A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

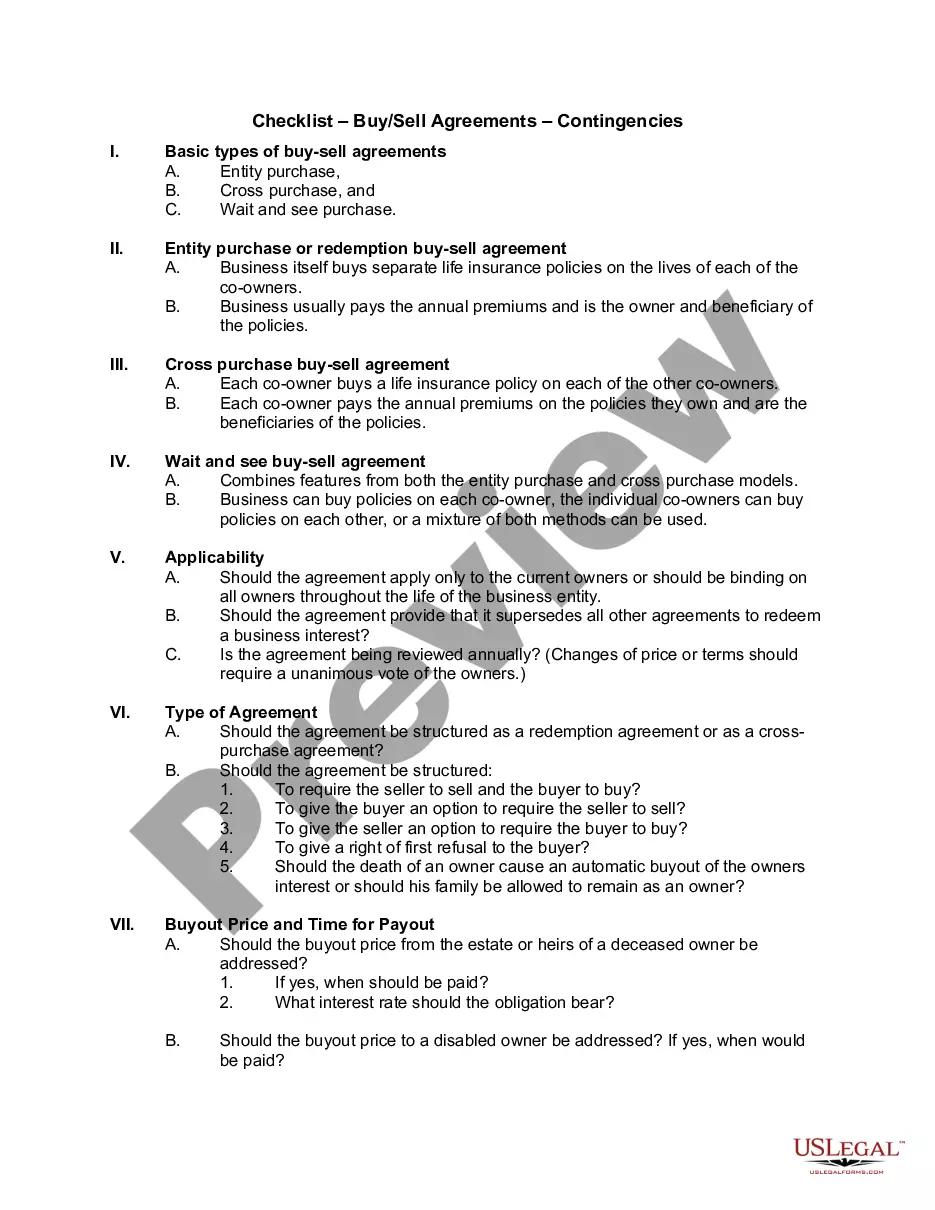

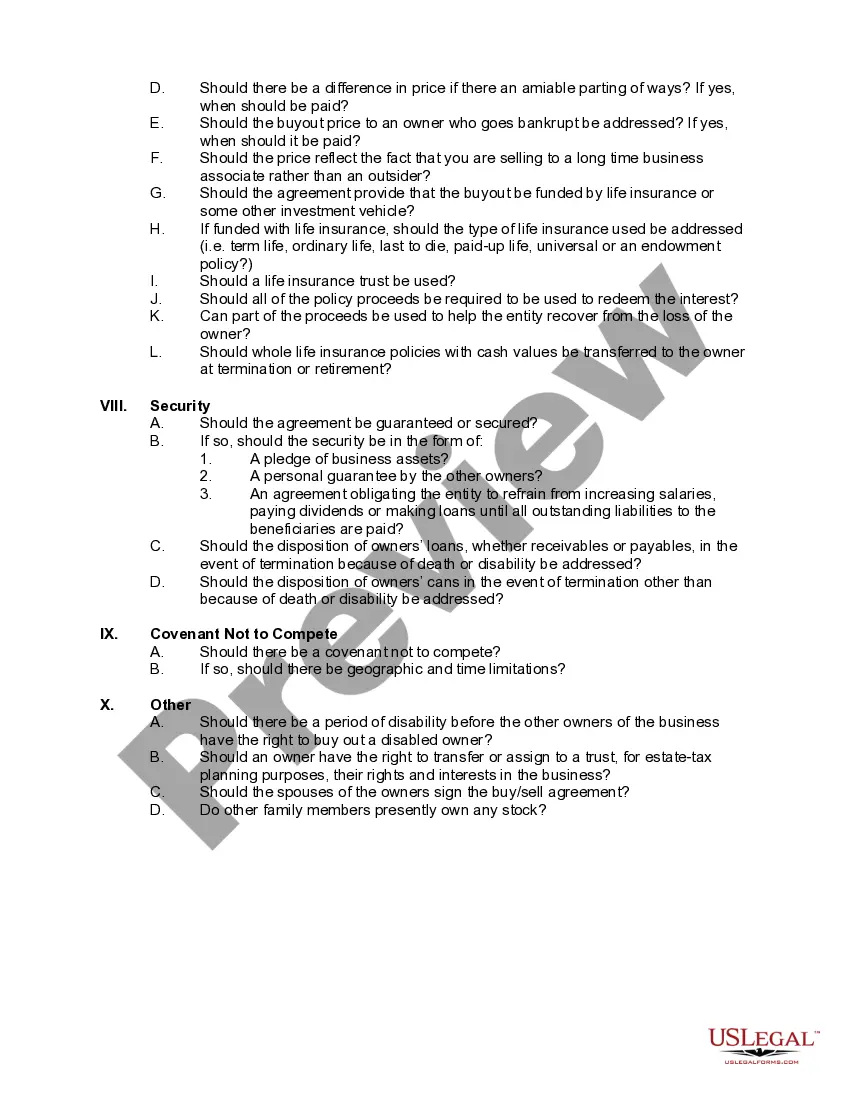

Los Angeles, California is a bustling city known for its vibrant culture, diversity, and thriving real estate market. When it comes to buying or selling property in this metropolitan area, having a detailed checklist is crucial to ensure a smooth transaction. One important aspect of this checklist is understanding the significance of buy/sell agreements and contingencies. Buy/sell agreements are legally binding contracts that outline the terms and conditions of a real estate transaction between the buyer and seller. These agreements cover various aspects, including purchase price, financing terms, contingencies, and other crucial details. In Los Angeles, California, where the real estate market can be highly competitive and fast-paced, having a well-drafted buy/sell agreement is essential to protect the interests of both parties involved. Contingencies, on the other hand, are provisions or conditions in the buy/sell agreement that must be met for the transaction to proceed. These contingencies act as safeguards for the buyer, allowing them to cancel the agreement or renegotiate the terms if the specified conditions are not fulfilled. By including contingencies in the buy/sell agreement, both buyers and sellers can navigate potential obstacles and ensure a fair and transparent transaction. There are different types of Los Angeles, California checklist — buy/sell agreement— - contingencies that one should consider: 1. Financing Contingency: This contingency allows the buyer to cancel the agreement if they are unable to secure adequate financing for the purchase. It typically includes a timeframe within which the buyer needs to secure a mortgage or loan commitment from a lender. 2. Inspection Contingency: This contingency gives the buyer the right to conduct property inspections to assess its condition thoroughly. If the inspection reveals any significant issues or defects, the buyer can negotiate repairs or request a price reduction. If the seller refuses, the buyer may cancel the agreement. 3. Appraisal Contingency: This contingency enables the buyer to back out of the deal or renegotiate the purchase price if the appraised value of the property is lower than the agreed-upon price. The contingency protects the buyer from overpaying for the property. 4. Sale Contingency: This type of contingency is applicable when the buyer needs to sell their current property in order to finance the purchase. It allows the buyer to cancel the agreement if they are unable to sell their property within a specified period. 5. Title Contingency: This contingency ensures that the property has a clear and marketable title. It allows the buyer to review the title report and disclose any potential title issues. If any unresolved disputes or liens are discovered, the buyer can negotiate with the seller or cancel the agreement. In conclusion, when navigating the real estate market in Los Angeles, California, it is crucial to have a comprehensive checklist that includes buy/sell agreements and contingencies. By understanding and incorporating these crucial elements, both buyers and sellers can safeguard their interests and ensure a successful and smooth transaction.Los Angeles, California is a bustling city known for its vibrant culture, diversity, and thriving real estate market. When it comes to buying or selling property in this metropolitan area, having a detailed checklist is crucial to ensure a smooth transaction. One important aspect of this checklist is understanding the significance of buy/sell agreements and contingencies. Buy/sell agreements are legally binding contracts that outline the terms and conditions of a real estate transaction between the buyer and seller. These agreements cover various aspects, including purchase price, financing terms, contingencies, and other crucial details. In Los Angeles, California, where the real estate market can be highly competitive and fast-paced, having a well-drafted buy/sell agreement is essential to protect the interests of both parties involved. Contingencies, on the other hand, are provisions or conditions in the buy/sell agreement that must be met for the transaction to proceed. These contingencies act as safeguards for the buyer, allowing them to cancel the agreement or renegotiate the terms if the specified conditions are not fulfilled. By including contingencies in the buy/sell agreement, both buyers and sellers can navigate potential obstacles and ensure a fair and transparent transaction. There are different types of Los Angeles, California checklist — buy/sell agreement— - contingencies that one should consider: 1. Financing Contingency: This contingency allows the buyer to cancel the agreement if they are unable to secure adequate financing for the purchase. It typically includes a timeframe within which the buyer needs to secure a mortgage or loan commitment from a lender. 2. Inspection Contingency: This contingency gives the buyer the right to conduct property inspections to assess its condition thoroughly. If the inspection reveals any significant issues or defects, the buyer can negotiate repairs or request a price reduction. If the seller refuses, the buyer may cancel the agreement. 3. Appraisal Contingency: This contingency enables the buyer to back out of the deal or renegotiate the purchase price if the appraised value of the property is lower than the agreed-upon price. The contingency protects the buyer from overpaying for the property. 4. Sale Contingency: This type of contingency is applicable when the buyer needs to sell their current property in order to finance the purchase. It allows the buyer to cancel the agreement if they are unable to sell their property within a specified period. 5. Title Contingency: This contingency ensures that the property has a clear and marketable title. It allows the buyer to review the title report and disclose any potential title issues. If any unresolved disputes or liens are discovered, the buyer can negotiate with the seller or cancel the agreement. In conclusion, when navigating the real estate market in Los Angeles, California, it is crucial to have a comprehensive checklist that includes buy/sell agreements and contingencies. By understanding and incorporating these crucial elements, both buyers and sellers can safeguard their interests and ensure a successful and smooth transaction.