Suffolk County, located in the state of New York, offers a comprehensive checklist for the sale of a business. This checklist serves as a guideline for business owners who are planning to sell their businesses in Suffolk County and ensures that all necessary steps and requirements are fulfilled during the selling process. The Suffolk New York Checklist — Sale of a Business covers various crucial aspects involved in selling a business, including legal, financial, and administrative obligations. By adhering to this checklist, business owners can ensure a smooth and successful sale transaction. Here are the key elements covered in the checklist: 1. Preliminary Planning: — Determine the desired sale price of the business. — Evaluate the financial records and business valuation. — Identify potential buyers and establish confidentiality agreements. — Seek professional assistance from lawyers, accountants, and business brokers if necessary. 2. Legal Considerations: — Review contracts, leases, and agreements tied to the business. — Comply with necessary permits, licenses, and registrations. — Ensure the business is free from any legal disputes or liabilities. — Determine if any government approvals or notifications are required. 3. Financial and Tax Planning: — Compile and organize financial statements and tax returns. — Identify any outstanding debts or obligations to be settled. — Determine the tax implications of the sale and strategize tax optimization. — Consult with financial advisors on ways to enhance the business's financial attractiveness. 4. Business Documentation: — Prepare a detailed business profile and marketing materials. — Gather essential documents such as licenses, agreements, and intellectual property records. — Create an information memorandum highlighting the business's key attributes. — Conduct thorough due diligence to ensure accuracy and completeness of documents. 5. Negotiation and Closing: — Engage in negotiations with potential buyers. — Consult legal professionals and brokers during the negotiation process. — Draft and review the purchase agreement and related documents. — Plan and facilitate a smooth transition for the new owner. Different types of Suffolk New York Checklist — Sale of a Business may include: 1. Retail Business Sale Checklist: — Focuses on specific requirements and considerations for retail businesses. — Includes guidelines on inventory management, customer base, and lease agreements. 2. Franchise Business Sale Checklist: — Addresses the unique aspects involved in selling a franchise business. — Covers franchisor approval, transfer fees, and franchise agreements. 3. Service-Based Business Sale Checklist: — Catered for businesses that provide services rather than tangible products. — Emphasizes aspects such as client contracts, customer relationships, and service-level agreements. By following these comprehensive checklists catered to specific types of businesses, business owners in Suffolk County, New York, can navigate the complex process of selling a business with confidence and ensure a successful transition for all parties involved.

Suffolk New York Checklist - Sale of a Business

Description

How to fill out Suffolk New York Checklist - Sale Of A Business?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Suffolk Checklist - Sale of a Business, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Suffolk Checklist - Sale of a Business from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Suffolk Checklist - Sale of a Business:

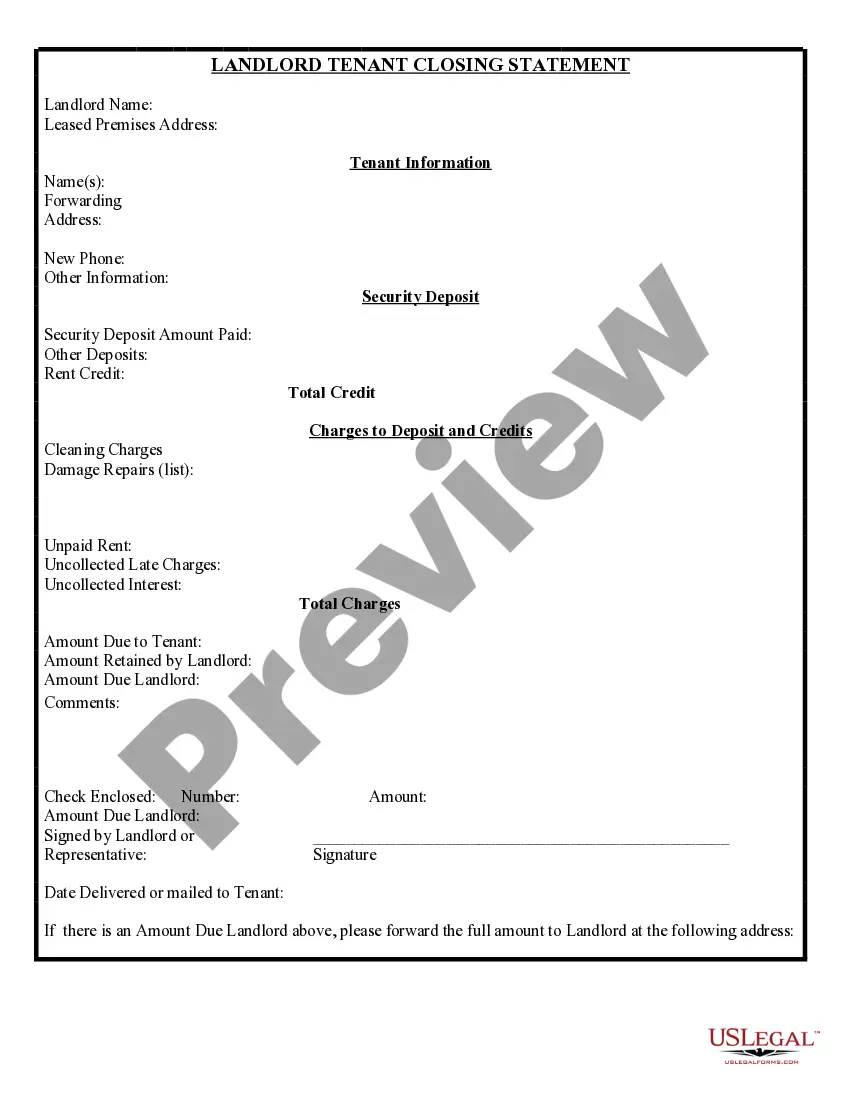

- Take a look at the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Form 941, Employer's Quarterly Federal Tax Return, or Form 944, Employer's Annual Federal Tax Return, for the quarter in which you make final wage payments. Check the box to tell the IRS your business has closed and enter the date final wages were paid on line 17 of Form 941 or line 14 of Form 944.

A sole proprietor can make the decision to close a business on his own. A business that is a partnership, limited liability company or a corporation must have a mutual agreement among the partners about the shut down of the company.

To close their business account, a sole proprietor needs to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

You are required to register if the items or services that you sell are subject to sales tax. This requirement also includes the sale of items through an online auction or other websites.

(Valid for at most 6 months.) Pay $250 for a license expiring September 30 of the following odd year.

The completed Certificate of Dissolution, together with the required consent attached, and the statutory filing fee of $60 should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

File a final business tax return(s) appropriate to your type of business and pay all outstanding taxes and fees. If you need an updated balance of your outstanding liabilities, log in or create an Online Services account. If you have questions, call the Civil Enforcement Division.

To dissolve your New York LLC, you must submit the completed Articles of Dissolution form to the New York Department of State by mail, fax or in person, along with the filing fee. The New York Department of State does not require original signatures on filed documents.

There are no fees associated with obtaining a Certificate of Authority or using a resale certificate. New York takes operating without a Certificate of Authority seriously: violations could result in a penalty of up to $10,000.