Fairfax Virginia General Form of Assignment as Collateral for Note is a legally binding document that establishes the transfer of assets or property as security for a promissory note. This arrangement ensures that the lender has a claim on the assigned collateral in case the borrower fails to repay the note as agreed upon. In Fairfax, Virginia, there are several types of General Form of Assignment as Collateral for Note that individuals or businesses may encounter. Some of these variations include: 1. Real Estate Collateral Assignment: This type of assignment involves using real property, such as land or buildings, as collateral for a note. The borrower transfers their ownership rights temporarily to the lender until the note is fully repaid. 2. Vehicle Collateral Assignment: Here, the borrower transfers the title or ownership of a vehicle, such as a car or motorcycle, to the lender as collateral for the note. This ensures that if the borrower defaults on payments, the lender can seize and sell the vehicle to recover their money. 3. Accounts Receivable Collateral Assignment: This form of assignment involves using a company's accounts receivable, which represent outstanding invoices owed by customers, as collateral. Lenders may accept this assignment to secure a note by gaining a claim on the future payments due from customers. 4. Equipment Collateral Assignment: Businesses can use their machinery, tools, or other valuable equipment as collateral for a note. By assigning their interest in these assets to the lender, the borrower provides security for the repayment of the note. 5. Investment Collateral Assignment: This type of collateral assignment involves transferring the ownership of stocks, bonds, or other investment assets to the lender to secure a note. If the borrower fails to make payments, the lender can liquidate these investments to recover their funds. It is essential for both parties involved to carefully review and understand the Fairfax Virginia General Form of Assignment as Collateral for Note before signing. Seeking legal advice is highly recommended ensuring that all legal requirements are met and that both parties' interests are protected.

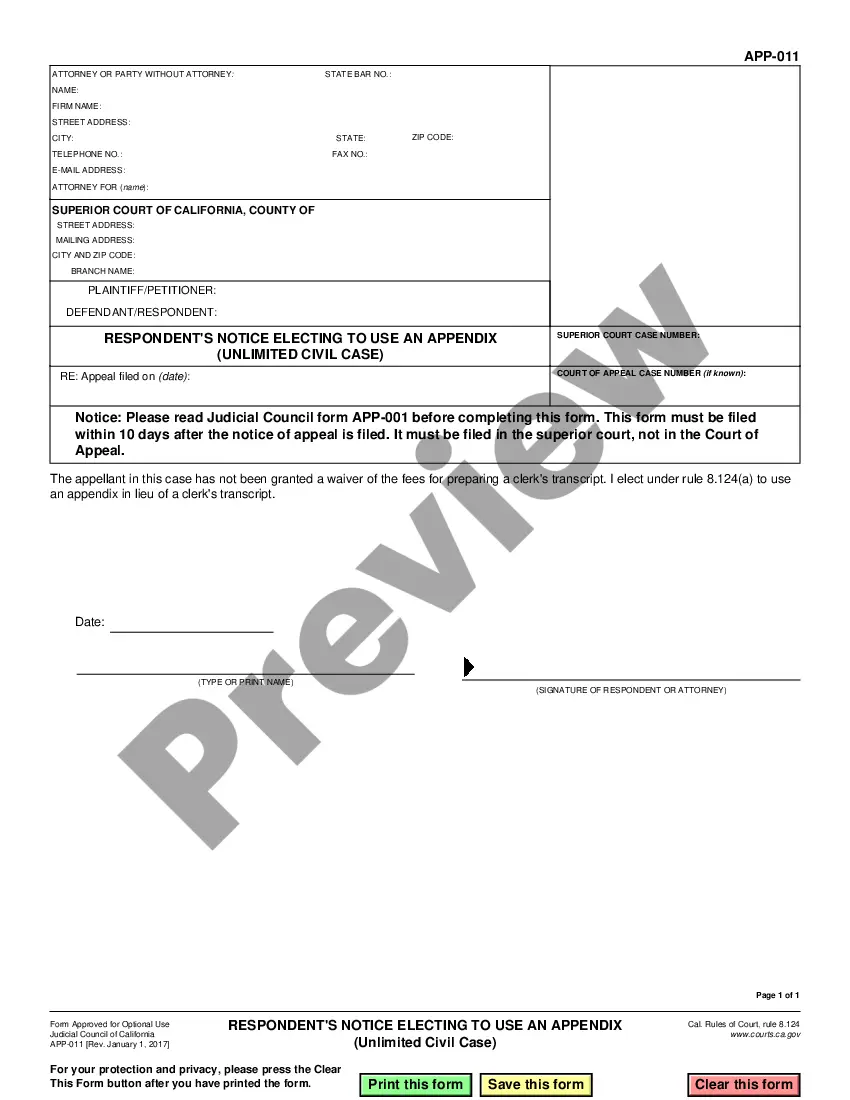

Fairfax Virginia General Form of Assignment as Collateral for Note

Description

How to fill out Fairfax Virginia General Form Of Assignment As Collateral For Note?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Fairfax General Form of Assignment as Collateral for Note, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information materials and guides on the website to make any activities associated with paperwork execution simple.

Here's how to purchase and download Fairfax General Form of Assignment as Collateral for Note.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the legality of some documents.

- Check the related document templates or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Fairfax General Form of Assignment as Collateral for Note.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Fairfax General Form of Assignment as Collateral for Note, log in to your account, and download it. Needless to say, our website can’t replace an attorney entirely. If you have to cope with an exceptionally challenging case, we advise getting an attorney to review your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant paperwork with ease!

Form popularity

FAQ

For further information please contact the Land Records Division of the County Circuit Court. They are located in Suite 317 of the Fairfax County Courthouse (4110 Chain Bridge Rd). For more information, call 703-691-7320, or visit their website.

The public is able to access documents, such as deeds, birth and death certificates, military discharge records, and others through the register of deeds. There may be a fee to access or copy public records through the register of deeds.

Cases are filed at the Civil Division Clerk's Office, Room 211. You may print out and bring the forms with you, or the Clerk's Office can provide forms for you to fill out. Please note that clerks cannot provide legal advice.

The small claims division of a district court has the power to hear civil cases in which a party (the plaintiff) is seeking a money amount up to $5,000. This court also hears cases where the plaintiff is seeking return of personal property valued up to $5,000.

If you know the instrument number or deed book and page number, you may request a copy of your deed either by mail or over the telephone by calling 703-691-7320, option 3 and then option 3 again. Send your written request to: Fairfax Circuit Court 4110 Chain Bridge Road, Suite 317 Fairfax, VA 22030.

If your lawsuit is for more than $200, the filing fee is $26, plus $12 for each person or business you are suing. If your lawsuit is for $200 or less, the filing fee is $21, plus $12 for each person or business you are suing. If you win the judgment will include your filing & service fees.

A civil lawsuit is a case in which a person or business asks for money or property from another. The party who brings the lawsuit is called the plaintiff and the party against whom the lawsuit is brought is called the defendant. Any Virginia resident, including corporations, can sue or be sued in GDC.

In-Person Filings Cases are filed at the Civil Division Clerk's Office, Room 211. You may print out and bring the forms with you, or the Clerk's Office can provide forms for you to fill out. Please note that clerks cannot provide legal advice.Filing fees are due at the time of filing.

Land records from 1757 to present are available for the public to research using Public Access terminals in the Clerk's Office. These records include, but are not limited to: Assignments. Certificates of Satisfaction.

The Office of the Circuit Court Clerk.

More info

The U.S. Health Care Act, H.R. 3200, the Health Coverage Exchanges and the National Disability Insurance Program. I am not required to report back to the judge. However, if you need immediate help please call 911. Jury Duty Information, Sample Jury Docket, Jury Notation, and the U.S. District Court For the Northern District of Ohio and Counties: The information in the section on Jury Dockets are found under Jury Dockets for the Northern District of Ohio and Counties. Juror Notation is found under the Juror Notation page. This page allows you to write your initials, name, address, telephone number and address in the upper right corner, and have that information recorded on the juries' dockets. The U.S.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.