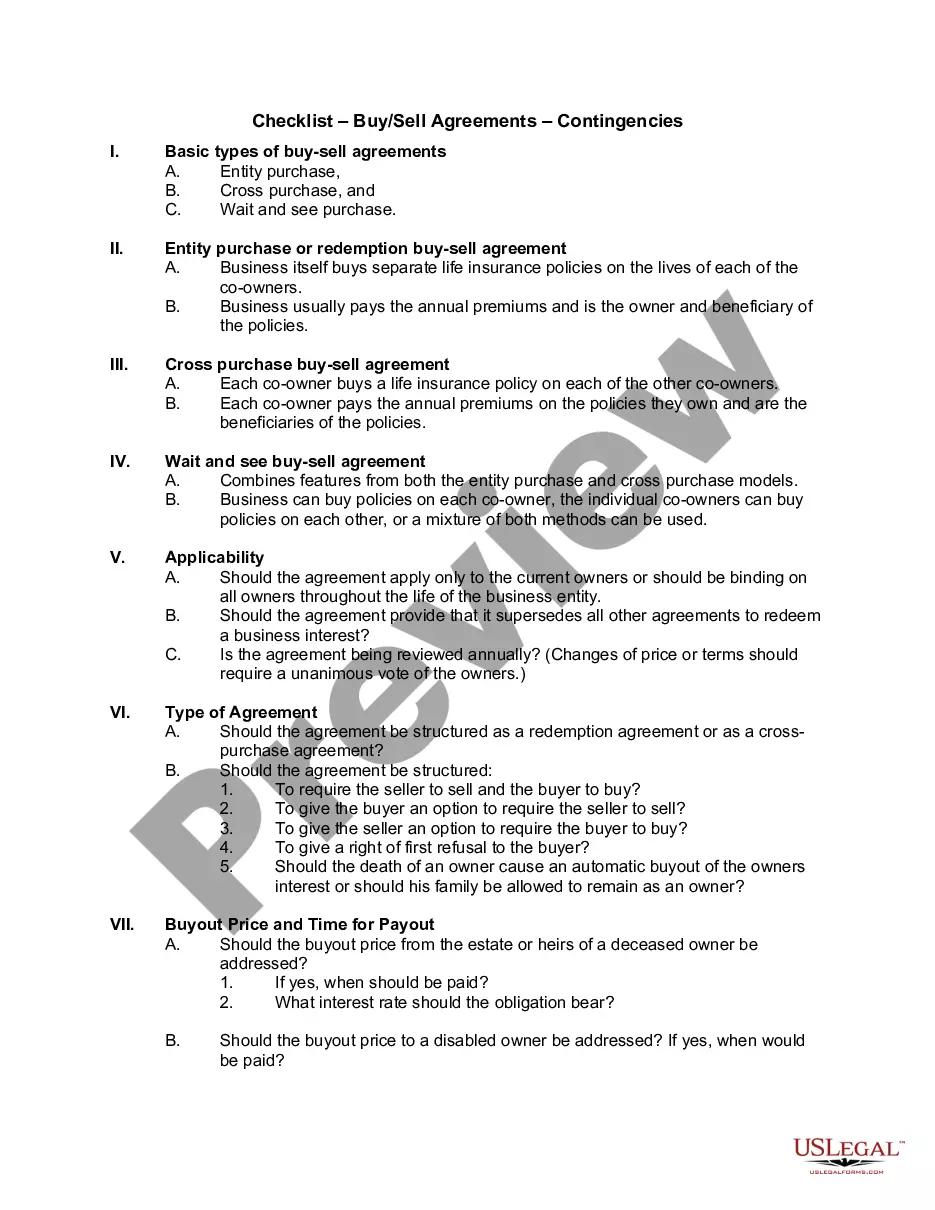

A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

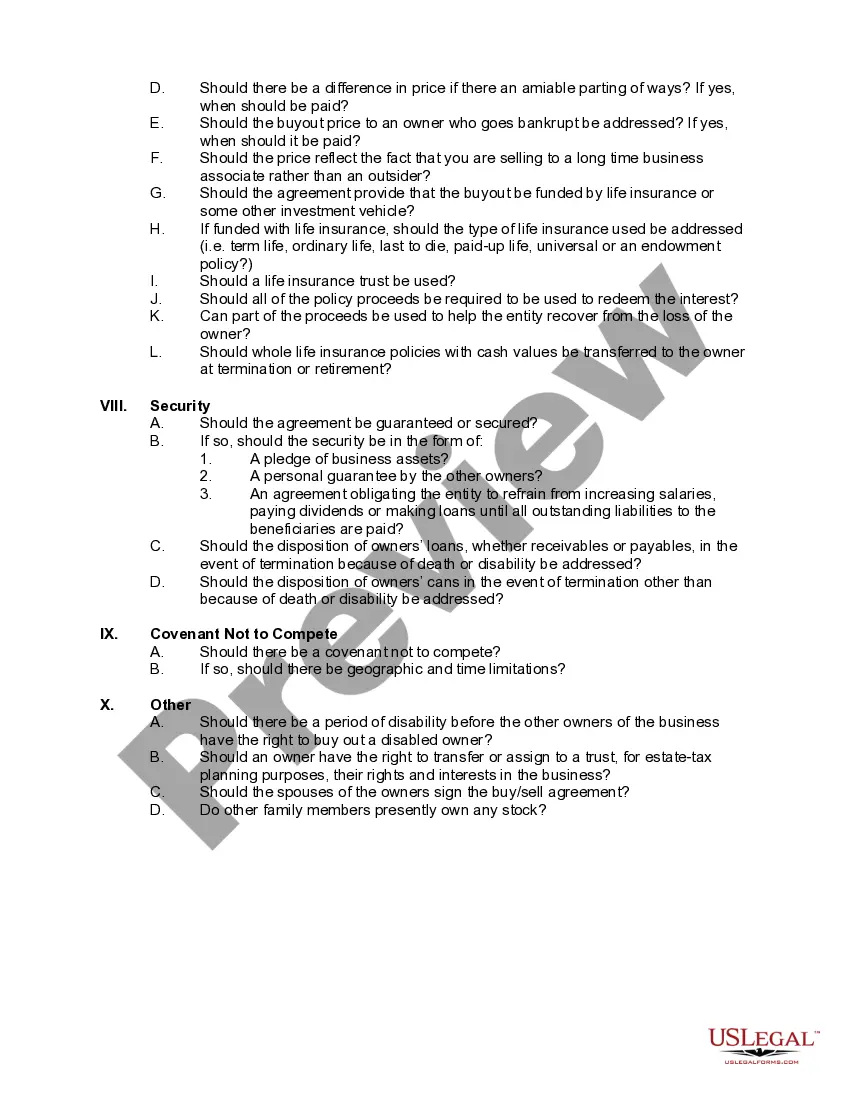

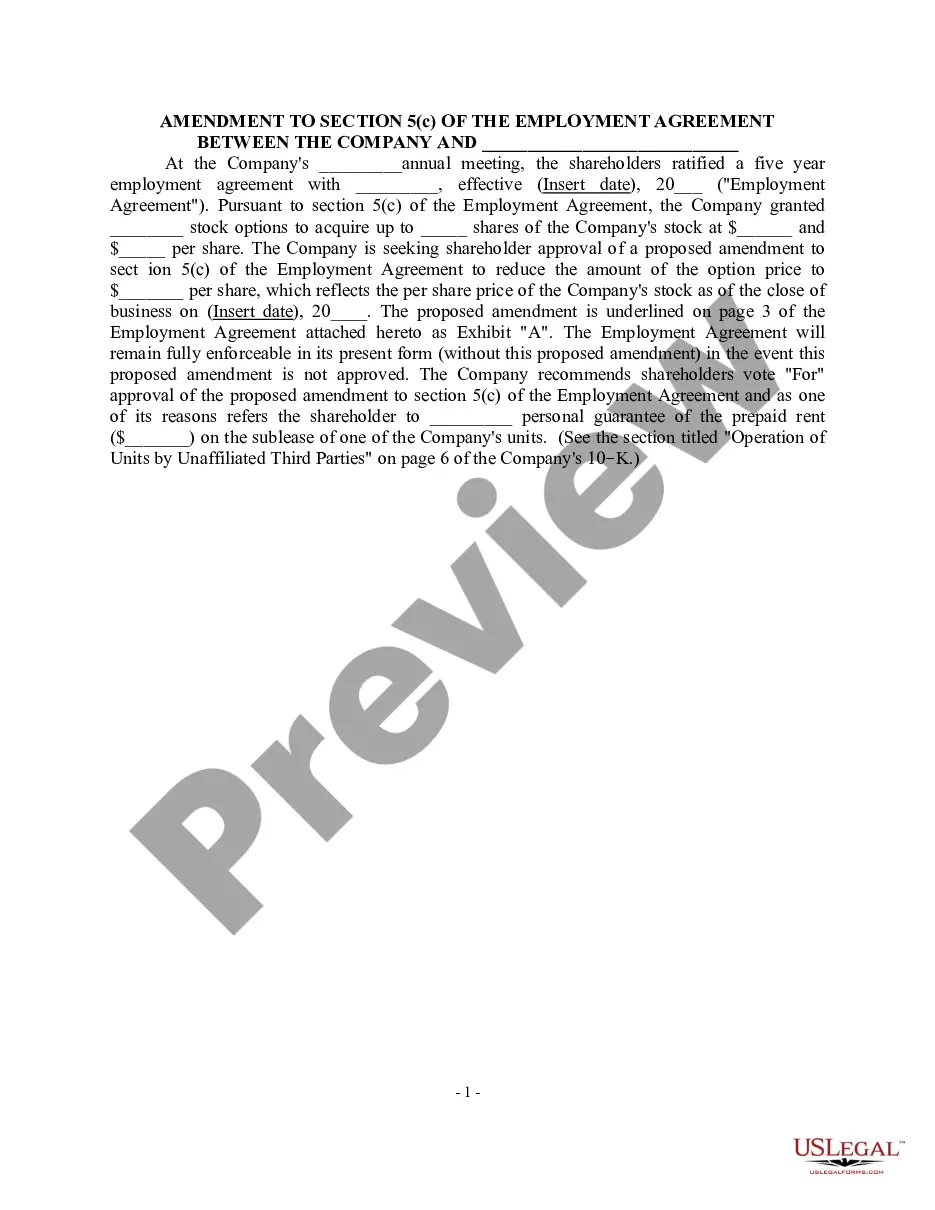

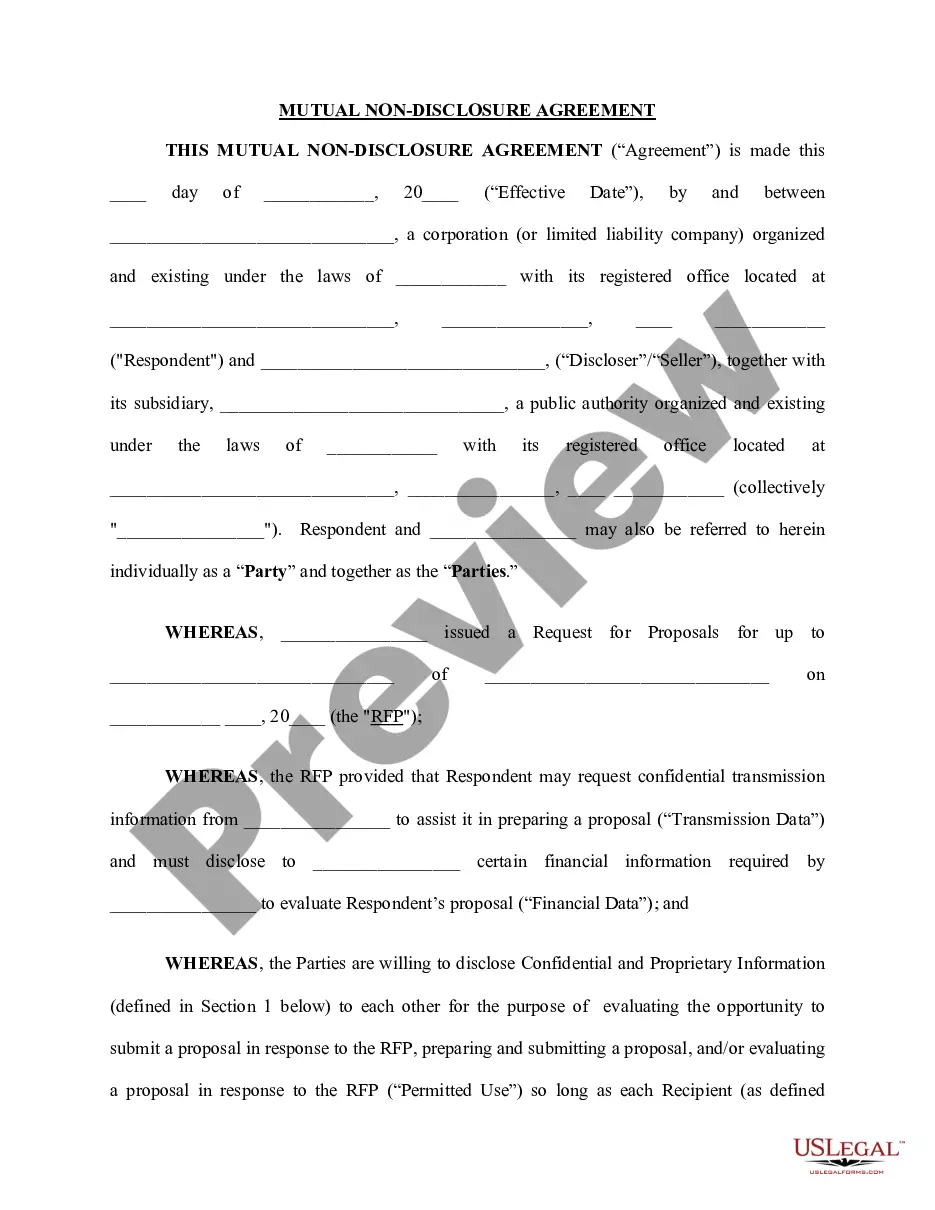

Lima Arizona Checklist — Buy/Sell Agreements — Contingencies: A Comprehensive Guide When engaging in real estate transactions in Lima, Arizona, it is crucial to understand the key aspects of buy/sell agreements and contingencies to ensure a smooth and successful process. This detailed checklist aims to provide you with all the relevant information required for navigating buy/sell agreements and understanding different types of contingencies in Lima, Arizona. 1. Introduction to Buy/Sell Agreements: A buy/sell agreement is a legally binding contract between a buyer and a seller that outlines the terms and conditions of a property transaction. It ensures that both parties agree to the sale, the price, and any contingencies or conditions that need to be fulfilled before the sale is finalized. 2. Essential Elements of a Buy/Sell Agreement: a. Purchase Price and Payment Terms: Specifies the agreed-upon purchase price and the payment terms, including down payment amount, financing options, and proposed closing date. b. Title and Survey: Outlines the requirements for a clear title, including obtaining a survey and addressing any easements or encroachments. c. Inspection Contingencies: Describes the buyer's right to inspect the property and the timeframe for completing inspections. It may also include provisions for repairs or a reduction in purchase price based on inspection results. d. Financing Contingencies: Addresses the buyer's ability to secure financing and the conditions under which either party can terminate the agreement if financing falls through. e. Disclosure Obligations: Specifies the seller's duty to provide accurate property disclosures, including information regarding any known defects, environmental concerns, or legal issues. f. Contingencies for Selling Existing Property: If the buyer needs to sell their existing property to finance the purchase, this contingency outlines the necessary steps, timelines, and any penalties for non-compliance. g. Closing and Possession: Determines who will be responsible for closing costs, the allocation of property taxes, and the possession date. 3. Types of Contingencies in Buy/Sell Agreements: a. Inspection Contingency: Allows the buyer to conduct a thorough inspection of the property within a specified timeframe to identify any potential issues. b. Financing Contingency: Provides an opportunity for the buyer to secure appropriate financing for purchasing the property, ensuring they are not bound by the agreement if financing is unavailable or unsatisfactory. c. Appraisal Contingency: Indicates that the buyer has the right to a professional appraisal conducted by a licensed appraiser to determine the fair market value of the property. If the appraised value is lower than the agreed-upon price, renegotiation or termination of the agreement is possible. d. Home Sale Contingency: Allows the buyer to sell their existing property before fulfilling the purchase obligations, ensuring they are not burdened with multiple mortgages. e. Title Contingency: Requires the seller to provide a clear title without any liens or encumbrances, ensuring the buyer receives rightful ownership of the property. f. Pest Inspection Contingency: Allows the buyer to conduct a pest inspection to identify any pest infestations or related damage that may affect the property's value. g. Financing Addendum Contingency: Defines specific terms and conditions related to financing, such as interest rates, loan types, and timelines. Navigating buy/sell agreements and contingencies can be complex, so it is advisable to seek legal advice or consult a qualified real estate professional to ensure compliance with local laws and regulations. Implementing this comprehensive checklist will assist you in seamlessly executing property transactions in Lima, Arizona, while protecting your rights and interests.Lima Arizona Checklist — Buy/Sell Agreements — Contingencies: A Comprehensive Guide When engaging in real estate transactions in Lima, Arizona, it is crucial to understand the key aspects of buy/sell agreements and contingencies to ensure a smooth and successful process. This detailed checklist aims to provide you with all the relevant information required for navigating buy/sell agreements and understanding different types of contingencies in Lima, Arizona. 1. Introduction to Buy/Sell Agreements: A buy/sell agreement is a legally binding contract between a buyer and a seller that outlines the terms and conditions of a property transaction. It ensures that both parties agree to the sale, the price, and any contingencies or conditions that need to be fulfilled before the sale is finalized. 2. Essential Elements of a Buy/Sell Agreement: a. Purchase Price and Payment Terms: Specifies the agreed-upon purchase price and the payment terms, including down payment amount, financing options, and proposed closing date. b. Title and Survey: Outlines the requirements for a clear title, including obtaining a survey and addressing any easements or encroachments. c. Inspection Contingencies: Describes the buyer's right to inspect the property and the timeframe for completing inspections. It may also include provisions for repairs or a reduction in purchase price based on inspection results. d. Financing Contingencies: Addresses the buyer's ability to secure financing and the conditions under which either party can terminate the agreement if financing falls through. e. Disclosure Obligations: Specifies the seller's duty to provide accurate property disclosures, including information regarding any known defects, environmental concerns, or legal issues. f. Contingencies for Selling Existing Property: If the buyer needs to sell their existing property to finance the purchase, this contingency outlines the necessary steps, timelines, and any penalties for non-compliance. g. Closing and Possession: Determines who will be responsible for closing costs, the allocation of property taxes, and the possession date. 3. Types of Contingencies in Buy/Sell Agreements: a. Inspection Contingency: Allows the buyer to conduct a thorough inspection of the property within a specified timeframe to identify any potential issues. b. Financing Contingency: Provides an opportunity for the buyer to secure appropriate financing for purchasing the property, ensuring they are not bound by the agreement if financing is unavailable or unsatisfactory. c. Appraisal Contingency: Indicates that the buyer has the right to a professional appraisal conducted by a licensed appraiser to determine the fair market value of the property. If the appraised value is lower than the agreed-upon price, renegotiation or termination of the agreement is possible. d. Home Sale Contingency: Allows the buyer to sell their existing property before fulfilling the purchase obligations, ensuring they are not burdened with multiple mortgages. e. Title Contingency: Requires the seller to provide a clear title without any liens or encumbrances, ensuring the buyer receives rightful ownership of the property. f. Pest Inspection Contingency: Allows the buyer to conduct a pest inspection to identify any pest infestations or related damage that may affect the property's value. g. Financing Addendum Contingency: Defines specific terms and conditions related to financing, such as interest rates, loan types, and timelines. Navigating buy/sell agreements and contingencies can be complex, so it is advisable to seek legal advice or consult a qualified real estate professional to ensure compliance with local laws and regulations. Implementing this comprehensive checklist will assist you in seamlessly executing property transactions in Lima, Arizona, while protecting your rights and interests.