proceed. They act as safeguards and allow the parties involved in the transaction to legally back out if specific conditions are not met. Common contingencies in Collin, Texas, include: — Financing contingency: This contingency provides the buyer with a specific time frame to secure suitable financing for the property. If financing cannot be obtained under agreed-upon terms, the buyer can withdraw from the transaction without penalty. — Inspection contingency: Buyers typically have the right to conduct inspections on the property within a specified time frame. If significant issues are discovered during the inspection, the buyer may negotiate repairs, credits, or even withdraw from the agreement if the seller refuses to address the concerns adequately. — Appraisal contingency: This contingency allows the buyer to withdraw from the contract if the property does not appraise for the agreed-upon purchase price. It ensures that the buyer does not overpay for the property based on its market value. — Title contingency: The buyer has the right to receive a clear and marketable title to the property. If title issues arise, the buyer can either request remediation or cancel the transaction. — Home sale contingency: When a buyer needs to sell their current property to finance the purchase, this contingency allows them to withdraw from the agreement if they cannot successfully sell their home within a specified period. The above-described Collin Texas Checklist — Buy/Sell Agreement— - Contingencies provides crucial guidance for anyone involved in a real estate transaction in Collin, Texas. By carefully understanding and implementing these important elements, both buyers and sellers can protect their interests, minimize risks, and ensure a successful closing.